Q4 2025 RF Front-End IP: Stable Leaders, China Accelerates, Lansus Enters Top Five, Filters Dominate

SOPHIA ANTIPOLIS, France – January 26, 2025 – KnowMade’s Q4 2025 RF Front-End Modules & Components Patent Monitor confirms that RF front-end innovation remains structurally stable while becoming increasingly competitive. The quarter covers 611 new patent families, 477 newly granted families, and 226 expired or abandoned patents, reflecting a robust global IP pipeline across both filings and granted protections. In total, over 1,200 patent families were analyzed worldwide in this quarter, underscoring sustained activity and continuous IP portfolio optimization across the RF front-end ecosystem.

IP Leadership and Competitive Landscape

The first-tier RF front-end IP landscape remained largely unchanged in Q4 2025. Established international leaders such as Murata and Skyworks continued to anchor the global IP hierarchy, supported by sustained new filings and strong granted patent portfolios. These positions reflect long-term investments in acoustic filters, PA integration, and system-level module design. Qorvo, Qualcomm, and Samsung Electronics also maintained leading roles, underscoring the structural stability of the top tier despite intensifying competition across RF front-end technologies.

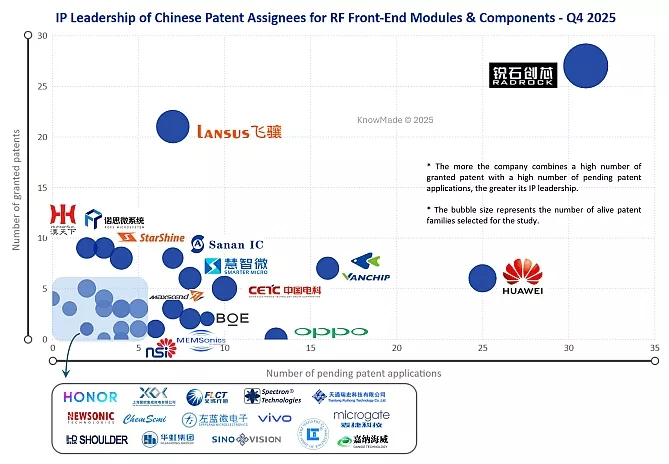

A notable development this quarter was the strengthening position of Chinese players within the upper ranks, as illustrated by the IP leadership analysis focused on Chinese patent assignees. Following RadRock’s strong IP momentum earlier in the year, Lansus emerged as another standout, breaking into the top five assignees for the first time. With a combined total of 28 newly granted and newly filed patent families recorded in Q4, Lansus surpassed Qualcomm in quarterly activity, highlighting its steady and focused expansion within the Chinese RF front-end market. Overall, Chinese companies accounted for 39 of the top 50 assignees, reinforcing China’s growing weight in global RF IP generation.

Figure 1: IP leadership of Chinese patent assignees for RF front-end modules & components in Q4 2025.

Beyond established names, new Chinese IP entrants gained visibility during the quarter. Smarter Microelectronics, distinguished by its close collaboration with academic institutions, demonstrated notable momentum in component-level innovation. Spectron Technologies and Microgate Technology also emerged as promising newcomers, signaling the rise of a new generation of Chinese RF front-end IP players and a broadening innovation base beneath the market’s leading tier.

Geographic Coverage and Filing Strategies

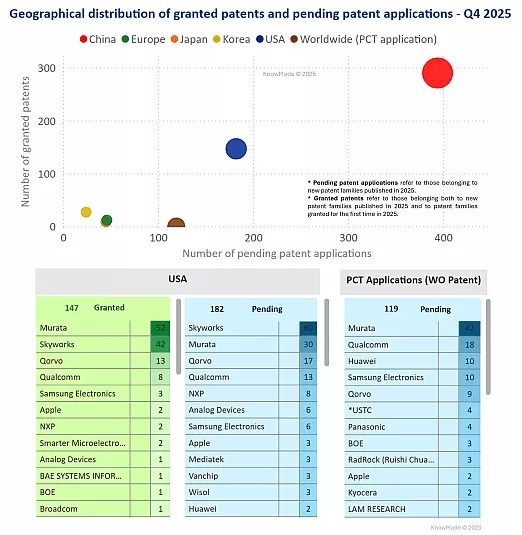

Geographically, Q4 2025 patent activity continued to be strongly driven by China, which led in both pending and granted patent volumes, confirming its role as the primary engine of RF front-end IP generation.

