Contract Manufacturers Make About Nine Out of 10 Media Tablets in 2012

September 25, 2012

Jeffrey Wu

Although your new media tablet may sport the logo of a familiar brand name like Apple or Amazon, there’s a 90 percent chance the device was actually made by a company with a much less famous moniker, such as Hon Hai or Quanta.

That’s because the vast majority of tablets—including the iPad and Kindle Fire—actually are made by contract or outsourced manufacturers based in Asia, according to an IHS iSuppli Global Manufacturing & Design Report from information and analytics provider IHS. (NYSE: IHS). The percentage of tablets made by outsourced manufacturers is set to rise this year and beyond as brands seek to minimize operational risks and reduce costs.

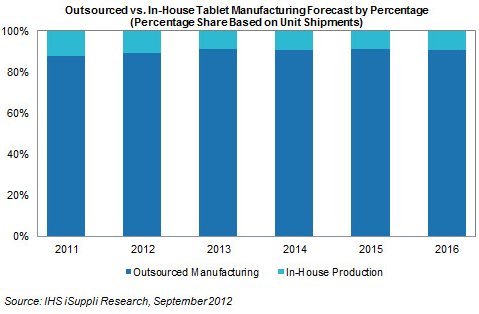

Outsourced manufacturers in 2011 were responsible for 87.5 percent of tablet production, compared to 12.5 percent that were made in-house. The percentage of outsourced tablets this year is expected to increase to 89.2 percent, with the portion claimed by in-house production projected to decline to 10.8 percent, as shown in the figure below. The years after that will see the share by outsourced manufacturing of tablets remain in the low 90 percent range, hitting a high of 91.1 percent by 2015 before settling back down at 90.4 percent in 2016.

“The high percentage of outsourced manufacturing of tablets reflects the choice among tablet brands and original equipment manufacturers—even ones as big as Apple—to refrain from in-house production,” said Jeffrey Wu, senior analyst for OEM at IHS. “Tablet brands use outsourcing for many reasons, including faster time to market; the leveraging of capabilities, especially for firmware development and hardware integration; and asset flexibility that translates into reduced corporate expenditures and lower headcount.”

Hon Hai Dominates Tablet Contract Manufacturing

The biggest contract manufacturer of tablets is Apple partner Hon Hai, of Taiwan, also known as Foxconn. Hon Hai accounted for 62 percent of tablet shipments last year. The company’s position in the tablet space is unique—not only because it accounts for the majority of tablet shipments in 2011, but also because of its close relationship with Apple.

Hon Hai is an EMS provider, a type of outsourced manufacturer that generally does not participate in designing product but simply offers manufacturing and supply chain management services. EMS providers for the most part control a smaller piece of the outsourced manufacturing space for computing products like notebook PCs—traditionally dominated by a rival group of makers known as original design manufacturers (ODM), which enjoy an advantage over EMS providers by being able to design products and offer manufacturing services alike. In the tablet production space, however, ODMs are the underdogs.

This is because Hon Hai, with Apple as its main client, holds the coveted right to make the iPad, the industry’s best-selling tablet by a wide margin. The ODMs have then been left to scramble for what remains of the tablet market—making rival devices for the likes of Barnes & Noble, Amazon and Asus, none of whose product offerings matches the iPad’s soaring sales and unequalled clout.

Android and Windows Power Rise of ODMs in Tablet Market

With the emergence of Android—and soon, Windows-based tablets—ODMs will have a better chance of breaking Hon Hai’s near-impregnable hold on the market. If the Android and Windows tablets prove successful, ODMs could see their share of the tablet outsourcing market grow, expanding to as much as 53 percent by 2016, on the assumption that consumers will embrace iPad alternatives.

Nonetheless, concerns for ODMs and Hon Hai alike could be in store.

Currently sidelined in much of the dynamic tablet space, ODMs also have concerns about their prospects in future tablet production. Most ODMs make notebook PCs as well, and choosing to produce tablets for other clients could mean endangering their own stake in the PC market—much as tablets are now eating into the share traditionally enjoyed by notebook computers among consumers. However, strengthening their foothold in the tablet space is inevitable for ODMs, especially as tablets continue to gain momentum at the expense of notebook computers.

ODMs also face potentially higher operating expenses and risks with the emergence of more tablet platform options—signified by the rise of Android and Windows—which would involve additional research and development costs in order for ODMs to maintain technical capabilities on those fronts.

Hon Hai, the current champion among tablet producers, is likewise not entirely free of peril. Should Apple shift some of its tablet production to other contract manufacturers in an effort to diversify its contract manufacturing base, Hon Hai could suffer a blow.

For other tablet brands like Samsung and Motorola that choose in-house production, their share of tablet manufacturing is not expected to exceed the 12.5 percent that the collective in-house space saw in 2011. Share of in-house production in the years ahead will stay in the 9 to 10 percent range, IHS predicts, as ODMs and EMS providers battle fiercely among themselves for an increasing stake in the hotly contested tablet business.

Read More > Tablets—Highly Outsourced with Low Margins

IHS iSuppli's market intelligence helps technology companies achieve market leadership. Catch the latest manufacturing and pricing industry, electronic manufacturing, manufacturing industry news, component pricing news from all across the world straight from our immensely experienced analysts. iSuppli provides comprehensive The IHS iSuppli® Manufacturing & Pricing portal provides the latest industry updates and a team of expert analysts who are at your disposal. To learn more, call us at 310-524-4007. for new and upcoming devices in the market. To know more, send us an e-mail on info@isuppli.com or contact us on +1.310.524.4007.

Related Semiconductor IP

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

Related News

- Most OEMs Plan to Reduce Number of Contract Manufacturers, IHS iSuppli Survey Reveals

- DSP manufacturers to take hard look at 3G requirements

- MIPS Technologies' contract revenue gains make up for declining royalties in fiscal Q3

- Mentor Graphics Calibre to Improve Semiconductor Manufacturer's System-on-a-Chip Designs

Latest News

- IObundle Promotes IOb-Cache: Premier Open-Source Cache System for AI/ML Memory Bottlenecks

- Quintauris Secures Capital Increase to Accelerate RISC-V Adoption

- MIPI Alliance Releases UniPro v3.0 and M-PHY v6.0, Accelerating JEDEC UFS Performance for Edge AI in Mobile, PC and Automotive

- Marvell to Showcase PCIe 8.0 SerDes Demonstration at DesignCon 2026

- Embedded FPGA reaches a new stage of industrial maturity – Menta at Embedded World 2026