SpaceX Acquires Akoustis’s IP, Murata and RadRock Dominate Q2 2025 RF Front-End Patent Activity

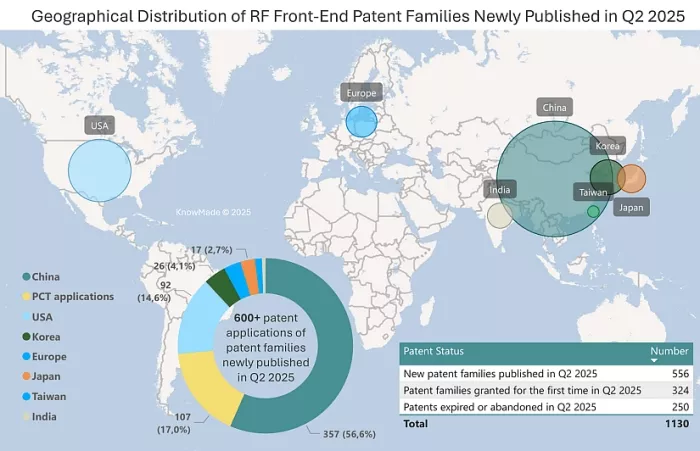

SOPHIA ANTIPOLIS, France – July 22, 2025 – The RF front-end landscape has entered a phase of accelerated transformation, fueled by next-generation connectivity demands, from 5G-Advanced and Wi-Fi 7 to satellite-based internet and edge computing. KnowMade’s Q2 2025 RF Front-End Modules & Components Patent Monitor reveals a fiercely competitive global innovation landscape, with over 1,100 patent events analyzed this quarter, including 556 new patent families, 324 new grants, and 250 expirations or abandonments.

Long-time industry leader Murata maintains its stronghold, while China’s RadRock (Ruishi Chuangxin) surges forward with aggressive new patent filings. In parallel, SpaceX has made a bold entry into the RF component space by acquiring key IP assets from Akoustis, including 40 core patents in acoustic wave filters.

China Still Leads on Volume, But Not Alone

As shown in Figure 1, the global center of gravity for RF front-end innovation continues to shift toward Asia. In Q2 2025, China accounted for 56.6% of newly published RF front-end module patent families, maintaining its position as the most active filing region. The United States followed with 14.6%, while PCT applications represented 17%. Other regions, including Japan, South Korea, and Europe, also contributed significantly.

Figure 1: Global distribution of filing regions for RF front-end module-related patent families (inventions) newly published in Q2 2025, and the legal status of all patents analyzed in Q2 2025 for RF Front-End Modules & Components Patent Monitor.

Although China remains the dominant source of new patent filings, its lead is increasingly being challenged in terms of technological depth and portfolio maturity. Chinese companies such as RadRock, Chemsemi, Maxscend, Huawei, and Lansus are actively expanding their patent portfolios across multiple RF segments. At the same time, global incumbents including Murata, Qualcomm, and Skyworks are reinforcing their IP positions through a high volume of granted patents and focused innovation in core technologies. This dual dynamic, volume-driven growth from China and high-value consolidation from global leaders, continues to reshape the competitive landscape of RF front-end IP.

Murata vs. RadRock: Volume Meets Velocity

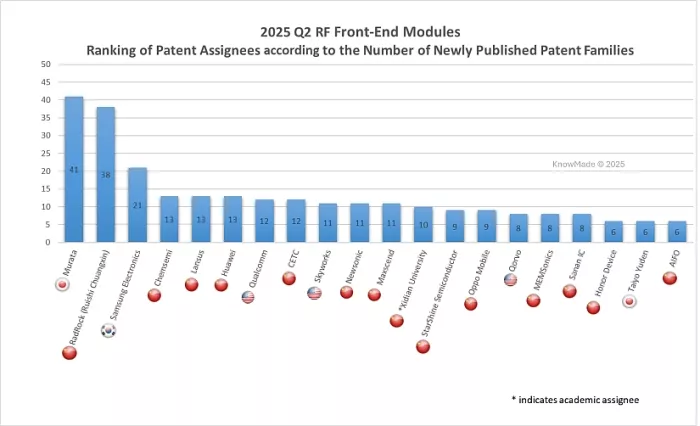

According to Figure 2, Murata leads the global assignee ranking with 41 newly published patent families in Q2 2025, closely followed by RadRock with 38. Together, these two companies account for the largest share of RF front-end module patent filings this quarter. They exemplify two distinct innovation models: one based on maturity and integration, the other on speed and focus.

Figure 2: Active patent assignees according to the number of their new patent families (inventions) related to RF front-end module published in Q2 2025.

Murata continues to file patents across the entire RF front-end chain, holding strong positions in SAW, BAW, and LBAW filters, power amplifiers (PA), multiplexers, and packaging technologies. Its portfolio spans multiple jurisdictions including the United States, Japan, China, South Korea, and through the PCT routes. This reflects a comprehensive global strategy focused on long-term product integration and miniaturization.

RadRock, in contrast, is rapidly expanding within the Chinese market. Its filings emphasize PA circuits, reconfigurable front-end architectures, and compact module-level innovations. While the vast majority of its patents are currently filed in China, RadRock has begun submitting a small number of PCT applications. This early international outreach suggests the company is preparing for future overseas expansion or global licensing opportunities.

In the past two quarters alone, RadRock has published 74 new patent families, surpassing long-established players such as Qualcomm, Skyworks, and Samsung in volume. This reflects not only a drive for domestic leadership but also growing ambitions to compete globally.

