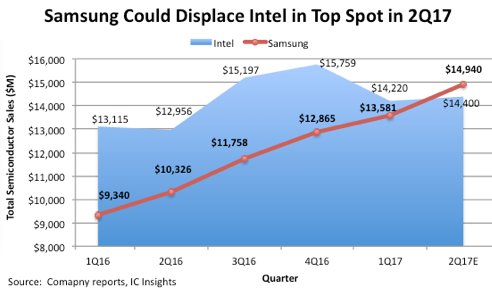

Samsung Poised to Become World's Largest Semi Supplier in 2Q17

Intel could yield the #1 position it has held since 1993.

May 2, 2017 -- After nearly a quarter of a century, the semiconductor industry could see a new #1 supplier in 2Q17. If memory market prices continue to hold or increase through 2Q17 and the balance of this year, Samsung could charge into the top spot and displace Intel, which has held the #1 ranking since 1993. Using the mid range sales guidance set by Intel for 2Q17, and a modest, yet typical, 2Q sales increase of 7.5% for Samsung, the South Korean supplier would unseat Intel as the world’s leading semiconductor supplier in 2Q17 (Figure 1). If achieved, this would mark a milestone achievement not only for Samsung, specifically, but for all other competing semiconductor producers who have tried for years to supplant Intel as the world’s largest supplier. In 1Q16, Intel’s sales were 40% greater than Samsung’s, but in just over a year’s time, that lead may be erased and Intel may find itself trailing in quarterly sales.

Figure 1

Samsung’s big increase in sales has been driven by an amazing rise in DRAM and NAND flash average selling prices (Figure 2). IC Insights expects that the tremendous gains in DRAM and NAND flash pricing experienced through 2016 and into the first quarter of 2017 will begin to cool in the second half of the year, but there remains solid upside potential to IC Insights’ current forecast of 39% growth for the 2017 DRAM market and 25% growth in the NAND flash market.

Figure 2

As shown in Figure 3, Intel has been locked in as the world’s top semiconductor manufacturer since 1993 when it introduced its x486 processor and soon thereafter, its revolutionary Pentium processor, which sent sales of personal computers soaring to new heights.

Figure 3

Over the past 24 years, some companies have narrowed the sales gap between themselves and Intel, but never have they surpassed the MPU giant. If memory prices don’t tank in the second half of this year, it’s quite possible that Samsung could displace Intel in full-year semiconductor sales results as well. Presently, both companies are headed for about $60.0 billion in 2017 semiconductor sales.

Report Details: The 20th Anniversary 2017 McClean Report

Further details and rankings of top semiconductor suppliers as well as overall market trends within the IC industry are provided in the 2017 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry, which is IC Insights’ flagship report covering the IC market. A subscription to The McClean Report includes free monthly updates from March through November (including a 250+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual-user license to the 2017 edition of The McClean Report is priced at $4,090 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,090.

Related Semiconductor IP

- 8MHz / 40MHz Pierce Oscillator - X-FAB XT018-0.18µm

- UCIe RX Interface

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

Related News

- Sonics Surpasses One Billion Units and Remains World's Largest Supplier of Network-on-Chip Technology

- Using "Final Market Value", TSMC Became the Largest Semiconductor Supplier in the World in 2Q13

- Samsung Passes Intel to Become World's Largest Semi Supplier in 2Q21

- Alphawave Semi Expands Partnership with Samsung Foundry to Further Drive Innovation at Advanced Semiconductor Nodes

Latest News

- Alchip Reports ASIC-Leading 2nm Developments

- AI Demand Drives 4Q25 Global Top 10 Foundries Revenue Up 2.6% QoQ; Samsung Gains Share and Tower Moves Up in Rankings

- GlobalFoundries Announces Availability of AutoPro150 eMRAM Technology on Enhanced FDX Platform for Advanced Automotive Applications

- Axiomise Launches nocProve for NoC Verification

- CAST Debuts TSN-EP-10G IP for High-Performance, Time-Sensitive Networking Ethernet Designs