Global Fab Equipment Spending Rebounds in Second Half of 2019 with Stronger 2020 Projected, SEMI Reports

MILPITAS, Calif. – December 16, 2019 – Projected 2019 global fab equipment spending has been revised upward to US$56.6 billion on the strength of surging memory investments in the latter part of the year after a weak first half, SEMI reported today in its World Fab Forecast. SEMI data now point to just a 7 percent decline in fab equipment investments from 2018 to 2019, a marked improvement on the previously forecast drop of 18 percent. Rising investments in memory – particularly 3D NAND – leading-edge logic and foundries have powered the turnaround.

SEMI has also revised its 2020 fab equipment investment projections to a more upbeat US$58 billion.

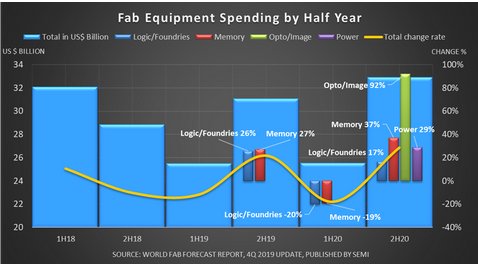

The rebound snaps a global slowdown in fab equipment spending that saw total investments drop 10 percent in the second half of 2018 and 12 percent in the first half of 2019 as indicated by the yellow trend line in Figure 1. During the first six months of 2019, fab equipment spending for memory fell 38 percent, to below US$10 billion, as 3D NAND sector investments took an especially hard hit, plunging 57 percent from the second half of 2018. DRAM investments fell 12 percent in the second half of 2018 and another 12 percent in the first half of this year.

Figure 1: Fab equipment spending by half year and change rates of main investment contributors

The downtrend shifted abruptly toward the end of 2019. Investments in leading-edge logic and foundry are now expected to climb 26 percent in the second half of 2019, lead by TSMC and Intel, and 3D NAND spending will skyrocket more than 70 percent over the same period. While the decline in DRAM investments continued in the first half of this year, the descent since July has been more muted.

Lead by Sony, image sensors spending is expected to jump 20 percent in the first half of 2020 and soar by over 90 percent in the second half, peaking at US$1.6 billion. Investments for power-related devices, driven by Infineon, ST Microelectronics and Bosch, are projected to grow by over 40 percent in the first half of 2020 and another 29 percent in the second half, reaching nearly US$1.7 billion.

The latest World Fab Forecast report, published in late November 2019, covers quarterly spending for construction and equipment from 2018 to 2020. The report lists more than 1,340 fabs and lines and 135 facilities expected to start volume production in 2019 or later. The World Fab Forecast also provides quarterly totals for capacities, technology nodes, 3D layers, product types and wafer sizes.

Learn more about SEMI fab databases.

About SEMI

SEMI® connects more than 2,100 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics design and manufacturing. SEMI members are responsible for the innovations in materials, design, equipment, software, devices, and services that enable smarter, faster, more powerful, and more affordable electronic products. Electronic System Design Alliance (ESD Alliance), FlexTech, the Fab Owners Alliance (FOA) and the MEMS & Sensors Industry Group (MSIG) are SEMI Strategic Association Partners, defined communities within SEMI focused on specific technologies. Visit www.semi.org

Related Semiconductor IP

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

Related News

- Fab Equipment Spending Breaking Industry Records

- Total Fab Equipment Spending Reverses Course, Growth Outlook Revised Downward

- Global Fab Equipment Spending to Rebound in 2020 with 20 Percent Growth

- 300mm Fab Equipment Spending to Seesaw, Reach New Highs in 2021 and 2023, SEMI Reports

Latest News

- CAST Debuts TSN-EP-10G IP for High-Performance, Time-Sensitive Networking Ethernet Designs

- Synopsys Introduces Software-Defined Hardware-Assisted Verification to Enable AI Proliferation

- AimFuture and ITM Semiconductor to Develop AI-Integrated Technology for Robotics and Mobility

- TSMC February 2026 Revenue Report

- Silvaco Announces Immediate Availability of Production Ready Mixel MIPI PHY IP, Strengthening its Comprehensive Silicon IP Offering