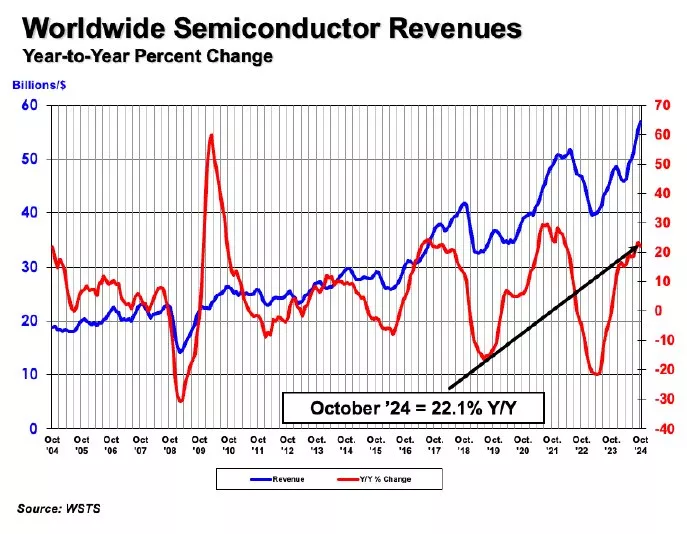

Global Semiconductor Sales Increase 22.1% Year-to-Year in October; Annual Sales Projected to Increase 19.0% in 2024

Sales in October reached highest-ever monthly total; worldwide chip sales increase 2.8% month-to-month

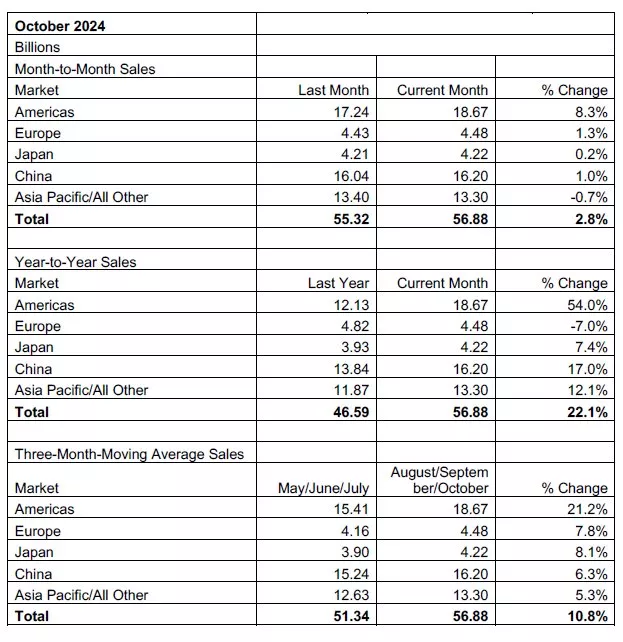

WASHINGTON — Dec. 5, 2024 — The Semiconductor Industry Association (SIA) today announced global semiconductor sales hit $56.9 billion during the month of October 2024, an increase of 22.1% compared to the October 2023 total of $46.6 billion and 2.8% more than the September 2024 total of $55.3 billion. Monthly sales are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. SIA represents 99% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms.

Additionally, a new WSTS industry forecast—endorsed by SIA—has been revised upward for 2024. It now projects annual global sales will increase 19.0% year-to-year, reaching a sales total of $626.9 billion this year. In 2025, global sales are projected to reach $697.2 billion, a year-to-year increase of 11.2%. WSTS tabulates its semi-annual industry forecast by gathering input from an extensive group of global semiconductor companies that provide accurate and timely indicators of semiconductor trends.

“The global semiconductor market is closing out 2024 on a high note, as the industry reached its highest-ever monthly sales total in October and month-to-month sales increased for the seventh consecutive month,” said John Neuffer, SIA president and CEO. “Total annual sales are now projected to increase by nearly 20% in 2024—higher than earlier forecasts—and then continue to grow by double-digits in 2025.”

Regionally, year-to-year sales in October were up in the Americas (54.0%), China (17.0%), Asia Pacific/All Other (12.1%), and Japan (7.4%), but down in Europe (-7.0%). Month-to-month sales in October increased in the Americas (8.3%), Europe (1.3%), China (1.0%), and Japan (0.2%), but decreased slightly in Asia Pacific/All Other (-0.7%).

For comprehensive monthly semiconductor sales data and detailed WSTS forecasts, consider purchasing the WSTS Subscription Package. For detailed historical information about the global semiconductor industry and market, consider ordering the SIA Databook.

Related Semiconductor IP

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

Related News

- GUC Monthly Sales Report - October 2024

- UMC Reports Sales for October 2024

- Global Semiconductor Sales Increase 18.8% in Q1 2025 Compared to Q1 2024; March 2025 Sales up 1.8% Month-to-Month

- Global Semiconductor Sales Increase 4.7% Month-to-Month in October

Latest News

- SEALSQ and Lattice Collaborate to Deliver Unified TPM-FPGA Architecture for Post-Quantum Security

- SEMIFIVE Partners with Niobium to Develop FHE Accelerator, Driving U.S. Market Expansion

- TASKING Delivers Advanced Worst-Case Timing Coupling Analysis and Mitigation for Multicore Designs

- Efficient Computer Raises $60 Million to Advance Energy-Efficient General-Purpose Processors for AI

- QuickLogic Announces $13 Million Contract Award for its Strategic Radiation Hardened Program