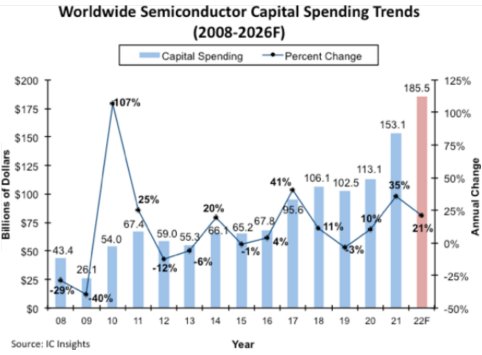

Semi Capex On Pace For 21% Growth to $185.5B This Year

2020-2022 expected to be the first 3-year period of double-digit capex growth since 1993-1995.

August 23, 2022 -- IC Insights has adjusted its 2022 worldwide semiconductor capital-spending forecast that now shows a 21% increase this year, to $185.5 billion (Figure 1). The revised outlook, which was included in IC Insights’ recently released August 3Q Update to The McClean Report, represents a decrease from $190.4 billion and 24% growth that was forecast at the beginning of this year. Though lowered, the revised capex forecast still represents a new record high level of spending. In fact, if industry capital spending rises as forecast by a double-digit amount this year, it will mark the first three-year period of double-digit capital expenditure gains in the semiconductor industry since 1993-1995.

Figure 1

Wafer fab utilization rates at many integrated device manufacturers (IDMs) remained well above 90% through the first half of this year and many semiconductor foundries operated at 100% utilization rates, as orders remained robust during the economic recovery from the Covid-19 pandemic.

Combined two-year semiconductor capital spending in 2021 and 2022 is now expected to reach $338.6 billion. IDMs and foundries are spending heavily on new manufacturing capacity for logic and memory devices built with leading-edge process technology. However, strong demand and ongoing shortages of many other essential chips such as power semiconductors, analog ICs, and various MCUs, have caused suppliers to boost manufacturing capacity for those products as well.

While all of that is positive news, a menacing cloud of uncertainty looms on the horizon. Soaring inflation and a rapidly decelerating worldwide economy caused semiconductor manufacturers to re-evaluate their aggressive expansion plans at the mid-point of the year. Several (but not all) suppliers—particularly many leading DRAM and flash memory manufacturers—have already announced reductions in their capex budgets for this year. Many more suppliers have noted that capital spending cuts are expected in 2023 as the industry digests three years of robust spending and evaluates capacity needs in the face of slowing economic growth.

Report Details: The 2022 McClean Report

The McClean Report—A Complete Analysis and Forecast of the Semiconductor Industry, is now available. A subscription to The McClean Report service includes the January Semiconductor Industry Flash Report, which provides clients with IC Insights’ initial overview and forecast of the semiconductor industry for this year through 2026. In addition, the third of four Quarterly Updates to the report was released in August, with one additional Quarterly Update to be released in November of this year. An individual user license to the 2022 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2022.

https://www.icinsights.com/services/mcclean-report/pricing-order-forms/

Related Semiconductor IP

- 8MHz / 40MHz Pierce Oscillator - X-FAB XT018-0.18µm

- UCIe RX Interface

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

Related News

- Global Semiconductor Materials Market Revenue Reaches Record $73 Billion in 2022, SEMI Reports

- Chartered still losing money, cuts capex

- ST to 're-deploy' 1,000 engineers amid Q1 losses, CapEx cuts

- Expected Top Ten IC Industry Capex Spenders In 2010

Latest News

- Silvaco Reports Fourth Quarter and Full-Year 2025 Financial Results

- Klepsydra Technologies and BrainChip Announce Strategic Partnership to Deliver Heterogeneous AI Runtime for Akida™ Neuromorphic Processors

- Alchip Reports ASIC-Leading 2nm Developments

- AI Demand Drives 4Q25 Global Top 10 Foundries Revenue Up 2.6% QoQ; Samsung Gains Share and Tower Moves Up in Rankings

- GlobalFoundries Announces Availability of AutoPro150 eMRAM Technology on Enhanced FDX Platform for Advanced Automotive Applications