300mm Fab Equipment Spending to Seesaw, Reach New Highs in 2021 and 2023, SEMI Reports

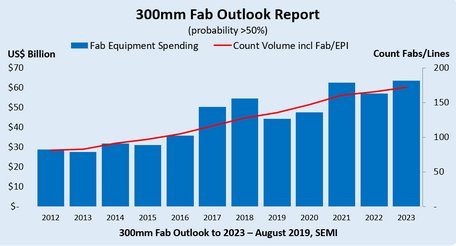

MILPITAS, Calif. — September 3, 2019 — 300mm fab equipment spending will slowly recover in 2020 after the 2019 downturn and take off in 2021 to log a new record high topping US$60 billion, only to lag again in 2022 and rebound to an all-time peak in 2023, according to the SEMI Industry Research and Statistics group in its first edition of the 300mm Fab Outlook report.

Most of the surges in fab equipment investment over the five-year outlook will be driven by memory (primarily NAND), foundry/logic, and power. Korea will head the list of top-spending regions followed by Taiwan and China, though Europe/Mideast and Southeast Asia are also expected to show healthy increases between 2019 and 2023.

Offering projections through 2023, the 300mm Fab Outlook report details fab investments across construction and equipment, as well as fab capacities and technologies investment for DRAM, NAND, foundry, logic, and a host of other products manufactured on 300mm wafers.

Fab equipment spending and volume fabs/lines count 2012-2023 and high-probability fab projects

The number of semiconductor fabs/lines in operation is expected to jump more than 30 percent, from 136 in 2019 to 172 in 2023, and climb even higher, to nearly 200, when lower probability fabs/lines are included in the count.

The new SEMI 300mm Fab Outlook report shows facility details by quarter through 2023 and also includes projections for fab projects through 2030 with estimates of various probabilities.

To learn more about the SEMI 300mm Fab Outlook report, click here.

About SEMI

SEMI® connects more than 2,100 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics design and manufacturing. SEMI members are responsible for the innovations in materials, design, equipment, software, devices, and services that enable smarter, faster, more powerful, and more affordable electronic products. Electronic System Design Alliance (ESD Alliance), FlexTech, the Fab Owners Alliance (FOA) and the MEMS & Sensors Industry Group (MSIG) are SEMI Strategic Association Partners, defined communities within SEMI focused on specific technologies. Visit www.semi.org to learn more

Related Semiconductor IP

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

Related News

- Global 300mm Fab Equipment Spending Forecast to Reach Record $119 Billion in 2026, SEMI Reports

- 300mm Fab Equipment Spending Forecast to Reach Record $137 Billion in 2027, SEMI Reports

- Fab Equipment Spending Breaking Industry Records

- Total Fab Equipment Spending Reverses Course, Growth Outlook Revised Downward

Latest News

- CAST Debuts TSN-EP-10G IP for High-Performance, Time-Sensitive Networking Ethernet Designs

- Synopsys Introduces Software-Defined Hardware-Assisted Verification to Enable AI Proliferation

- AimFuture and ITM Semiconductor to Develop AI-Integrated Technology for Robotics and Mobility

- TSMC February 2026 Revenue Report

- Silvaco Announces Immediate Availability of Production Ready Mixel MIPI PHY IP, Strengthening its Comprehensive Silicon IP Offering