China Takes the Lead in RF Front-End Patent Activity: RadRock and Others Surge Behind Murata

SOPHIA ANTIPOLIS, France – April 25, 2025 – The Q1 2025 edition of KnowMade’s RF Front-End Modules & Components Patent Monitor has just been released. The latest data confirms that China’s RF front-end patent activity has reached a pivotal moment. In Q1 2025, domestic companies such as RadRock (Ruishi Chuangxin), OPPO, Lansus, Newsonic, Starshine, and MEMSonics significantly expanded their intellectual property (IP) portfolios. While Murata remains the global benchmark, the shift in IP dynamics signals a new phase of competition that demands attention from every stakeholder in the RF value chain.

China Leads in RF FEM Patent Filings

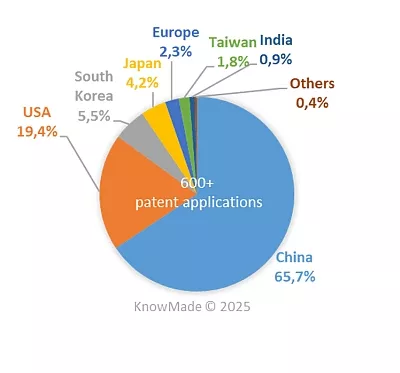

According to KnowMade’s latest IP intelligence, over 65% of all new patent families (inventions) related to RF front-end modules (RF FEM) published in Q1 2025 were filed in China, making it the most active jurisdiction globally. The United States followed with 19.4%, while South Korea and Japan accounted for 5.5% and 4.2% respectively. China’s dominance is now both quantitative and strategic, reflecting a long-term push for self-reliance and technology leadership.

Figure 1: Global distribution of patent filing regions for RF front-end module-related patent families (inventions) newly published in Q1 2025.

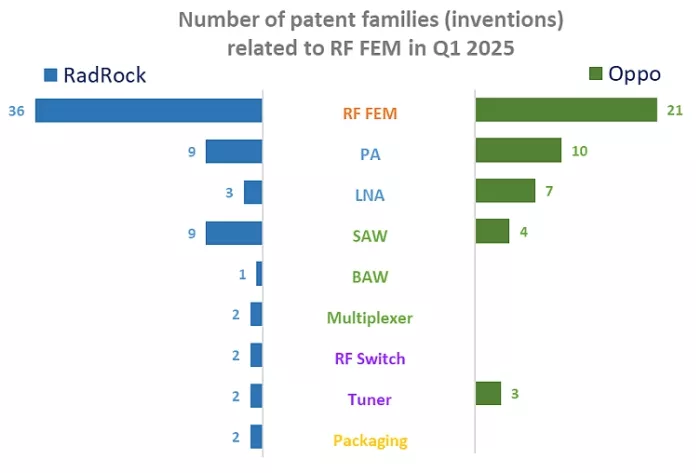

The ranking of top Chinese patent applicants for Q1 2025 (figure 2) further illustrates the country’s momentum. RadRock leads with a significant margin, followed by OPPO, Lansus, and a diverse set of emerging and established Chinese players across multiple RF domains.

Figure 2: Active industrial patent assignees according to the number of their new patent families (inventions) related to RF front-end module published in Q1 2025.

RadRock: Second Only to the Evergreen Murata

Founded in 2017, RadRock/Ruishi Chuangxin (锐石创芯) has quickly become China’s most prominent RF FEM patent applicant. In Q1 2025, the company published 36 new patent families, making it the second most active global IP player, just behind the evergreen leader Murata. RadRock’s patent portfolio comprises over 470 live patents and is notably broad and coherent. It covers nearly every major RF FEM component, including power amplifiers (PA), low-noise amplifiers (LNA), RF acoustic wave filters (SAW, BAW), multiplexers, switches, tuners, and packaging, positioning the company as a comprehensive and rapidly scaling IP player. The latest patent publications confirm and further strengthen the company’s strategic positioning in the RF FEM domain. In Q1 2025, RadRock’s patent activity places it ahead of several long-established global players, including Qualcomm, Skyworks, Qorvo, and Samsung. This marks a notable inflection point in the international RF FEM IP landscape.

OPPO: Strategic IP Player Beyond Smartphones

OPPO has long been one of the most aggressive IP players globally, consistently ranking among the top 10 applicants under the PCT system. Its sustained IP activity has been partly driven by years of high-profile litigation.

Although OPPO officially ended its four-year internal chip development program in 2023, its momentum in RF front-end IP has continued to accelerate. In Q1 2025, the company published 21 new patent families in RF FEM, reaffirming its status as a consistent patent applicant among global consumer electronics brands. OPPO’s RF FEM IP strategy is focused and deliberate. Its patents target PA, LNA, RF switches, and tuners, which are all essential components for achieving high-performance mobile communication.