The broader assignee landscape in Figure 2 shows a strong presence of Chinese companies among the top 20, with firms like Chemsemi, Lansus, Huawei, Newsonic, Maxscend and Sanan IC also contributing significantly. This underlines both China’s ongoing dominance in patent quantity and the increasing intensity of local competition. Meanwhile, U.S. and Japanese companies maintain strength through high-value patent filings that focus on technical depth and system-level performance.

Technological Focus: Acoustic Filtering and Power Efficiency

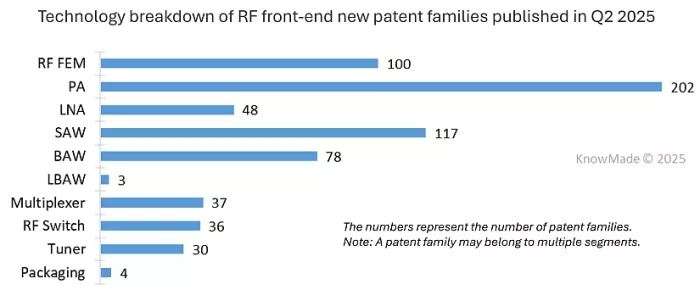

As illustrated in Figure 3, Q2 2025 patent activity in RF front-end modules continues to concentrate on two core technological domains: acoustic wave filtering (SAW, BAW, XBAR/LBAW) and power amplification.

Figure 3: Technology breakdown of RF front-end new patent families published in Q2 2025.

PA remain the most actively patented category, with 202 new patent families, reflecting ongoing efforts to improve transmit efficiency, signal linearity, and bandwidth agility. These advancements are critical for meeting the performance and energy demands of next-generation wireless standards such as 5G-Advanced and Wi-Fi 7. In parallel, SAW and BAW filters generated 117 and 78 new patent families, respectively. These filters remain indispensable for front-end signal conditioning, especially in densely packed RF environments. Innovations this quarter focus on miniaturized resonator designs, spurious mode suppression, and temperature stability, often leveraging advanced packaging and material enhancements. Other areas with notable activity include multiplexers, RF switches, and LNA circuits, all of which support the industry-wide shift toward integrated, multi-band front-end modules optimized for performance and size. Overall, the Q2 patent landscape reflects a clear priority: enabling compact, energy-efficient, and high-selectivity RF front ends to support increasingly complex wireless architectures.

SpaceX’s Strategic Move : Acquiring Akoustis Filter IP

SpaceX, through its subsidiary Tune Holdings, completed the acquisition of nearly all operating assets of Akoustis in Q2 2025, following a court-approved auction in April conducted under Section 363 of the U.S. Bankruptcy Code. The transaction, valued at approximately 30.2 million U.S. dollars in cash, also involved the assumption of certain liabilities.

Structured as a going-concern sale, the deal enables Tune Holdings to retain Akoustis’ operations, personnel, and customer relationships, thereby ensuring continuity of service. According to KnowMade’s patent monitoring, 40 U.S. patents had been successfully transferred to SpaceX by the end of the quarter. These patents cover key technologies related to high-frequency BAW filter design.

With this acquisition, SpaceX gains direct ownership of essential RF filter IP. This positions the company to internalize critical front-end components, reduce reliance on external suppliers, and improve performance across its communication systems. More broadly, the transaction reflects a growing trend in the RF front-end industry: core intellectual property is increasingly regarded not merely as a technical asset but as a strategic foundation for vertical integration and long-term competitiveness.

Is your organization ready to stay ahead of RF front-end IP shifts?

Explore KnowMade’s RF Front-End Modules & Components Patent Monitor, we offer quarterly updates on:

- Quarterly reports with updates on new, granted, and dead patents

- Insights into key IP players, technology trends, and litigation activity

- Segmented analysis by component type and innovation focus

- Direct access to analysts and tailored Excel databases

In addition to public insights like this article, we offer client-specific research and strategic support to align with your R&D, IP, or business goals.

Contact us to learn how we can support your strategic positioning.

About KnowMade

KnowMade is a Technology Intelligence and IP Strategy consulting company specialized in analysis of patents and scientific information. The company helps innovative companies and R&D organizations to understand their competitive landscape, follow technology trends, and find out opportunities and threats in terms of technology and patents.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patents and scientific information into business-oriented report for decision makers working in R&D, Innovation Strategy, Intellectual Property, and Marketing. Our experts provide prior art search, patent landscape analysis, scientific literature analysis, patent valuation, IP due diligence and freedom-to-operate analysis. In parallel the company proposes litigation/licensing support, technology scouting and IP/technology watch service.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Solid-State Sensors/Actuators, Semiconductor Manufacturing, Packaging & Assembly, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.

Related Semiconductor IP

- 5G IoT DSP

- 5G RAN DSP

- Modular, high performance 5G NR Layer 1 (PHY) solutions for Non-Terrestrial Network applications

- 5G Polar Decoder

- 5G LDPC Decoder

Related News

- China Takes the Lead in RF Front-End Patent Activity: RadRock and Others Surge Behind Murata

- Q4 2025 RF Front-End IP: Stable Leaders, China Accelerates, Lansus Enters Top Five, Filters Dominate

- NTLab announces highly linear GPS/GLONASS/Galileo/BeiDou RF front-end with reduced power consumption

- MIPI Alliance Updates its MIPI RFFE Interface for Mobile Device RF Front-End Architectures

Latest News

- GlobalFoundries Announces Availability of AutoPro 150 eMRAM Technology on Enhanced FDX Platform for Advanced Automotive Applications

- MIPS and INOVA Collaborate to put Physical AI into the palm of Robotic hands with new Reference Platform

- Allegro DVT Launches DWP300 DeWarp Semiconductor IP

- Ubitium Tapes Out Universal Processor to End Embedded Computing Complexity Crisis

- Movellus Advanced Clocking IP Selected for QuickLogic’s Strategic Radiation Hardened FPGA Program