Fabless Suppliers Hold Record 34.8% Share of Global IC Sales

2011-2021 CAGR for fabless company IC sales (10%) was double that of the IDM IC suppliers.

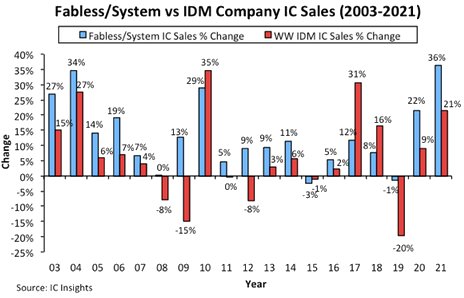

July 8, 2022 -- While there is a relatively close relationship between the annual market growth of the fabless IC suppliers and foundries, the sales growth rates of fabless IC companies versus IDM (integrated device manufacturers) IC suppliers have usually been very different (Figure 1). Typically, the sales growth rate registered by the fabless IC suppliers is better than that displayed by the IDMs. In fact, the first time on record that IDM IC sales growth outpaced fabless IC company sales growth was in 2010 when IDM IC sales grew 35% and fabless IC company sales grew 29%.

Figure 1

The disparity between fabless IC supplier growth and IDM IC supplier growth has been especially pronounced over the past three years. In 2019, driven by a collapse in the memory market, IDM IC sales plunged by 20%. In contrast, fabless IC supplier sales declined only 1%. In 2020, fabless IC company sales jumped by 22% while IDM sales increased by only 9%. Last year, fabless IC company sales surged 36% while IDM sales were up by 21%.

It is interesting to note that if Intel was excluded from the IDM listing in 2020 and 2021, total IDM supplier IC sales would have been up by 29% last year, eight points better than when the company is included. Moreover, if HiSilicon (which saw its sales plummet 81% last year) was excluded from the fabless company figures in 2020 and 2021, total fabless company IC sales growth last year would have been an amazing 44%!

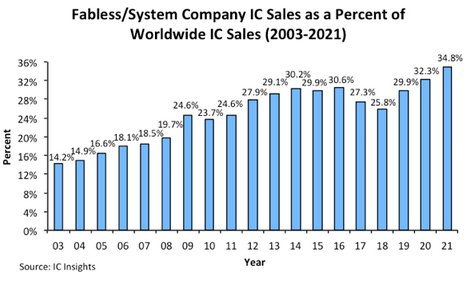

Fabless/system IC company sales were up 2.7x from 2011 to 2021 ($66.4 billion to $177.7 billion) whereas the total IDM IC sales were up 63% over this same timeperiod, from $203.9 billion in 2011 to $332.8 billion in 2021. Given the typical disparity in the annual growth rates in favor of the fabless/system IC suppliers, it comes as little surprise that, except in 2010, 2015, 2017, and 2018, fabless/system IC companies increased their share of the total IC market (Figure 2).

Figure 2

In 2003, fabless/system IC company sales accounted for only 14% of the total IC market. With the memory market soaring in 2017 and 2018, a market in which the fabless companies have very little share, the fabless share of the total IC market shrank in both of those years. However, with the memory market registering significant weakness in 2019, this situation reversed itself, with the fabless share of the total IC market jumping 4.1 percentage points that year to 29.9%.

With a 36% surge in fabless company IC revenue in 2021, the fabless companies’ share of worldwide IC sales set a new all-time record high in 2021 at 34.8%. Over the long-term, IC Insights believes that fabless/system IC suppliers, and the IC foundries that serve them, will continue to be a strong force in the total IC industry landscape with their percentage share of the total IC market expected to reach the high-30s over the next five years.

Report Details: The 2022 McClean Report

The McClean Report—A Complete Analysis and Forecast of the Semiconductor Industry, is now available. A subscription to The McClean Report service includes the January Semiconductor Industry Flash Report, which provides clients with IC Insights’ initial overview and forecast of the semiconductor industry for this year through 2026. In addition, the second of four Quarterly Updates to the report was released in May, with additional Quarterly Updates to be released in August and November of this year. An individual user license to the 2022 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2022.

https://www.icinsights.com/services/mcclean-report/pricing-order-forms/

Related Semiconductor IP

- 5G-NTN Modem IP for Satellite User Terminals

- HBM4E Controller IP

- 14-bit 12.5MSPS SAR ADC - Tower 65nm

- 5G-Advanced Modem IP for Edge and IoT Applications

- TSN Ethernet Endpoint Controller 10Gbps

Related News

- IDMs Could Top Fabless Semiconductor Company Growth for Only the Second Time in History

- World's Top Ten IC Design Company Revenue Reached US$39.43 billion in 1Q22, Marvell Growth Rate Tops List, Says TrendForce

- Breker Verification Systems Appoints Andy Stein Vice President of Worldwide Sales as Company Scales New Business Opportunities

- A System On Module (SoM) developed by Electra IC: BitFlex-SPB-A7 FPGA SoM

Latest News

- Marvell Extends ZR/ZR+ Leadership with Industry-first 1.6T ZR/ZR+ Pluggable and 2nm Coherent DSPs for Secure AI Scale-across Interconnects

- BrainChip Announces Neuromorphyx as Strategic Customer and Go-to-Market Partner for AKD1500 Neuromorphic Processor

- SCI Semiconductor Announces First Silicon of Cybersecure MCU, ICENI™

- Allen Wu on Disrupting $100M Cost of Building Custom AI Chips

- GUC Monthly Sales Report – February 2026