Advanced Processes and Chinese Policies Drive 3Q24 Global Top 10 Foundry Revenue to Record Highs

December 5, 2024 -- According to TrendForce’s latest report, while the overall economic situation did not significantly improve in the third quarter of 2024, factors such as supply chain stocking driven by new smartphone and PC/notebook launches in the second half of the year, coupled with continued strong demand for AI server-related HPC, led to an improvement in overall wafer foundry capacity utilization compared to the second quarter.

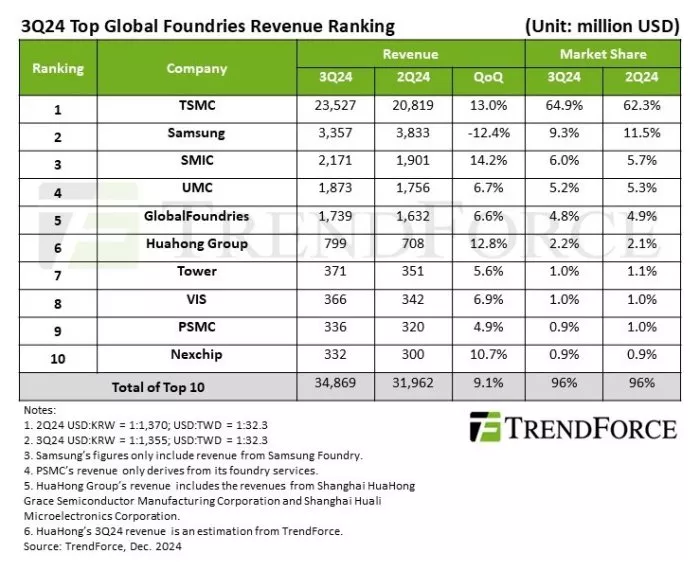

In the third quarter, the total revenue of the world’s top 10 wafer foundries increased by 9.1% QoQ—reaching US$34.9 billion. Part of this growth was attributed to the substantial contributions from the high-priced 3 nm process, breaking the record set during the pandemic.

Looking ahead to the fourth quarter of 2024, TrendForce predicts that advanced processes will continue to drive the revenue of the top 10 foundries, though the QoQ growth rate is expected to narrow slightly. Operational performance is anticipated to be polarized: AI and flagship smartphone/PC main chips are expected to sustain demand for 5/4 nm and 3 nm processes through the end of the year. CoWoS advanced packaging will continue to face supply shortages.

For mature processes at 28 nm and above, uncertain end-market sales, the approach of the traditional first-quarter sales lull in 2025, and a significant decline in stocking demand for peripheral ICs such as TV SoCs, LDDIs, and panel-related PMICs following inventory build-ups in the third quarter of 2024 are expected to weigh on demand.

However, these negative factors are likely to be offset by year-end shipment surges from Chinese smartphone brands and urgent orders driven by China’s old-for-new replacement subsidies, which are stimulating supply chain activity. Consequently, mature process capacity utilization in the fourth quarter is projected to remain flat or see slight growth compared to the previous quarter.

TrendForce reports that the revenue rankings of the top ten wafer foundries remain unchanged in the third quarter, with TSMC maintaining its leading position with a market share of nearly 65%. The simultaneous launch of flagship smartphone products, AI GPUs, and new PC CPUs drove an increase in TSMC’s capacity utilization and wafer shipments, resulting in a 13% QoQ revenue growth to $23.53 billion.

Samsung Foundry maintained its position as the second-largest foundry by revenue in the third quarter. Despite securing some smartphone-related orders, the company’s advanced process clients’ products are approaching the end of their life cycles. Additionally, intensified competition from Chinese peers in the mature processes led to price concessions, resulting in a 12.4% QoQ revenue decline and a decrease in market share to 9.3%.

SMIC, ranked third in revenue, saw no significant increase in wafer shipments during the third quarter. However, thanks to product mix optimization and the release of additional 12-inch capacity driving shipments, its revenue grew by 14.2% QoQ to $2.2 billion.

UMC, ranked fourth, experienced improvements in both wafer shipments and capacity utilization compared to the previous quarter, resulting in revenue growth to $1.87 billion, a 6.7% QoQ increase. GlobalFoundries, ranked fifth, benefited from inventory orders for peripheral ICs related to new smartphone and PC launches. This drove growth in wafer shipments and capacity utilization, with revenue increasing by 6.6% QoQ to $1.74 billion.

Consumer inventory stocking has spurred urgent orders for peripheral components and improved capacity utilization rates among Tier 2 wafer foundries

HuaHong Group secured orders for peripheral ICs for new smartphones and PCs, along with consumer inventory replenishment demand, which boosted the capacity utilization of its subsidiaries HLMC and HHGrace. The group’s overall revenue grew by 12.8% QoQ, reaching a market share of 2.2% and ranking it sixth.

Tower, ranked seventh, benefited in the third quarter from orders for smartphone peripheral RF ICs, optical communication SiPho and SiGe infrastructure components needed for AI servers. This improved its capacity utilization, resulting in a 5.6% QoQ revenue growth to $371 million.

VIS, ranked eighth, saw growth in capacity utilization and wafer shipments, driven by orders for consumer LDDIs, panel/smartphone PMICs, and AI-related MOSFETs. Its revenue grew by 6.9% QoQ to $366 million.

PSMC, ranked ninth, experienced stable increases in memory foundry production and received urgent orders for smartphone peripheral components in its logic business, driving its revenue to $336 million in the third quarter. Nexchip maintained its tenth position, with third-quarter revenue of $332 million, which reflected a 10.7% QoQ increase.

TrendForce Roadshow Japan – AI Innovations and Opportunities

Join us on December 12 at Villa Fontaine Grand Tokyo Ariake for an insightful seminar hosted by TrendForce. Our analysts will present on key topics, including foundry, HBM, and AI server. If you are interested in attending, please contact us for more details. We look forward to welcoming you!

Related Semiconductor IP

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

Related News

- Global Top 10 Foundries Q4 Revenue Up 7.9%, Annual Total Hits US$111.54 Billion in 2023, Says TrendForce

- 4Q24 Global Top 10 Foundries Set New Revenue Record, TSMC Leads in Advanced Process Nodes, Says TrendForce

- Global Top 10 Foundries' Total Revenue Grew by 6% QoQ for 3Q22, but Foundry Industry's Revenue Performance Will Enter Correction Period in 4Q22, Says TrendForce

- Total Revenue of Global Top 10 IC Design Houses for 3Q22 Showed QoQ Drop of 5.3%; Broadcom Returned to No. 2 Spot in Revenue Ranking by Overtaking NVIDIA and AMD, Says TrendForce

Latest News

- ASICLAND Partners with Daegu Metropolitan City to Advance Demonstration and Commercialization of Korean AI Semiconductors

- SEALSQ and Lattice Collaborate to Deliver Unified TPM-FPGA Architecture for Post-Quantum Security

- SEMIFIVE Partners with Niobium to Develop FHE Accelerator, Driving U.S. Market Expansion

- TASKING Delivers Advanced Worst-Case Timing Coupling Analysis and Mitigation for Multicore Designs

- Efficient Computer Raises $60 Million to Advance Energy-Efficient General-Purpose Processors for AI