Samsung Forecast to Top Intel as the #1 Semiconductor Supplier in 2017

Nvidia expected to make its first appearance in the top 10 ranking this year.

November 20, 2017 -- IC Insights will release its November Update to the 2017 McClean Report later this month. This Update includes a 2017-2021 semiconductor market update, a forecast for the major capital spenders for 2017 and 2018, an analysis of the DRAM market, and a look at the top-25 semiconductor suppliers expected for 2017. The top-10 2017 semiconductor suppliers are covered in this research bulletin.

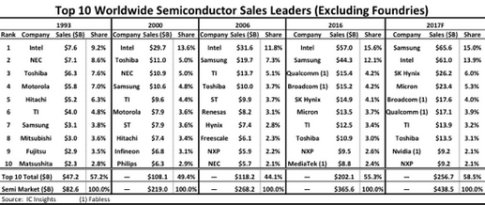

For the first time since 1993, the semiconductor industry is expected to witness a new number 1 supplier. Samsung first charged into the top spot in 2Q17 and displaced Intel, which had held the number 1 ranking since 1993. In 1Q16, Intel’s sales were 40% greater than Samsung’s, but in just over a year’s time, that lead has been erased. Intel is now expected to trail Samsung in the full-year 2017 semiconductor sales ranking by $4.6 billion. Samsung’s big increase in sales this year has been primarily driven by an amazing rise in DRAM and NAND flash average selling prices.

In 1993, Intel was the number 1 ranked supplier with a 9.2% share of the worldwide semiconductor market (Figure 1, which does not include the pure-play foundries). In 2006, Intel still held the number 1 ranking with an 11.8% share. In 2017, Intel's sales are expected to represent 13.9% of the total semiconductor market, down from 15.6% in 2016. In contrast, Samsung's global semiconductor marketshare was 3.8% in 1993, 7.3% in 2006, 12.1% in 2016, and forecast to be 15.0% in 2017. Thus, it appears that Samsung’s accession to the number 1 position in the semiconductor sales ranking this year has had more to do with Samsung gaining marketshare than Intel losing marketshare.

For 2017, the top 10 sales leaders are forecast to hold a 58.5% share of the worldwide semiconductor market. If this occurs, this would be the largest share of the market the top 10 companies held since 1993.

Memory giants SK Hynix and Micron are expected to make the biggest moves in the top-10 ranking in 2017 as compared to the 2016 ranking. Spurred by the surge in the DRAM and NAND flash markets, each company is forecast to move up two spots in the top-10 ranking with SK Hynix occupying the third position and Micron moving up to fourth.

Click to enlarge

Figure 1

Excluding foundries, there is expected to be one new entrant into the top-10 ranking in 2017—U.S.-headquartered Nvidia, which is forecast to register a 44% increase in sales this year. Nvidia is expected to replace fabless supplier MediaTek, whose 2017/2016 sales are expected to be down by 11% to $7.9 billion.

Six of the top-10 companies are expected to have sales of at least $17.0 billion in 2017. As shown, it is forecast to take $9.2 billion in sales just to make it into this year’s top-10 semiconductor supplier list. It should be noted that if Qualcomm and NXP’s expected sales for this year were combined, as if Qualcomm’s pending acquisition had already occurred, the companies’ 2017 sales would be $26.3 billion, enough to place the combined entity into third place in the top 10 ranking. Moreover, Broadcom’s current attempt to acquire Qualcomm, while Qualcomm itself is in the process of attempting to acquire NXP, adds additional uncertainty with regard to the future top 10 ranking.

As would be expected, given the possible acquisitions and mergers that could/will occur over the next couple of years (e.g., Qualcomm/NXP, Broadcom/Qualcomm/NXP, etc.), as well as any new ones that may develop, the top-10 semiconductor ranking is likely to undergo some significant changes over the next few years as the semiconductor industry continues along its path to maturity.

Report Details: The 2017 McClean Report

Further details and rankings of top semiconductor suppliers as well as overall market trends within the IC industry are provided in the 2017 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry, which is IC Insights’ flagship report covering the IC market. A subscription to The McClean Report includes free monthly updates from March through November (including a 250+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual-user license to the 2017 edition of The McClean Report is priced at $4,090 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,090.

Related Semiconductor IP

- 5G-NTN Modem IP for Satellite User Terminals

- HBM4E Controller IP

- 14-bit 12.5MSPS SAR ADC - Tower 65nm

- 5G-Advanced Modem IP for Edge and IoT Applications

- TSN Ethernet Endpoint Controller 10Gbps

Related News

- Semiconductor Industry Capital Spending Forecast to Jump 20% in 2017

- Wafer Shipments Forecast to Increase in 2017, 2018 and 2019

- IC Insights Raises 2017 IC Market Forecast to +22%

- Intel Explores Foundry Alliance with Samsung in High-Level Talks

Latest News

- OpenTitan Ships in Chromebooks: First Production Deployment

- Breker Verification Systems Adds RISC‑V Industry Expert Larry Lapides to its Advisory Board

- Weebit Nano’s ReRAM Selected for Korean National Compute-in-Memory Program

- Marvell Extends ZR/ZR+ Leadership with Industry-first 1.6T ZR/ZR+ Pluggable and 2nm Coherent DSPs for Secure AI Scale-across Interconnects

- BrainChip Announces Neuromorphyx as Strategic Customer and Go-to-Market Partner for AKD1500 Neuromorphic Processor