TSMC Reports First Quarter EPS of NT$13.94

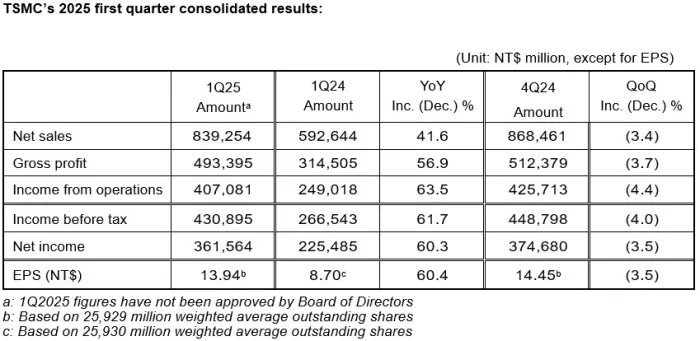

HSINCHU, Taiwan, R.O.C., Apr. 17, 2025 -- TSMC (TWSE: 2330, NYSE: TSM) today announced consolidated revenue of NT$839.25 billion, net income of NT$361.56 billion, and diluted earnings per share of NT$13.94 (US$2.12 per ADR unit) for the first quarter ended March 31, 2025.

Year-over-year, first quarter revenue increased 41.6%, while net income and diluted EPS increased 60.3% and 60.4% respectively. Compared to fourth quarter 2024, first quarter results represented a 3.4% decrease in revenue and a 3.5% decrease in net income. All figures were prepared in accordance with TIFRS on a consolidated basis.

In US dollars, first quarter revenue was $25.53 billion, which increased 35.3% year-over-year but decreased 5.1% from the previous quarter.

Gross margin for the quarter was 58.8%, operating margin was 48.5%, and net profit margin was 43.1%.

In the first quarter, shipments of 3-nanometer accounted for 22% of total wafer revenue; 5-nanometer accounted for 36%; 7-nanometer accounted for 15%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 73% of total wafer revenue.

“Our business in the first quarter was impacted by smartphone seasonality, partially offset by continued growth in AI-related demand.” said Wendell Huang, Senior VP and Chief Financial Officer of TSMC. “Moving into second quarter 2025, we expect our business to be supported by strong demand for our industry-leading 3nm and 5nm technologies. While we have not seen any changes in our customers’ behavior so far, uncertainties and risks from the potential impact from tariff policies exist. We will continue to closely monitor the potential impact on the end market demand, and manage our business prudently.”

Based on the Company’s current business outlook, management expects the overall performance for second quarter 2025 to be as follows:

- Revenue is expected to be between US$28.4 billion and US$29.2 billion;

And, based on the exchange rate assumption of 1 US dollar to 32.5 NT dollars,

- Gross profit margin is expected to be between 57% and 59%;

- Operating profit margin is expected to be between 47% and 49%.

Related Semiconductor IP

- MIPI D-PHY and FPD-Link (LVDS) Combinational Transmitter for TSMC 22nm ULP

- 12-bit, 400 MSPS SAR ADC - TSMC 12nm FFC

- General use, integer-N 4GHz Hybrid Phase Locked Loop on TSMC 28HPC

- Process/Voltage/Temperature Sensor with Self-calibration (Supply voltage 1.2V) - TSMC 3nm N3P

- 25MHz to 4.0GHz Fractional-N RC PLL Synthesizer on TSMC 3nm N3P

Related News

- Synopsys Posts Financial Results for Second Quarter Fiscal Year 2025

- Rambus Reports Second Quarter 2025 Financial Results

- Cadence Reports Second Quarter 2025 Financial Results

- Arteris Announces Financial Results for the Second Quarter and Estimated Third Quarter and Updated Full Year 2025 Guidance

Latest News

- Altera Advances FPGA-Based Physical AI for Robotics and Edge Applications

- TES offers new High-Speed Comparator IPs for X-FAB XT018 - 0.18µm BCD-on-SOI technology.

- QuickLogic Reports Fiscal Fourth Quarter and Full Year 2025 Financial Results

- MIPS, GlobalFoundries Bet on Physical AI

- IPrium releases LunaNet AFS LDPC Encoder and Decoder for Lunar Navigation Satellite Systems