Robust Growth Rates Expected For Nearly All IC Products in 2021

Special Purpose Logic, DRAM, Cellphone MPUs, and Display Drivers forecast to lead industry-wide upturn as demand extends into the second half of the year.

August 5, 2021 -- IC Insights recently released its Mid-Year Update to The McClean Report 2021. The update includes IC Insights’ ranking of revenue growth rates for the 33 IC product categories defined by the World Semiconductor Trade Statistics (WSTS) organization and confirms that vigorous end-use demand is affecting market growth across all product segments.

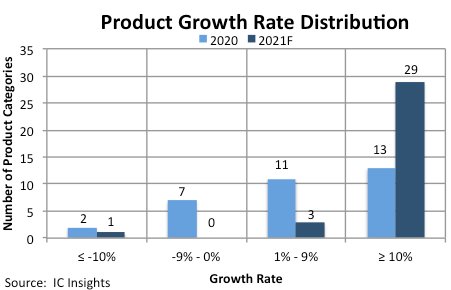

Figure 1 shows the distribution of growth rates for the 33 IC product categories in 2020 and IC Insights’ forecast for 2021. IC Insights expects 32 of the 33 product categories to experience sales growth this year with 29 product categories expected to see double-digit growth, representing one of the strongest and broadest sales industry outlooks that IC Insights has ever documented. In previous strong-growth years, perhaps a handful of IC products had extraordinary sales gains that helped raise overall IC market growth. But, in 2021, it appears that robust growth has permeated nearly all product categories across the entire IC industry. Only the fading and insignificant gate array market (forecast sales of $58 million in 2021) is expected to decline in sales.

Figure 1

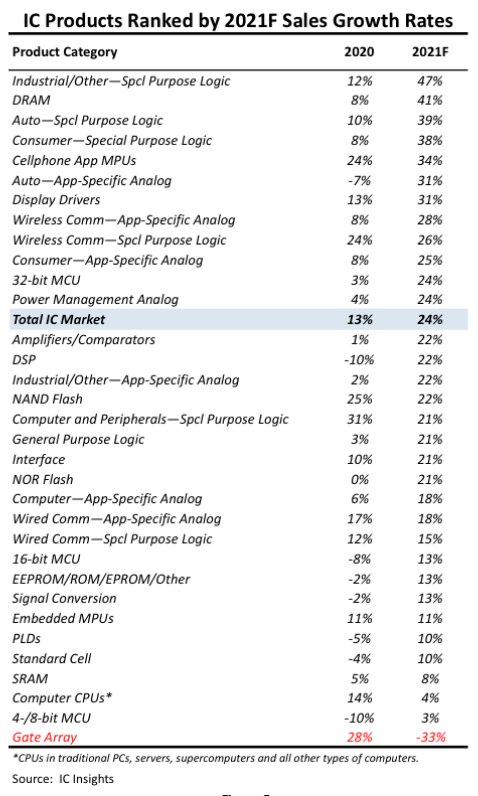

The 33 major IC product categories ranked by their forecast sales percentage growth rates for 2021 are shown in Figure 2. Many Special Purpose Logic categories are forecast to rank high on the growth list this year, along with DRAM, cellphone MPUs, and display drivers, which are all on track to see sales rise by more than 30%, with the total IC market now forecast to rise 24%.

Figure 2

Report Details: The 2021 McClean Report

The 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry was released in January 2021 and the Mid-Year Update in July 2021. A subscription to The McClean Report includes free monthly updates from March through November (including a 180+ page Mid-Year Update), and free access to subscriber-only pre-recorded webcasts through November. An individual user license to the 2021 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2021.

https://www.icinsights.com/services/mcclean-report/pricing-order-forms/

Related Semiconductor IP

- Specialized Video Processing NPU IP for SR, NR, Demosaic, AI ISP, Object Detection, Semantic Segmentation

- Ultra-Low-Power Temperature/Voltage Monitor

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

Related News

- Covid-19 Expected to Limit Growth Rates For Many IC Products in 2020

- Revenue Decline of Global Top 10 IC Design Houses Expanded to Nearly 10% in 4Q22, Decline Expected to Continue into 1Q23, Says TrendForce

- Robust AI Demand Drives 6% QoQ Growth in Revenue for Top 10 Global IC Design Companies in 1Q25

- M31 Technology: Robust Foundry Demand, Operating Margin Expected to Recover in 2026

Latest News

- Breker Verification Systems and Moores Lab AI Partner to Create First AI-Driven SoC Verification Solution

- JEDEC® Announces Updates to Universal Flash Storage (UFS) and Memory Interface Standards

- SambaNova Abandons Intel Acquisition, Raises Funding Instead

- Tensor and Arm partner to deliver AI-defined compute foundation for world’s first personal robocar

- 10xEngineers and Andes Enable High-Performance AI Compilation for RISC-V AX46MPV Cores