Top 10 Companies Hold 57% of Global Semi Marketshare

In 2021, five of the top 10 semiconductor companies were fabless suppliers. In 2008, there was one fabless company in the ranking; in 2000, there were none.

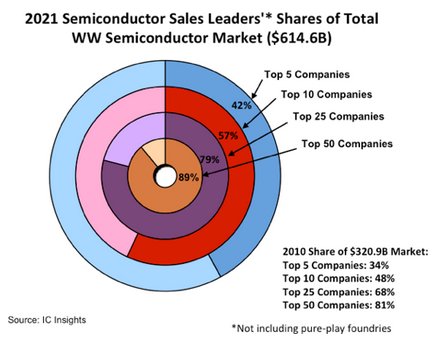

April 26, 2022 -- IC Insights' 2Q Update to The McClean Report 2022 will be released in May. It presents an analysis of the marketshare of the major semiconductor suppliers excluding the pure-play foundries (Figure 1). While there is a small amount of double-counting effect due to the IDM foundry revenue included in the figures, it is not large enough to significantly alter the trend discussed below.

Figure 1

In 2021, the top 50 semiconductor suppliers, not including the pure-play foundries, represented 89% of the total $614.6 billion worldwide semiconductor market, up eight points from the 81% share the top 50 companies held in 2010. As shown, the top 5, top 10, and top 25 companies’ share of the 2021 worldwide semiconductor market increased 8, 9, and 11 percentage points, respectively, as compared to 2010. With additional mergers and acquisitions expected over the next few years, IC Insights believes that the consolidation could raise the shares of the top suppliers to even loftier levels.

History of the Top 10 Ranking

In 2017, for the first time since 1993, the semiconductor industry witnessed a new number one supplier. In 1993, Intel was the number one ranked supplier with a 9.2% share of the worldwide semiconductor market. In 2017, Intel's sales represented 13.9% of the total semiconductor market. In contrast, Samsung's global semiconductor marketshare was 3.8% in 1993 and 14.8% in 2017. Thus, Samsung’s accession to the number one position in the semiconductor sales ranking in 2017 had more to do with it rapidly gaining marketshare than Intel losing marketshare.

In 2019, a steep 32% drop in the memory market pulled the total semiconductor market down by 12%. Since 77% of Samsung’s semiconductor sales were memory devices that year, the memory market plunge dragged the company’s total semiconductor sales down by 29%. Although Intel’s semiconductor sales were relatively flat in 2019, the company regained its position as the number one semiconductor supplier that year (Figure 2), a position it had held from 1993 through 2016. However, Samsung regained the number one spot in the ranking in 2021 after it posted a 33% increase in sales and Intel’s sales increased an anemic 1%.

Excluding foundries, there were two new entrants into the top 10 ranking in 2021—Taiwan-based fabless supplier MediaTek and U.S.-based fabless supplier AMD. These two companies replaced Apple and Infineon in the top 10 ranking last year. MediaTek registered an amazing 61% jump in sales, which moved the company up three positions in the ranking (from 11th to 8th) while AMD posted an even larger 68% surge in sales in 2021 to go from the 14th position to the number 10 spot in the ranking.

In 2021, five of the top 10 semiconductor suppliers were fabless companies, two more than in 2019. As shown, in 2008 there was only one fabless company in the ranking (i.e., Qualcomm) and in 2000, there were none.

All of the top 10 companies had sales of at least $16.4 billion in 2021. As would be expected, given the possible acquisitions and mergers that could occur in the future, the top 10 semiconductor ranking is likely to undergo some significant changes over the next few years as the semiconductor industry continues along its path to maturity.

Figure 2

Report Details: The 2022 McClean Report

The McClean Report—A Complete Analysis and Forecast of the Semiconductor Industry, is now available. A subscription to The McClean Report service includes the January Semiconductor Industry Flash Report, which provides clients with IC Insights’ initial overview and forecast of the semiconductor industry for this year through 2026. In addition, the first of four Quarterly Updates to the report was released in February, with additional Quarterly Updates to be released in May, August, and November of this year. An individual user license to the 2022 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2022.

https://www.icinsights.com/services/mcclean-report/pricing-order-forms/

Related Semiconductor IP

- 5G-NTN Modem IP for Satellite User Terminals

- HBM4E Controller IP

- 14-bit 12.5MSPS SAR ADC - Tower 65nm

- 5G-Advanced Modem IP for Edge and IoT Applications

- TSN Ethernet Endpoint Controller 10Gbps

Related News

- TrendForce Reports Top 10 Semiconductor Foundries Worldwide for 1H18, TSMC Ranks First with an Estimated Market Share of 56.1%

- Amid Rising Volume and Pricing, Top 10 IC Design Companies Post 2021 Revenue Topping US$100 Billion

- Top Semiconductor R&D Leaders Ranked for 2014

- Top 10 Semiconductor R&D Spenders Increase Outlays 6% in 2017

Latest News

- Marvell Extends ZR/ZR+ Leadership with Industry-first 1.6T ZR/ZR+ Pluggable and 2nm Coherent DSPs for Secure AI Scale-across Interconnects

- BrainChip Announces Neuromorphyx as Strategic Customer and Go-to-Market Partner for AKD1500 Neuromorphic Processor

- SCI Semiconductor Announces First Silicon of Cybersecure MCU, ICENI™

- Allen Wu on Disrupting $100M Cost of Building Custom AI Chips

- GUC Monthly Sales Report – February 2026