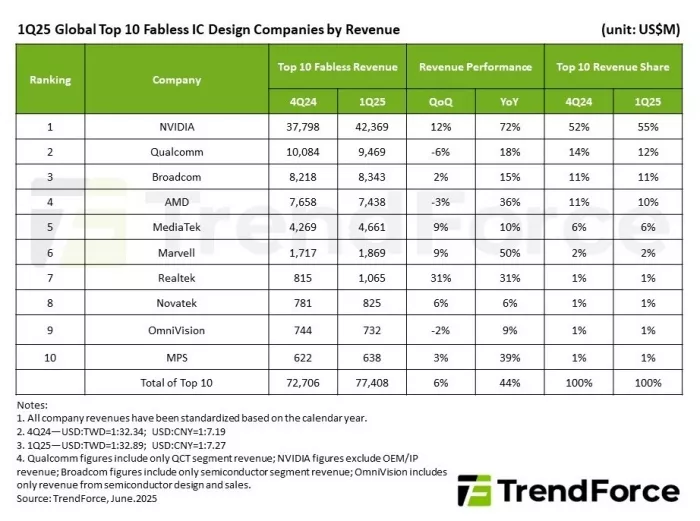

Robust AI Demand Drives 6% QoQ Growth in Revenue for Top 10 Global IC Design Companies in 1Q25

June 12, 2025 -- TrendForce’s latest investigations reveal that 1Q25 revenue for the global IC design industry reached US$77.4 billion, marking a 6% QoQ increase and setting a new record high. This growth was fueled by early stocking ahead of new U.S. tariffs on electronics and the ongoing construction of AI data centers around the world, which sustained strong chip demand despite the traditional off-season.

NVIDIA remained the top-ranking IC design company, with Q1 revenue surging to $42.3 billion—up 12% QoQ and 72% YoY—thanks to increasing shipments of its new Blackwell platform. Although its H20 chip is constrained by updated U.S. export controls and is expected to incur losses in Q2, the higher-margin Blackwell is poised to replace the Hopper platform gradually, cushioning the financial impact.

AMD ranked fourth, posting $7.44 billion in revenue, down 3% QoQ due to slight weakness in its data center segment and continued softness in gaming and embedded products. However, revenue still rose 36% YoY. AMD is preparing to ramp up mass production of its next-generation MI350 platform in the second half of 2025, with plans to launch the MI400 in 2026, positioning itself as a direct competitor to NVIDIA’s Blackwell and upcoming Rubin AI chips.

In third place, Broadcom’s semiconductor revenue hit a record $8.34 billion in Q2, up 15% YoY. The company continues to expand its high-speed interconnect solutions for AI servers, launching the industry’s first 102.4 Tbps co-packaged optics (CPO) switch and securing custom AI ASIC contracts with several tech giants and establishing itself as a key NVIDIA rival in AI chip infrastructure.

Marvell posted $1.87 billion in revenue, up 9% QoQ, driven by strong demand for AI server components. In addition to providing customized AI ASICs for major CSPs, Marvell’s optical interconnect solutions play a crucial role in scaling AI data centers.

Qualcomm, the world’s second-largest IC design firm, reported Q1 (F2Q25) revenue of $9.47 billion. Its QCT mobile segment declined due to seasonality, and concerns over Apple’s growing in-house chip development further dampened the outlook, leading to a 6% QoQ revenue decline. In response, Qualcomm is actively expanding into AI smartphones, AI PCs, automotive, and IoT sectors.

MediaTek secured fifth place with $4.66 billion in Q1 revenue, driven by strong demand from Chinese smartphone OEMs for its Dimensity 9400+ and 8000 series chips. Higher ASPs for smartphone SoCs also contributed to the revenue boost.

Realtek delivered a standout performance, with Q1 revenue up 31% to over $1.06 billion. Growth was fueled by increased PC-related inventory stocking amid market uncertainty, greater Wi-Fi 7 adoption, and rising demand for automotive Ethernet solutions.

Novatek saw Q1 revenue rise to over $825 million, up 6% QoQ, supported by consumer subsidies in China and early shipments from customers looking to avoid tariff-related risks.

OmniVision posted Q1 revenue of $732 million, down 2% QoQ due to the smartphone off-season. However, its automotive CIS business showed strong momentum as domestic EV brands increasingly adopted camera-based driver assistance systems.

MPS hit a record high with Q1 revenue of about $638 million, driven by soaring demand for power management ICs in AI data centers. Its computing and storage segments saw significant expansion.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

Related Semiconductor IP

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

Related News

- Amid Rising Volume and Pricing, Top 10 IC Design Companies Post 2021 Revenue Topping US$100 Billion

- Top 10 Companies Hold 57% of Global Semi Marketshare

- Q2 Revenue for Top 10 Global IC Houses Surges by 12.5% as Q3 on Pace to Set New Record, Says TrendForce

- Global Top 10 IC Design Houses See 49% YoY Growth in 2024, NVIDIA Commands Half the Market, Says TrendForce

Latest News

- TSMC February 2026 Revenue Report

- Silvaco Announces Immediate Availability of Production Ready Mixel MIPI PHY IP, Strengthening its Comprehensive Silicon IP Offering

- Movellus Partners with Synopsys to Deliver Power Efficiency for Next Generation IC’s

- BrainChip Enables the Next Generation of Always-On Wearables with the AkidaTag© Reference Platform

- eSOL and Quintauris Partner to Expand Software Integration in RISC-V Automotive Platforms