Fab Equipment Spending Breaking Industry Records

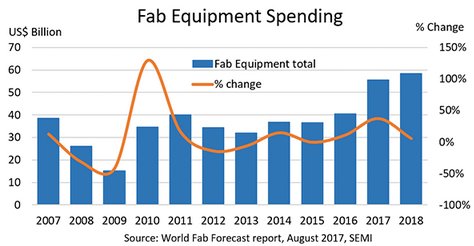

MILPITAS, Calif. â September 12, 2017 âThe latest update to the World Fab Forecast report, published on September 5, 2017 by SEMI, again reveals record spending for fab equipment. Out of the 296 Front End facilities and lines tracked by SEMI, the report shows 30 facilities and lines with over $500 million in fab equipment spending. 2017 fab equipment spending (new and refurbished) is expected to increase by 37 percent, reaching a new annual spending record of about US$55 billion. The SEMI World Fab Forecast also forecasts that in 2018, fab equipment spending will increase even more, another 5 percent, for another record high of about $58 billion. The last record spending was in 2011 with about $40 billion. The spending in 2017 is now expected to top that by about $15 billion.

Figure 1: Fab equipment spending (new and refurbished) for Front End facilities

Examining 2017 spending by region, SEMI reports that the largest equipment spending region is Korea, which increases to about $19.5 billion in spending for 2017 from the $8.5 billion reported in 2016. This represents 130 percent growth year-over-year. In 2018, the World Fab Forecast report predicts that Korea will remain the largest spending region, while China will move up to second place with $12.5 billion (66 percent growth YoY) in equipment spending. Double-digit growth is also projected for Americas, Japan, and Europe/Mideast, while other regions growth is projected to remain below 10 percent.

The World Fab Forecast report estimates that Samsung is expected to more than double its fab equipment spending in 2017, to $16 billion to $17 billion for Front End equipment, with another $15 billion in spending for 2018. Other memory companies are also forecast to make major spending increases, accounting for a total of $30 billion in memory-related spending for the year. Other market segments, such as Foundry ($17.8 billion), MPU ($3 billion), Logic ($1.8 billion), and Discrete with Power and LED ($1.8 billion), will also invest huge amounts on equipment. These same product segments also dominate spending into 2018.

In both 2017 and 2018, Samsung will drive the largest level in fab spending the industry has ever seen. While a single company can dominate spending trends, SEMI’s World Fab Forecast report also shows that a single region, China, can surge ahead and significantly impact spending. Worldwide, the World Fab Forecast tracks 62 active construction projects in 2017 and 42 projects for 2018, with many of these in China.

For insight into semiconductor manufacturing in 2017 and 2018 with more details about capex for construction projects, fab equipping, technology levels, and products, visit the SEMI Fab Database webpage (www.semi.org/en/MarketInfo/FabDatabase) and order the SEMI World Fab Forecast Report. The report, in Excel format, tracks spending and capacities for over 1,200 facilities including over 80 future facilities, across industry segments from Analog, Power, Logic, MPU, Memory, and Foundry to MEMS and LEDs facilities.

About SEMI

SEMI® connects over 2,000 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics manufacturing. SEMI members are responsible for the innovations in materials, design, equipment, software, devices, and services that enable smarter, faster, more powerful, and more affordable electronic products. FlexTech and the MEMS & Sensors Industry Group (MSIG) are SEMI Strategic Association Partners, defined communities within SEMI focused on specific technologies. Since 1970, SEMI has built connections that have helped its members prosper, create new markets, and address common industry challenges together. SEMI maintains offices in Bangalore, Berlin, Brussels, Grenoble, Hsinchu, Seoul, Shanghai, Silicon Valley (Milpitas, Calif.), Singapore, Tokyo, and Washington, D.C. For more information, visit www.semi.org

Related Semiconductor IP

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

Related News

- Total Fab Equipment Spending Reverses Course, Growth Outlook Revised Downward

- Global Fab Equipment Spending to Rebound in 2020 with 20 Percent Growth

- 300mm Fab Equipment Spending to Seesaw, Reach New Highs in 2021 and 2023, SEMI Reports

- Global Fab Equipment Spending Rebounds in Second Half of 2019 with Stronger 2020 Projected, SEMI Reports

Latest News

- Synopsys Introduces Software-Defined Hardware-Assisted Verification to Enable AI Proliferation

- AimFuture and ITM Semiconductor to Develop AI-Integrated Technology for Robotics and Mobility

- TSMC February 2026 Revenue Report

- Silvaco Announces Immediate Availability of Production Ready Mixel MIPI PHY IP, Strengthening its Comprehensive Silicon IP Offering

- Movellus Partners with Synopsys to Deliver Power Efficiency for Next Generation IC’s