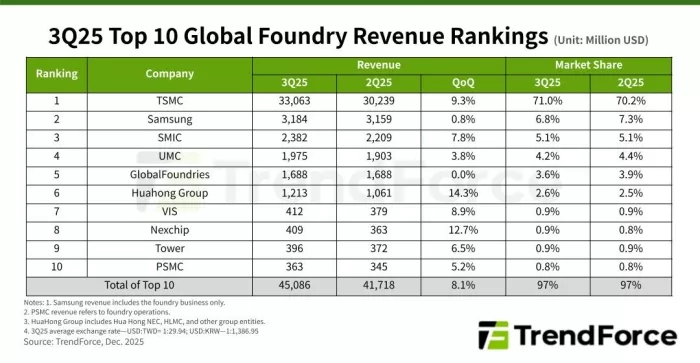

Consumer Electronics and AI Product Launches Lift 3Q25 Top-10 Foundry Revenue by 8.1%, Says TrendForce

December 12, 2025 -- TrendForce’s latest research indicates that the global foundry industry continued to profit in 3Q25, fueled by strong demand for AI in HPC and new consumer-electronics chips and IC peripherals. Revenue was primarily driven by advanced processes at 7 nm and below, with support from high-value wafers. Chinese foundries also expanded their business through supply-chain diversification. As a result, total revenue for the top 10 foundries increased by 8.1% QoQ to nearly US$45.1 billion.

TrendForce notes that expectations for 2026 demand have become cautious amid geopolitical headwinds. Furthermore, DRAM shortages and quarterly price increases since mid-2025 continue to strain downstream production costs. Even though automotive and industrial-control segments are preparing to resume restocking toward the end of 2025, the 4Q25 uptick in foundry utilization will be limited. Consequently, revenue growth among the top 10 is projected to narrow significantly in the fourth quarter.

TSMC, a leader in the industry, reported its 3Q25 revenue was fueled by smartphones and HPC. As Apple aggressively stockpiled for new iPhones and NVIDIA’s Blackwell platform entered peak mass production, both wafer shipments and ASPs rose QoQ. Revenue rose 9.3% to slightly above $33 billion, raising its market share slightly to 71%.

Samsung Foundry’s overall capacity utilization rose slightly from the previous quarter, but the impact on revenue was limited. Its sales held roughly flat at $3.184 billion, maintaining a 6.8% market share and ranking second. Meanwhile, SMIC saw improvements in utilization, wafer shipments, and ASP in 3Q25, driving its revenue up 7.8% QoQ to $2.382 billion and securing third.

Ranking fourth, UMC benefited from demand for peripheral ICs used in new smartphone and PC/notebook models, along with early pull-in orders from European and U.S. clients. Mature-process restocking modestly lifted overall utilization, pushing revenue 3.8% QoQ to nearly $1.98 billion and a 4.2% market share.

GlobalFoundries also saw slightly higher wafer shipments in 3Q25, driven by restocking tied to new smartphone and PC launches. However, a one-time ASP adjustment left revenue essentially flat at $1.69 billion. Although it retained the fifth position, its market share declined to 3.6% amid intensifying competition.

“China for China” drives Nexchip to overtake Tower as No. 8

HuaHong Group reported over $1.21 billion in revenue, with a 2.6% market share and a sixth-place ranking. Its subsidiary, HHGrace, benefited from the gradual ramp-up of its 12-inch capacity and higher-priced wafer shipments in the second half of 2025, which helped drive up wafer shipments and ASP. Vanguard ranked seventh with $412 million in revenue, an 8.9% QoQ increase, owing to rising PMIC demand for new smartphone and PC/notebook models that offset declining DDIC orders.

Nexchip experienced a 12.7% QoQ growth, reaching $409 million in revenue. This increase was fueled by strong demand for consumer DDIC, CIS, and PMIC ahead of new product launches, as well as expanding customer share within the “China for China' trend. The company surpassed Tower to secure the eighth position.

Tower rose 6.5% QoQ to achieve $396 million in revenue, but ultimately fell to ninth place despite higher utilization and shipments. PSMC, boosted by increased wafer demand for DRAM and better foundry pricing, reported $363 million, rising 5.2% QoQ to secure the tenth spot.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

Related Semiconductor IP

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

Related News

- Weebit Nano licenses ReRAM to DB HiTek, a global top-10 foundry

- Urgent Orders Boost Wafer Foundry Utilization in Q2; Global Top 10 Foundry Revenue Grows 9.6% while VIS Climbs Two Spots, Says TrendForce

- Advanced Processes and Chinese Policies Drive 3Q24 Global Top 10 Foundry Revenue to Record Highs

- Tariff Effects and China Subsidies Soften 1Q25 Downturn; Foundry Revenue Decline Narrows to 5.4%

Latest News

- ASICLAND Partners with Daegu Metropolitan City to Advance Demonstration and Commercialization of Korean AI Semiconductors

- SEALSQ and Lattice Collaborate to Deliver Unified TPM-FPGA Architecture for Post-Quantum Security

- SEMIFIVE Partners with Niobium to Develop FHE Accelerator, Driving U.S. Market Expansion

- TASKING Delivers Advanced Worst-Case Timing Coupling Analysis and Mitigation for Multicore Designs

- Efficient Computer Raises $60 Million to Advance Energy-Efficient General-Purpose Processors for AI