The United States remained one of the most strategically important markets for IP protection. Leading international assignees such as Murata, Skyworks, Qorvo, Qualcomm, and Samsung Electronics held dominant granted and pending positions in the U.S., reflecting their focus on securing high-value RF front-end patents in a key commercialization and enforcement jurisdiction. Notably, several Chinese players, including Smarter Microelectronics and BOE, also appeared among granted assignees in the U.S., signaling selective but increasingly targeted international expansion.

In parallel, the use of the PCT route remained a preferred strategy for global players seeking broad international coverage. Murata led PCT filings by a wide margin, followed by Qualcomm, Huawei, Samsung Electronics, and Qorvo, underlining their long-term, worldwide IP deployment strategies. The presence of Chinese assignees such as Huawei and RadRock among PCT applicants further illustrates China’s growing participation in global RF IP competition beyond domestic filings.

Figure 2: Global distribution of granted patents and pending patent applications for RF front-end modules & components in Q4 2025, and ranking of patent assignees by the number of pending application and granted patents in the United States and via PCT route.

Explore RF IP

Technology Segments and Component-Level Competition

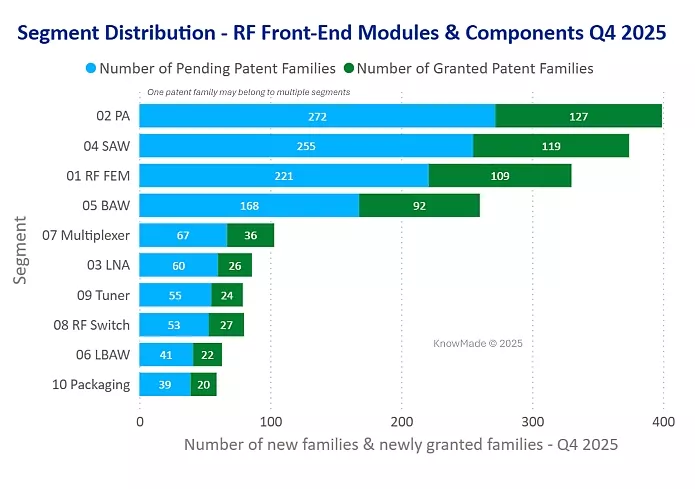

From a technology perspective, Q4 2025 patent activity shows a distribution broadly consistent with previous quarters, with Power Amplifiers (PA), SAW, RF FEM, and BAW remaining the most active segments in both new patent family publications and patent families granted for the first time. This stability underscores the sustained strategic importance of core RF front-end components, while BAW, RF FEM, and advanced filter technologies continued to gain incremental momentum. Activity in multiplexers, LNAs, tuners, and RF switches remained moderate and steady, largely supporting highly integrated, filter-centric front-end architectures.

Figure 3: Segment distribution of new patent family publications and patent families granted for the first time for RF front-end modules & components in Q4 2025.

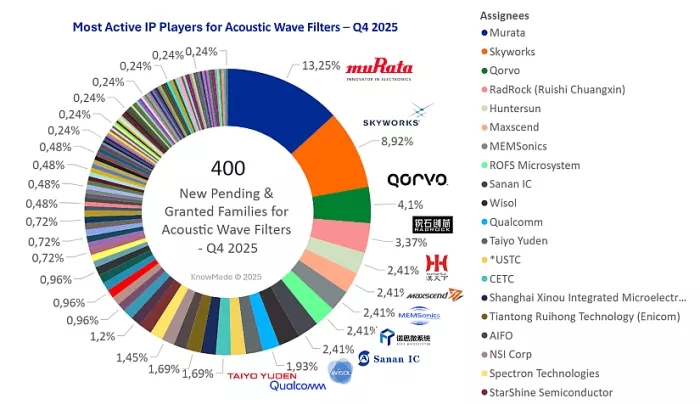

Acoustic Wave Filters (AWF) stand out as one of the highest-barrier and most competitive domains within the RF front end. Covering SAW, BAW, and derived technologies such as FBAR, XBAR, and TF-SAW, this field continues to attract intensive IP investment as players push performance boundaries in frequency range, bandwidth, power handling, and integration. The strong concentration of patent activity in AWF reflects both its technical complexity and its critical role in next-generation 5G and early 6G devices.

Figure 4: Distribution, by assignee, of newly published patent families and patent families granted for the first time related to Acoustic Wave Filters (AWF) in Q4 2025.