Figure 3: Technology breakdown of RadRock’s and Oppo’s RF front-end patent families published in Q1 2025.

A New Generation of Chinese IP Players Gains Ground

A broader cohort of Chinese companies is now cementing their presence in RF IP:

- MEMSonics (武汉敏声) and EPICMEMS (开元通信) : active in BAW/SAW acoustic filters

- Lansus (深圳飞骧), Newsonic (新声半导体), and StarShine Semiconductor (浙江星曜半导体): focusing on FEM chips and modules

- Huawei: maintaining strength in amplifiers, tuning, filtering, and advanced packaging

- CETC (China Electronics Technology Group): driving system-level IP under state-led innovation mandates

Meanwhile, companies such as Enicom /Tiantong Ruihong Technology (天通瑞宏科技有限公司), Maxscend (江苏卓胜微电子股份有限公司), NSI Corp (中芯国际), Sappland (杭州左蓝微电子技术有限公司), Raytron Technology (睿创微纳), Vanchip (唯捷创芯), Yuntatech (云塔科技/安努奇) , Sanan IC (三安集成) , Shoulder electronic (好达电子) and FaradChase (凡麒微电子) rapidly emerging as key players in the field, contributing significantly to the growing diversity and dynamism of China’s RF IP ecosystem.

A New RF IP Era Demands Fresh Competitive Intelligence

The RF front-end patent landscape is undergoing a fundamental shift. Chinese players are advancing rapidly, not only in patent volume, but also in technical breadth, portfolio coherence, and system-level integration.

As predicted in KnowMade’s earlier open-access articles:

- How China is Leveraging IP to Regain Control of Its Domestic Supply Chain in the RF Front-End Industry (Feb 2024)

- RF Acoustic Wave Filters and RF Front-End Modules: Chinese Companies MEMSonics and EPICMEMS Are Ramping Up Their Developments – Cause for Alarm? (Feb 2023)

That projected evolution is no longer a forecast, it is becoming reality.

Is your organization prepared to monitor these changes, mitigate IP risks, and identify timely licensing or partnership opportunities?

Explore KnowMade RF patent monitor, custom analysis, and consulting services.In addition to these public articles, we offer a full suite of in-depth, client-specific deliverables.

Contact us to learn how we can support your strategic positioning.

About the author

Yanni ZHOU, PhD., works at KnowMade in the field of RF Technologies for Wireless Communications, Sensing, and Imaging. She holds a Ph.D. in RF and Wireless Communication from the University of Lyon, INSA Lyon, INRIA, France, and an Engineer’s Degree in Electrical Engineering from INSA Lyon, France. Yanni previously worked at Nokia Bell Labs, Strategy & Technology, focusing on 5G/6G and RF front-end systems. She developed innovative RF solutions effectively integrated into communication and radar systems. Her work also includes designing advanced radar sensing and imaging systems for accurate detection in complex environments.

About KnowMade

KnowMade is a technology intelligence and IP strategy consulting company specialized in analyzing patents and scientific publications. The company helps innovative companies, investors, and R&D organizations to understand the competitive landscape, follow technological evolutions, reduce uncertainties, and identify opportunities and risks in terms of technology and intellectual property.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patent information and scientific literature into actionable insights, providing high added value reports for decision makers working in R&D, innovation strategy, intellectual property, and marketing. Our experts provide prior art search, patent landscape analysis, freedom-to-operate analysis, IP due diligence, and monitoring services.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Sensors, Semiconductor Packaging, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.

Related Semiconductor IP

- Bluetooth Low Energy 6.0 Scalable RF IP

- All Digital Fractional-N RF Frequency Synthesizer PLL in GlobalFoundries 22FDX

- Wi-Fi 7(be) RF Transceiver IP in TSMC 22nm

- mmWave 8x8 MIMO RF Front End V2

- Single-carrier RF transceiver on TSMC 22nm ULL

Related News

- SpaceX Acquires Akoustis’s IP, Murata and RadRock Dominate Q2 2025 RF Front-End Patent Activity

- NTLab announces highly linear GPS/GLONASS/Galileo/BeiDou RF front-end with reduced power consumption

- MIPI Alliance Updates its MIPI RFFE Interface for Mobile Device RF Front-End Architectures

- RFaxis Expands Portfolio of CMOS RF Front-End ICs for Internet of Things (IoT)

Latest News

- Marvell Extends ZR/ZR+ Leadership with Industry-first 1.6T ZR/ZR+ Pluggable and 2nm Coherent DSPs for Secure AI Scale-across Interconnects

- BrainChip Announces Neuromorphyx as Strategic Customer and Go-to-Market Partner for AKD1500 Neuromorphic Processor

- SCI Semiconductor Announces First Silicon of Cybersecure MCU, ICENI™

- Allen Wu on Disrupting $100M Cost of Building Custom AI Chips

- GUC Monthly Sales Report – February 2026