IC Insights Raises 2017 IC Market Forecast to +22%

Strong growth to be driven by a 74% surge in the DRAM market and 44% jump in the NAND flash market.

October 19, 2017 -- IC Insights is set to release its October Update to The McClean Report. The 30-page Update includes a detailed analysis of IC Insights’ revised forecasts for the IC, O-S-D, and total semiconductor markets through 2021. Shown below is an excerpt from the Update.

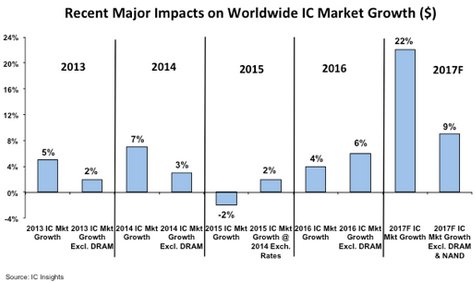

IC Insights has raised its IC market growth rate forecast for 2017 to 22%, up six percentage points from the 16% increase shown in its Mid-Year Update. The IC unit volume shipment growth rate forecast has also been increased from 11% depicted in the Mid-Year Update to 14% currently. As shown below, a large portion of the market forecast revision is due to the surging DRAM and NAND flash markets.

In addition to increasing the IC market forecast for this year, IC Insights has also increased its forecast for the O-S-D (optoelectronics, sensor/actuator, and discretes) market. In total, the semiconductor industry is now expected to register a 20% increase this year, up five percentage points from the 15% growth rate forecast in the Mid-Year Update.

For 2017, IC Insights expects a whopping 77% increase in the DRAM ASP, which is forecast to propel the DRAM market to 74% growth this year, the largest growth rate since the 78% DRAM market increase in 1994. After including a 44% expected surge in the NAND flash market in 2017, including a 38% increase in NAND flash ASP this year, the total memory market is forecast to jump by 58% in 2017 with another 11% increase forecast for 2018.

At $72.0 billion, the DRAM market is forecast to be by far the largest single product category in the semiconductor industry in 2017, exceeding the expected NAND flash market ($49.8 billion) by $22.2 billion this year. As shown in Figure 1, the DRAM and NAND flash segments are forecast to have a strong positive impact of 13 percentage points on total IC market growth this year. Excluding these memory segments, the IC industry is forecast to grow by 9%, less than half of the current total IC market growth rate forecast of 22% when including these memory markets.

Figure 1

Report Details: The 2017 McClean Report

Additional details on the IC market and other trends within the IC industry are provided in The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2017). A subscription to The McClean Report includes free monthly updates from March through November (including the Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual-user license to the 2017 edition of The McClean Report is priced at $4,090 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,090.

Related Semiconductor IP

- 5G-NTN Modem IP for Satellite User Terminals

- HBM4E Controller IP

- 14-bit 12.5MSPS SAR ADC - Tower 65nm

- 5G-Advanced Modem IP for Edge and IoT Applications

- TSN Ethernet Endpoint Controller 10Gbps

Related News

- 17 Semiconductor Companies Forecast to Have >$10.0 Billion in Sales This Year

- Semi Industry Capex Forecast to Jump 24% and Reach Over $190 Billion This Year

- 2022 to Mark the Third Year in a Row of ≥20% Growth for the Foundry Market

- Analog Market Momentum to Continue Throughout 2022

Latest News

- OpenTitan Ships in Chromebooks: First Production Deployment

- Breker Verification Systems Adds RISC‑V Industry Expert Larry Lapides to its Advisory Board

- Weebit Nano’s ReRAM Selected for Korean National Compute-in-Memory Program

- Marvell Extends ZR/ZR+ Leadership with Industry-first 1.6T ZR/ZR+ Pluggable and 2nm Coherent DSPs for Secure AI Scale-across Interconnects

- BrainChip Announces Neuromorphyx as Strategic Customer and Go-to-Market Partner for AKD1500 Neuromorphic Processor