The assignee distribution for AWF-related patent families further highlights this competitive landscape. While Murata and Skyworks remain leading contributors, the pie chart illustrates a broadening base of active participants, including Chinese players such as RadRock, Huntersun, Maxscend, MEMSonics, ROFS Microsystem, Sanan IC, CETC, Shanghai Xinou Integrated Microelectronics, Enicom, AIFO, NSI corp, Spectron and StarShine Semiconductor, alongside established Japanese and Korean specialists like Wisol and Taiyo Yuden. The increasingly fragmented share among assignees signals intensifying competition and continuous innovation in high-performance acoustic filter technologies, with no single player dominating all AWF sub-segments.

IP Transfers, Collaborations, and Litigation Activity

Q4 2025 also saw selective but strategically significant activity across IP transfers, collaborations, and litigation, reflecting ongoing portfolio optimization and competitive positioning in RF front-end technologies. Several targeted patent transfers were recorded, notably two RF-related patents transferred from Vivo to Nokia (including US12021571 on digital pre-distortion processing and US12323353 on RF front-end device control), as well as two acoustic resonator patents transferred from CETC to Huawei (CN220190843 and CN116647205), both addressing transverse mode suppression in acoustic filters. In addition, Oppo transferred an antenna switching patent (CN112737604) to Shenzhen Zhiyi Technology, illustrating continued reallocation of RF front-end assets within China’s ecosystem.

Collaborative patent filings further highlighted the role of cross-border and academia–industry partnerships in high-barrier component technologies. Murata and Panasonic jointly filed multiple PCT applications, including WO2025/258231 and WO2025/258230, focused on advanced acoustic reflector stacks and mode suppression in elastic wave devices. In parallel, Chinese players such as Smarter Microelectronics expanded co-filings with South China University of Technology on PA architectures and RF front-end integration, while NSI Corp and Spectron Technologies jointly addressed transverse spurious mode suppression in acoustic resonators (CN121217073). These collaborations underscore sustained investment in next-generation acoustic and PA technologies. In Europe and the United States, STMicroelectronics, together with CNRS and University of Bordeaux / Bordeaux INP, filed the patent application US20250379546, describing a hybrid-coupler Doherty PA architecture using inductive load modulation to improve efficiency and output power.

Litigation activity during the quarter remained concentrated on core acoustic filter IP. In the United States, Denso filed a patent infringement lawsuit against Qorvo (Case 5:25-cv-00176) involving a BAW-related patent (US7758979), reinforcing the strategic value of piezoelectric thin-film technologies. In Europe, Murata initiated proceedings against Maxscend (Case 7O 14074/25) over thin-film SAW technology, centered on patent EP3007358. Together, these cases highlight the intense competitive pressure and legal scrutiny surrounding advanced acoustic wave filter technologies.

Is your organization ready to stay ahead of RF front-end IP shifts?

Explore KnowMade’s RF Front-End Modules & Components Patent Monitor, we offer quarterly updates on:

- Quarterly reports with updates on new, granted, and dead patents

- Insights into key IP players, technology trends, and litigation activity

- Segmented analysis by component type and innovation focus

- Direct access to analysts and tailored Excel databases

In addition to public insights like this article, we offer client-specific research and strategic support to align with your R&D, IP, or business goals.

Contact us to learn how we can support your strategic positioning.

Related Semiconductor IP

- Bluetooth Low Energy 6.0 Scalable RF IP

- All Digital Fractional-N RF Frequency Synthesizer PLL in GlobalFoundries 22FDX

- Wi-Fi 7(be) RF Transceiver IP in TSMC 22nm

- mmWave 8x8 MIMO RF Front End V2

- Single-carrier RF transceiver on TSMC 22nm ULL

Related News

- SpaceX Acquires Akoustis’s IP, Murata and RadRock Dominate Q2 2025 RF Front-End Patent Activity

- China Takes the Lead in RF Front-End Patent Activity: RadRock and Others Surge Behind Murata

- NTLab announces highly linear GPS/GLONASS/Galileo/BeiDou RF front-end with reduced power consumption

- MIPI Alliance Updates its MIPI RFFE Interface for Mobile Device RF Front-End Architectures

Latest News

- MIPS and INOVA Collaborate to put Physical AI into the palm of Robotic hands with new Reference Platform

- Allegro DVT Launches DWP300 DeWarp Semiconductor IP

- Ubitium Tapes Out Universal Processor to End Embedded Computing Complexity Crisis

- Movellus Advanced Clocking IP Selected for QuickLogic’s Strategic Radiation Hardened FPGA Program

- MIPS and Green Hills Software Accelerate Safety Certified Product Development for MIPS RISC-V Microcontrollers