Top Three Suppliers Held 94% of 2021 DRAM Marketshare

Samsung, SK Hynix accounted for 71% of DRAM sales. Major supplier base now reduced to six.

May 24, 2022 -- IC Insights’ 112-page May 2Q Update to The McClean Report 2022 is now available for subscribers to download. It includes a current outlook for the 2022 global economy, detailed market, unit shipment, and ASP forecasts for IC and O-S-D products through 2026, 2021 semiconductor supplier rankings by product type, the 1Q22 top-25 semiconductor supplier ranking, an analysis of the IC market by region with additional focus on the China market, semiconductor R&D spending trends, and an overview of various government-sponsored investment programs targeting the semiconductor industry.

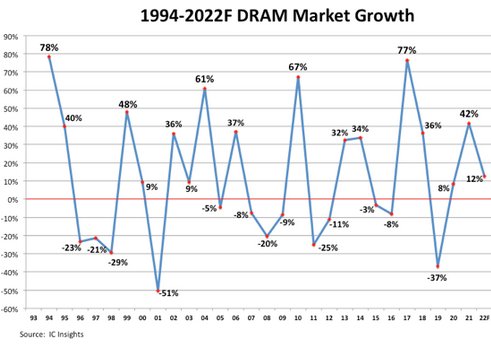

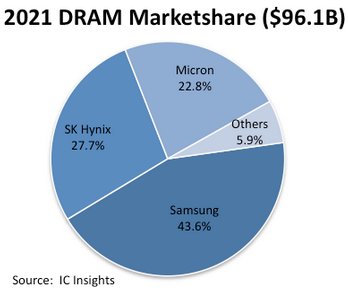

Over the past 30 years, the DRAM market has been characterized by periods of spectacular growth and years of devastating crashes (Figure 1). Most recently, the DRAM market fell 37% in 2019 but soared 42% in 2021. No matter the cause—and there are many—boom-bust cycles have lowered the number of major DRAM suppliers from 20 in the mid-1990s to just six today. The three largest suppliers—Samsung, SK Hynix, and Micron—collectively held 94% DRAM marketshare in 2021 (Figure 2). South Korea-based Samsung and SK Hynix accounted for 71.3% of the world’s DRAM sales last year.

With 44% marketshare, Samsung remained the world’s largest DRAM supplier in 2021 with sales that reached nearly $41.9 billion. Samsung advanced its DRAM business on several fronts last year. After being first to use extreme ultraviolet (EUV) lithography in March 2020, Samsung started mass production of 14nm EUV-based DRAM in October 2021. In doing so, it increased the number of EUV layers from two to five on its most advanced 14nm DDR5 DRAM process.

In November 2021, Samsung said it had applied its EUV technology to develop a 14nm 16Gb low power double data rate 5X (LPDDR5X) DRAM specifically for high-speed applications including 5G, artificial intelligence (AI), machine learning (ML), and other big data end uses. The company claims the LPDDR5X DRAM offers data processing speeds of up to 8.5Gbps (1.3x faster than existing 6.4Gbps LPDDR5 devices) and it consumes around 20% less power than LPDDR5 memory.

Figure 1

Figure 2

The company also unveiled its first DRAM memory module supporting the new Compute Express Link (CXL) interconnect standard and unveiled 2GB GDDR6 and 2GB DDR4 automotive DRAMs designed for autonomous electric vehicles and high-performance infotainment systems.

Ranked second and accounting for 28% DRAM marketshare in 2021 was SK Hynix, whose DRAM sales increased 39% to $26.6 billion. DRAM accounted for about 71% of the company’s total 2021 semiconductor sales. Its total DRAM sales were split: server DRAM, 40%; mobile DRAM, 35%; 15% from PC DRAM; and consumer and graphics DRAM each accounted for 5%.

In 2021, SK Hynix released what is claimed was the industry’s highest-performing DDR5 DRAM with data speed capable of transmitting 163 full-HD movies per second. The chip is called HBM3 since it is the third-generation of Hynix’s High Bandwidth Memory.

Like Samsung, SK Hynix also started using EUV lithography for mass production of 8Gb LPDDR4 DRAM based on its fourth generation 10nm-class process called 1-alpha (1a nm) process.

Micron was the third-largest DRAM supplier in 2021, with sales of $21.9 billion. Micron’s DRAM sales increased 41% and accounted for 23% of global marketshare. On the whole, DRAM accounted for about 73% of Micron’s total calendar year IC sales of $30.0 billion.

In 2021, Micron introduced its 1a nm memory node, which was designed in part to support the data center transition to DDR5 DRAM, driven by new CPU platforms that are expected to begin ramping later this year and gain momentum in 2023. Micron’s 1a nm DRAM is also being applied in low-power communication applications, including 5G smartphones.

Micron manufactures its 1a nm DRAM using a technique that does not require EUV lithography. However, the company has placed orders for EUV equipment and plans to transition to EUV technology to manufacture its DRAM using its 1-gamma (1g) nm node starting in 2024.

Report Details: The 2022 McClean Report

The McClean Report—A Complete Analysis and Forecast of the Semiconductor Industry, is now available. A subscription to The McClean Report service includes the January Semiconductor Industry Flash Report, which provides clients with IC Insights’ initial overview and forecast of the semiconductor industry for this year through 2026. In addition, the second of four Quarterly Updates to the report was released in May, with additional Quarterly Updates to be released in August and November of this year. An individual user license to the 2022 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2022.

https://www.icinsights.com/services/mcclean-report/pricing-order-forms/

Related Semiconductor IP

- Low Latency DRAM Synthesizable Transactor

- Low Latency DRAM Memory Model

- Embedded OTP (One-Time Programmable) IP, 2Kx32 bits for 1.0V/2.6V DRAM

- Embedded OTP (One-Time Programmable) IP, 4Kx32 bits for 1.2V/2.5V DRAM

- DDR2-PHY command/address block for DRAM chip, BOAC ; UMC 90nm SP/RVT Low-K Logic Process

Related News

- TSMC Achieves 65 Nanometer Embedded DRAM Milestone

- Inapac Technology Releases New 16Mb DRAM Design for Mobile Applications That Reduces SiP/MCP Cost

- Inapac Technology and ProMOS to Collaborate On 256Mb Mobile DDR DRAM for System-in-Package / Multi-Chip Package Applications

- Industry Ships 25 Million XDR DRAM Memory Devices

Latest News

- ASICLAND Partners with Daegu Metropolitan City to Advance Demonstration and Commercialization of Korean AI Semiconductors

- SEALSQ and Lattice Collaborate to Deliver Unified TPM-FPGA Architecture for Post-Quantum Security

- SEMIFIVE Partners with Niobium to Develop FHE Accelerator, Driving U.S. Market Expansion

- TASKING Delivers Advanced Worst-Case Timing Coupling Analysis and Mitigation for Multicore Designs

- Efficient Computer Raises $60 Million to Advance Energy-Efficient General-Purpose Processors for AI