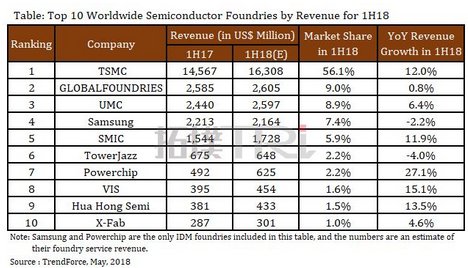

TrendForce Reports Top 10 Semiconductor Foundries Worldwide for 1H18, TSMC Ranks First with an Estimated Market Share of 56.1%

May 31, 2018 -- According to TrendForce’s latest report, the premium smartphone market experienced weak demand in 1H18, as the vendors blurred the lines between their mid-range and premium models, and the new devices released did not trigger a high level of replacement demand as anticipated. The weak demand for smartphone indirectly reduced the demand for high-performance processors from smartphone vendors, and lowered the growth momentum for foundries to develop advanced process technology. Therefore, TrendForce forecasts lower revenue growth for global foundries in 1H18 than in 1H17, with the total revenue reaching about US$29.06 billion, a year-on-year growth of 7.7%. As for the ranking of foundries by revenue, TSMC, GLOBALFOUNDRIES, and UMC are expected to take first, second, and third place respectively.

TrendForce notes that the 1H18 top ten ranking of foundries remains almost the same as a year ago, except for X-Fab surpassing Dongbu HiTek and ranking the 10th. The weak demand from smartphones has also influenced TSMC, who witnessed lower-than-expected growth momentum. However, the company may still acquire a market share of 56.1% despite the headwinds. GLOBALFOUNDRIES, ranking the second, sees subtle revenue increase in 1H18 compared with 1H17 since there is no significant change in its customer structure.

UMC is the third in the revenue ranking for 1H18, with limited revenue growth due to pressure from TSMC's dominant market share in advanced processes. Currently, UMC focuses on developing new customers of products based on 28nm and 14nm processes, in order to consume the capacity.

Samsung, ranking the fourth, is actively promoting its Multi-Project Wafer (MPW) service among potential clients, exploring new possibilities of cooperation. SMIC, ranking the fifth, is now devoted to improving the yield rate of 28nm process. Manufacturing on other processes with mature yield remains the major driver for the revenue growth of SMIC, who has been continuously receiving orders from domestic customers in China.

TowerJazz has been adjusting its product mixes, increasing the share of high-profit products. The adjustment has resulted in lower-than-expected revenue in the first half of the year, a decrease by 4% over the same period last year. Powerchip has benefited from growing orders and staged remarkable performance, with an estimated revenue growth of 27.1% over the same period last year.

As for the production capacity of 200mm wafers, the market in 1H18 shows the same trend of undersupply as in last year. Rising quotes for manufacturing products on 200mm wafers have brought remarkable revenue performance for 200mm wafer fabs. VIS and Hua Hong Semiconductor are expected to record revenue growths of 15.1% and 13.5% respectively. X-Fab is expected to benefit from industrial and automotive markets, recording a slight growth of 4.6% in 1H18.

In addition, TrendForce also notes that, foundries have made progresses on the development of third-generation semiconductors. VIS has become the first foundry in the world to provide foundry service on 200mm GaN-on-Silicon wafers. X-Fab has integrated SiC to its 150mm wafer fab with a monthly capacity of 30,000 pieces. Taiwan-based Episil Technologies is also actively developing its foundry service of SiC and GaN wafers.

Related Semiconductor IP

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

Related News

- Total Revenue of Top 10 Foundries Expected to Increase by 18% YoY in 4Q20 While UMC Overtakes GlobalFoundries for Third Place, Says TrendForce

- Quarterly Revenue of Top 10 Foundries Breaks Records in 1Q21 Owing to Price Hikes Caused by Tight Foundry Capacities, Says TrendForce

- Top 10 Foundries Post Record 4Q21 Performance for 10th Consecutive Quarter at US$29.55B, Says TrendForce

- Global Top 10 Foundries' Total Revenue Grew by 6% QoQ for 3Q22, but Foundry Industry's Revenue Performance Will Enter Correction Period in 4Q22, Says TrendForce

Latest News

- SEALSQ and Lattice Collaborate to Deliver Unified TPM-FPGA Architecture for Post-Quantum Security

- SEMIFIVE Partners with Niobium to Develop FHE Accelerator, Driving U.S. Market Expansion

- TASKING Delivers Advanced Worst-Case Timing Coupling Analysis and Mitigation for Multicore Designs

- Efficient Computer Raises $60 Million to Advance Energy-Efficient General-Purpose Processors for AI

- QuickLogic Announces $13 Million Contract Award for its Strategic Radiation Hardened Program