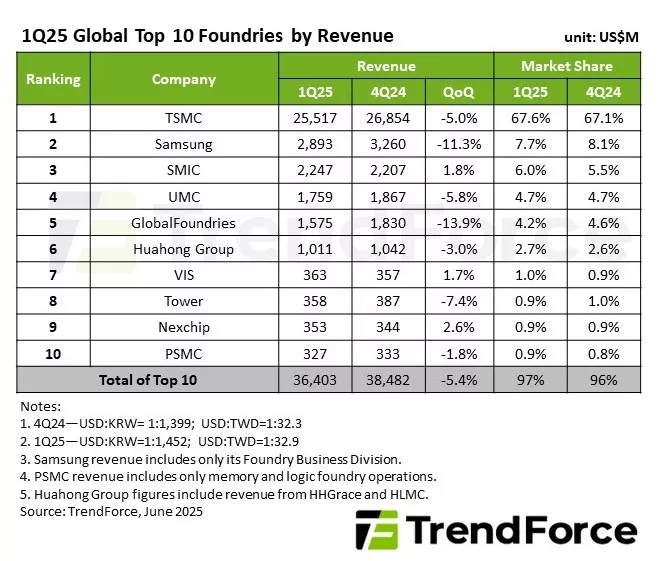

Tariff Effects and China Subsidies Soften 1Q25 Downturn; Foundry Revenue Decline Narrows to 5.4%

June 9, 2025 -- TrendForce’s latest investigations find that the global foundry industry recorded 1Q25 revenue of US$36.4 billion—a 5.4% QoQ decline. The downturn was softened by last-minute rush orders from clients ahead of the U.S. reciprocal tariff exemption deadline, as well as continued momentum from China’s 2024 consumer subsidy program. These factors help offset the typical seasonal slump.

Looking ahead to Q2, the effects of tariff-driven early procurement are expected to fade and lead to a general slowdown. However, continued demand from China’s subsidy program, along with pre-launch inventory builds for new smartphone models and stable AI HPC demand, are expected to support capacity utilization and drive a revenue rebound for the top 10 foundries.

TSMC maintained its dominant position with a 67.6% market share. While smartphone-related wafer shipments declined due to seasonal factors, solid AI HPC demand and urgent TV-related orders (linked to tariff avoidance) helped limit its revenue drop to 5%, totaling $25.5 billion.

Samsung Foundry fell 11.3% QoQ, posting Q1 revenue of $2.89 billion. Its limited exposure to China’s consumer subsidy benefits, compounded by the U.S.’s advanced node restrictions, contributed to the decline. Market share dipped slightly to 7.7%.

SMIC benefited from early stocking in response to both U.S. tariffs and Chinese subsidies. This helped mitigate ASP declines, resulting in a 1.8% revenue increase to $2.25 billion, which placed the company in third place.

UMC retained its fourth position. Early customer stocking helped keep wafer shipments and capacity utilization steady, though ASPs declined due to an annual pricing adjustment. Revenue edged down 5.8% to $1.76 billion.

GlobalFoundries, whose customers primarily placed orders for markets outside of China, did not benefit from the subsidy program. Combined with seasonal weakness, wafer shipments and ASPs declined, pulling revenue down 13.9% to $1.58 billion and slightly shrinking its market share.

Vanguard rises to seventh, driven by early stocking and high utilization

HuaHong Group placed sixth with $1.01 billion in revenue, down 3%. New capacity from HHGrace contributed, with selective low-price strategies attracting new orders. However, revenue declined post-merger with HLMC and other subsidiaries.

Vanguard rose to seventh place with revenue up 1.7% to $363 million. Tariff and subsidy-driven pre-stocking lifted utilization rates above typical off-season levels. Revenue grew while ASPs declined due to a higher mix of low-end products.

Tower dropped to eighth with revenue of $358 million, down 7.4%. It was hit hard by seasonal weakness and did not benefit from China subsidies.

Nexchip climbed to ninth with revenue increasing 2.6% to $353 million, supported by urgent orders tied to U.S. tariffs and China subsidies.

PSMC rounded out the top ten with $327 million in revenue, down 1.8% QoQ. While memory foundry demand weakened, rush consumer orders helped keep utilization steady.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

Related Semiconductor IP

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

Related News

- Urgent Orders Boost Wafer Foundry Utilization in Q2; Global Top 10 Foundry Revenue Grows 9.6% while VIS Climbs Two Spots, Says TrendForce

- Advanced Processes and Chinese Policies Drive 3Q24 Global Top 10 Foundry Revenue to Record Highs

- Robust AI Demand Drives 6% QoQ Growth in Revenue for Top 10 Global IC Design Companies in 1Q25

- 2Q25 Foundry Revenue Surges 14.6% to Record High, TSMC’s Market Share Hits 70%

Latest News

- ASICLAND Partners with Daegu Metropolitan City to Advance Demonstration and Commercialization of Korean AI Semiconductors

- SEALSQ and Lattice Collaborate to Deliver Unified TPM-FPGA Architecture for Post-Quantum Security

- SEMIFIVE Partners with Niobium to Develop FHE Accelerator, Driving U.S. Market Expansion

- TASKING Delivers Advanced Worst-Case Timing Coupling Analysis and Mitigation for Multicore Designs

- Efficient Computer Raises $60 Million to Advance Energy-Efficient General-Purpose Processors for AI