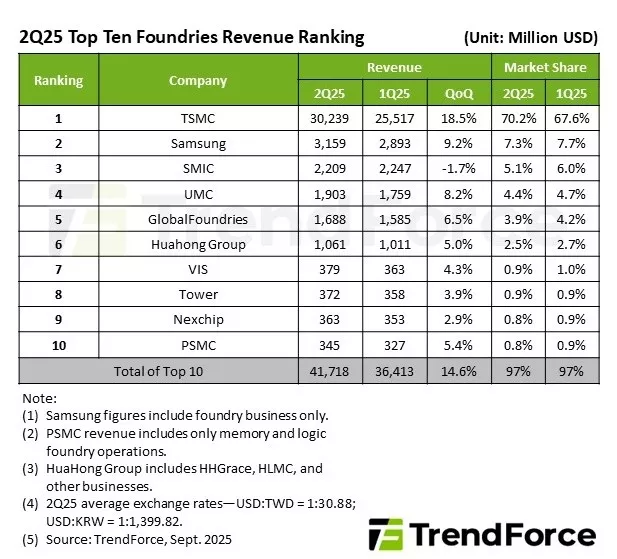

2Q25 Foundry Revenue Surges 14.6% to Record High, TSMC’s Market Share Hits 70%

September 1, 2025 -- TrendForce’s latest investigations reveal that global foundry revenue in 2Q25 reached a record US$41.7 billion, up 14.6% QoQ, thanks to China’s consumer subsidy program spurring early stocking, along with upcoming demand for new smartphones, notebooks/PCs, and servers launching in the second half of the year. Both capacity utilization and wafer shipments improved significantly across the top ten foundries.

Looking ahead to 3Q25, seasonal demand for new products will drive order momentum. Advanced nodes will benefit from strong demand for flagship chips, while mature nodes will be supported by peripheral IC orders. As a result, industry-wide utilization rates are expected to rise further, supporting continued revenue growth—albeit at a more moderate pace.

The revenue performance of the top 10 foundries in the second quarter is as follows:

TSMC reported outstanding performance, with major smartphone clients entering their ramp-up cycle and strong shipments of AI GPUs, notebooks, and PCs pushing wafer shipments and ASPs higher. Revenue climbed 18.5% QoQ to $30.24 billion, lifting its market share to a record 70.2% and cementing its leadership position.

Samsung Foundry also posted solid results, benefiting from smartphone demand and the ramp-up of the Nintendo Switch 2. Shipments were weighted toward high-value advanced nodes, driving revenue up 9.2% QoQ to $3.16 billion to give the company a 7.3% market share as it ranked second.

SMIC, while still supported by U.S. tariffs and China’s subsidies, struggled with lingering issues from its advanced-node production lines in the first quarter, which led to shipment delays and lower ASPs. Its revenue slipped 1.7% QoQ to $2.21 billion, with market share dipping slightly to 5.1%, though it retained third place.

UMC performed well, with gains in both shipments and ASPs lifting revenue by 8.2% QoQ to $1.9 billion, securing a 4.4% market share and ranking fourth. GlobalFoundries followed closely, benefiting from new product stocking and modest ASP improvements. Its revenue increased 6.5% QoQ to $1.69 billion, placing fifth with a 3.9% share.

Shipments of Tier 2 foundries improved, supported by orders for peripheral ICs used in new products

Amid China’s consumption subsidies and the push for IC localization, HHGrace, a subsidiary of HuaHong Group, saw its capacity utilization improve in the second quarter, which drove a sequential increase in total wafer shipments. While this was partly offset by a slight decline in ASP, revenue still rose by 4.6% QoQ. Including HLMC and other affiliated businesses, HuaHong Group’s consolidated revenue grew by around 5% to reach approximately $1.06 billion, securing a 2.5% market share and holding steady at sixth place.

Vanguard reported revenue growth of 4.3% QoQ to nearly $379 million, ranking seventh, while Tower improved utilization as clients resumed stocking for second-half launches, pushing revenue up 3.9% QoQ to $372 million, maintaining eighth place.

Nexchip also benefited from subsidy-driven demand and higher orders for peripheral ICs, though low pricing limited upside. Its revenue grew nearly 3% QoQ to $363 million, ranking ninth. Finally, PSMC achieved revenue of $345 million, up 5.4% QoQ, securing tenth place.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

Related Semiconductor IP

- 8MHz / 40MHz Pierce Oscillator - X-FAB XT018-0.18µm

- UCIe RX Interface

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

Related News

- Urgent Orders Boost Wafer Foundry Utilization in Q2; Global Top 10 Foundry Revenue Grows 9.6% while VIS Climbs Two Spots, Says TrendForce

- Advanced Processes and Chinese Policies Drive 3Q24 Global Top 10 Foundry Revenue to Record Highs

- Tariff Effects and China Subsidies Soften 1Q25 Downturn; Foundry Revenue Decline Narrows to 5.4%

- Consumer Electronics and AI Product Launches Lift 3Q25 Top-10 Foundry Revenue by 8.1%, Says TrendForce

Latest News

- Alchip Reports ASIC-Leading 2nm Developments

- AI Demand Drives 4Q25 Global Top 10 Foundries Revenue Up 2.6% QoQ; Samsung Gains Share and Tower Moves Up in Rankings

- GlobalFoundries Announces Availability of AutoPro150 eMRAM Technology on Enhanced FDX Platform for Advanced Automotive Applications

- Axiomise Launches nocProve for NoC Verification

- CAST Debuts TSN-EP-10G IP for High-Performance, Time-Sensitive Networking Ethernet Designs