2H20 Growth Expectations Vary Among Leading IC Suppliers

TSMC continues to reap the benefits of strong demand for 7nm and 5nm devices.

September 7, 2020 -- As expected, most IC suppliers experienced weaker demand and generally poor sales results in the first half of this year due to the Covid-19 pandemic and strained U.S./China trade relations. However, as reported in IC Insights’ August Update to the 2020 McClean Report, some key IC suppliers believe that the second half of this year will yield better results. Second-half guidance and outlooks for the full year from three leading IC companies help shed some light on what companies are expecting for the second half of this year.

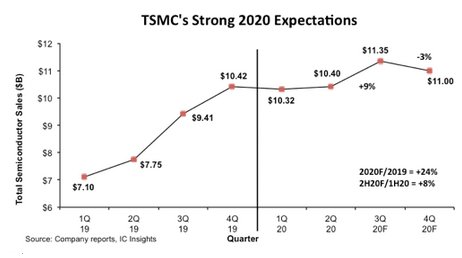

TSMC is by far the largest semiconductor foundry in the world and is a critical supplier of 7/5nm application processor devices. Figure 1 shows an updated outlook at TSMC’s 2020 sales forecast given its actual 1H20 results. As shown, while the company expects its full-year sales “to grow above 20%” this year, IC Insights believes its 2H20/1H20 sales will increase by 8%, yielding a full-year jump of 24% for TSMC.

Figure 1

There is no doubt that Apple’s need for leading-edge application processors will be a driving force in this growth. In the second half of 2020, TSMC reported that it shipped its one-billionth 7nm IC and expects to be in high volume production of devices manufactured using its 5nm process technology. In total, the company expects about $3.5 billion in revenue come from its 5nm shipments in 2H20, representing 8% of its total sales in 2020.

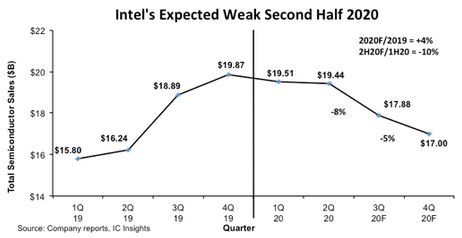

Intel, the largest semiconductor supplier in the world, put its full-year 2020 sales growth guidance at 4% during a discussion of its actual 2Q20 sales results. However, Intel’s 2H20/1H20 expectations are for a 10% drop in revenue (Figure 2). The company attributed its strong 1H20 sales and soft 2H20 expectations to some customers building inventory, a “safety stock” of parts given the uncertainties surrounding the trade issues. This inventory is expected to burn off in the second half of this year.

Figure 2

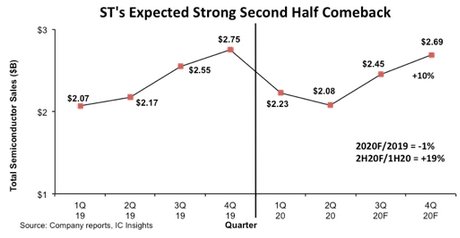

ST, the world’s fourth-largest analog IC supplier and a key automotive device producer, has big hopes for 2H20. After a precipitous drop of 19% in 1H20/2H19, the company expects a strong 19% jump in its 2H20/1H20 sales (Figure 3). The company’s jump in sales in the second half of this year is forecast to be driven by a rebound in the automotive sector from a exceptionally weak 1H20 and a increase in demand from the industrial segment of the market as the global economy displays some stability from a disastrous first half of this year. However, even after a strong 2H20, ST’s total semiconductor sales are expected to be down 1% this year.

Figure 3

Report Details: The 2020 McClean Report

Additional details on IC market trends are provided in the 2020 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Report includes free monthly updates from March through November (including a 180+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual user license to the 2020 edition of The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

Related Semiconductor IP

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

Related News

- Microprocessor Growth Will Slow in 2022 after Cellphone MPU Surge

- 2022 to Mark the Third Year in a Row of ≥20% Growth for the Foundry Market

- Top Three Suppliers Held 94% of 2021 DRAM Marketshare

- Semiconductor Growth Still Seen at 11% Despite 2022 Headwinds

Latest News

- ASICLAND Partners with Daegu Metropolitan City to Advance Demonstration and Commercialization of Korean AI Semiconductors

- SEALSQ and Lattice Collaborate to Deliver Unified TPM-FPGA Architecture for Post-Quantum Security

- SEMIFIVE Partners with Niobium to Develop FHE Accelerator, Driving U.S. Market Expansion

- TASKING Delivers Advanced Worst-Case Timing Coupling Analysis and Mitigation for Multicore Designs

- Efficient Computer Raises $60 Million to Advance Energy-Efficient General-Purpose Processors for AI