U.S. to Hold Over 20% of Advanced Semiconductor Capacity by 2030, TSMC Expands Investment to US$165 Billion, Says TrendForce

March 6, 2025 -- TrendForce’s latest findings reveal that TSMC has announced it’s increasing investment in U.S. advanced semiconductor manufacturing, bringing the total to US$165 billion. Mass production is expected to begin after 2030 if the three newly planned fabs proceed on schedule. The U.S., which has been actively expanding its advanced semiconductor capacity, is projected to hold 22% of the global market share by 2030.

TrendForce notes that TSMC first announced plans for its Arizona fab in 2020 as part of a six-fab expansion strategy, aiming to mitigate geopolitical risks. However, escalating trade tensions and tariff issues have forced the company to accelerate its expansion timeline.

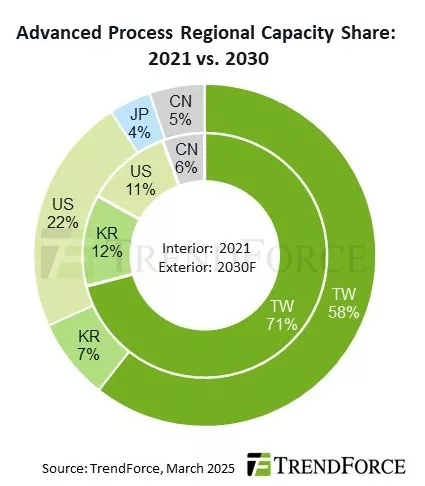

Since 2018, global trade conflicts and the COVID-19 pandemic have accelerated supply chain fragmentation, with governments worldwide striving to establish localized semiconductor production. TrendForce data from 2021 indicates that Taiwan accounted for 71% of global advanced node capacity and 53% of mature node capacity. However, by 2030, Taiwan’s advanced process share is expected to decline to 58%, while its mature process share will drop to 30% as the U.S. and China ramp up their semiconductor manufacturing capabilities.

Expanding U.S. investments is a strategic necessity as U.S.-based clients represent the largest share of TSMC’s advanced node adoption. TSMC is also establishing two advanced packaging plants and a R&D center for HPC applications in addition to three new fabs. Arizona is set to become TSMC’s leading overseas technology hub, ensuring comprehensive service for key clients.

While expanding U.S. production reduces concentration risks, it could also lead to higher costs for U.S. IC customers. These increased expenses may trickle down to higher component and end-product prices, potentially affecting consumer purchasing behavior.

TrendForce observes that TSMC’s Arizona Phase 1 has just entered mass production, while Phase 2 and Phase 3 are still under construction, with mass production expected between 2026 and 2028. The actual timeline for the newly announced fabs remains uncertain, with no immediate impact on the industry in the short term. However, in the mid-to-long term, the cost implications and potential price increases across the supply chain will be key factors to watch.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

Related Semiconductor IP

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

- JESD204E Controller IP

Related News

- SkyWater Completes Acquisition of Fab 25, Expanding U.S. Pure-Play Foundry Capacity for Critical Semiconductor Technologies

- Progress in Importation of US Equipment Dispels Doubts on SMIC's Capacity Expansion for Mature Nodes for Now, Says TrendForce

- China and US Bolster Semiconductor Independence as Taiwan's Foundry Capacity Share Projected to Decline to 41% by 2027, Says TrendForce

- SkyWater to Acquire Infineon’s Austin Fab and Establish Strategic Partnership to Expand U.S. Foundry Capacity for Foundational Chips

Latest News

- TASKING Delivers Advanced Worst-Case Timing Coupling Analysis and Mitigation for Multicore Designs

- Efficient Computer Raises $60 Million to Advance Energy-Efficient General-Purpose Processors for AI

- QuickLogic Announces $13 Million Contract Award for its Strategic Radiation Hardened Program

- Cadence Reports Fourth Quarter and Fiscal Year 2025 Financial Results

- Renesas Develops 3nm TCAM Technology Combining High Memory Density and Low Power, Suitable for Automotive SoCs