Fabs Valued at Nearly $50 Billion to Start Construction in 2020

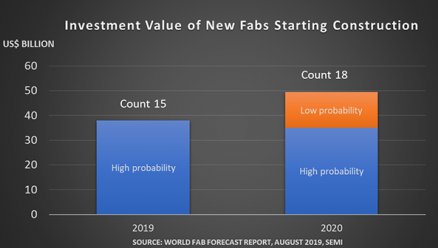

MILPITAS, Calif. – September 12, 2019 – Investments in new fab projects starting construction in 2020 is expected to reach nearly US$50 billion, up about US$12 billion from 2019, according to the latest update of the World Fab Forecast from SEMI. See figure 1.

Fifteen new fab projects with a total investment of US$38 billion will have started construction by the end of 2019 with 18 more fab projects forecast to start construction in 2020. Of the 18, 10 fab projects with a total investment value of more than US$35 billion carry a high probability and the other eight, with a total investment value of more than US$14 billion, are weighted with a low probability of materializing.

Figure 1: Total investments (construction and equipment) for new fabs and lines (greenfield, shell, new line) starting construction through 2020

Facilities that commence construction in 2019 will begin equipping as early as the first half of 2020, with some starting to ramp production as early as mid-2020. These new fab projects will add more than 740,000 wafers per month (in 200mm equivalents). Most of the additional capacity will be dedicated to foundries (37%) followed by memory (24%) and MPU (17%). Of the 15 new fab projects in 2019, about half are for 200mm wafer sizes. See figure 2.

Figure 2: Fab Count by wafer size for new fabs and lines (greenfield, shell, new line) starting construction in 2019 and 2020

The fab projects to begin construction in 2020 are expected to produce more than 1.1 million wafers per month (in 200mm equivalents). Most of these fabs and lines will begin equipping in 2021. The high-probability fabs will increase capacity by 650,000 wafers per month (in 200mm equivalents) while the low-probability facilities may add another 500,000 wafers per month (in 200mm equivalents). The bulk of the capacity will be for foundry (35%) and memory (34%) across various wafer sizes.

Published by the Industry Research and Statistics Group at SEMI, the World Fab Forecast covers new, planned and existing fabs as well as fab spending for construction and equipping, capacity expansion, and technology nodes by quarter and by product type with more than 1,300 front-end fab listings. All told, 192 updates have been made to the report, including the addition of 64 new facilities and lines since its previous publication in June 2019. The World Fab Forecast also includes projections for fabs and lines starting construction beyond 2020.

Learn more about SEMI fab databases.

About SEMI

SEMI® connects more than 2,100 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics design and manufacturing. SEMI members are responsible for the innovations in materials, design, equipment, software, devices, and services that enable smarter, faster, more powerful, and more affordable electronic products. Electronic System Design Alliance (ESD Alliance), FlexTech, the Fab Owners Alliance (FOA) and the MEMS & Sensors Industry Group (MSIG) are SEMI Strategic Association Partners, defined communities within SEMI focused on specific technologies. Visit www.semi.org

Related Semiconductor IP

- eUSB2V2.0 Controller + PHY IP

- I/O Library with LVDS in SkyWater 90nm

- 50G PON LDPC Encoder/Decoder

- UALink Controller

- RISC-V Debug & Trace IP

Related News

- SkyWater Begins Domestic Fab Expansion Tool Installation to Support DOD Investment of up to $170M

- U.S. to Hold Over 20% of Advanced Semiconductor Capacity by 2030, TSMC Expands Investment to US$165 Billion, Says TrendForce

- SkyWater Completes Acquisition of Fab 25, Expanding U.S. Pure-Play Foundry Capacity for Critical Semiconductor Technologies

- Cirrus Logic and GlobalFoundries Expand Strategic Investment to Advance Next-Generation Mixed-Signal Semiconductor Manufacturing in the U.S.

Latest News

- Nuclei Announces Strategic Global Expansion to Accelerate RISC-V Adoption in 2026

- Semidynamics Unveils 3nm AI Inference Silicon and Full-Stack Systems

- Andes Technology Launches RISC-V Now! — A Global Conference Series Focused on Commercial, Production-Scale RISC-V

- Rambus Reports Fourth Quarter and Fiscal Year 2025 Financial Results

- IntoPIX And Cobalt Digital Enable Scalable, Low-Latency IPMX Video With JPEG XS TDC At ISE 2026