Fabless IC Company Sales "Shine" While IDM IC Sales "Slump" in 2012

Contrary to some opinions, the fabless/foundry business model shows no signs of "collapsing"

January 09, 2013 -- IC Insights’ 2013 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry contains over 400 pages and 400 tables and graphs and will be released later this month. The report shows that the fabless IC suppliers grew by 6% in 2012, 10 points better than the 4% decline registered by the IDMs (i.e., companies with IC fabrication facilities) and eight points better than the 2% decline shown by the total IC market last year.

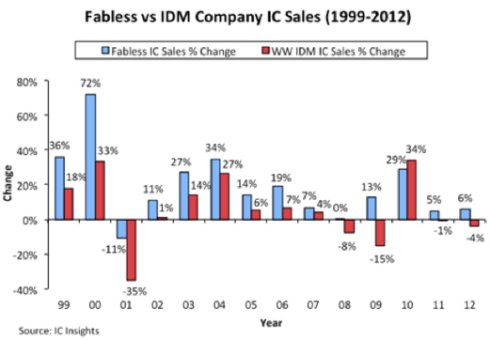

As shown in Figure 1, except for 2010, fabless company IC sales growth has outpaced IDM IC sales growth (or the decline was less severe) since 1999.

Figure 1

The year 2010 was the first and only time on record that IDM IC sales growth (34%) outpaced fabless IC company sales growth (29%). Since very few fabless IC suppliers participate in the memory market, they did not receive a boost from the surging DRAM and NAND flash memory markets in 2010, which grew 75% and 44%, respectively.

Another reason for relatively poor showing by the total IC fabless segment in 2010 was that some of the large fabless IC suppliers like MediaTek and ST-Ericsson, registered growth that was less than half the total 2010 IC industry average. However, the fabless IC suppliers once again grew faster than the total IC market beginning in 2011 by registering a 5% increase as compared to a 1% decline in sales for the IDM companies.

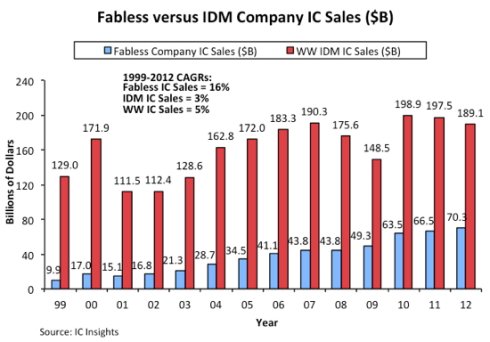

Figure 2 compares fabless-company IC sales to IDM-company IC sales since 1999. As shown, the 1999-2012 worldwide IC market displayed a modest 5% CAGR. In contrast, total IC sales from the fabless IC companies during this same timeframe increased at more than three times this rate and registered a very strong 16% CAGR. As a result of this trend, fabless IC company sales increased over 7x from 1999 to 2012 whereas total IDM IC sales were up less than 50% over this same timeperiod. Moreover, the IDM companies’ IC sales in 2012 were only 10% greater than they were 12 years earlier in 2000 and were less than they were five years ago in 2007.

Figure 2

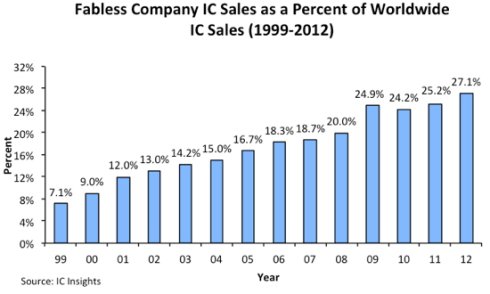

Given the big disparity in the 1999-2012 CAGRs between the fabless IC suppliers and the IDMs, it comes as little surprise that, except in 2010, fabless IC companies have been increasing their share of the worldwide IC market (Figure 3). As shown, in 1999, fabless IC company sales accounted for just over 7% of the total IC market. However, in 2012, fabless IC suppliers represented 27.1% of worldwide IC sales, a new record high.

Figure 3

IC Insights forecasts that in 2017, fabless IC companies will command at least one-third (33%) of the total IC market (especially if more large companies like IDT, LSI Logic, Agere, and AMD become fabless over the next five years). Over the long-term, IC Insights believes that fabless IC suppliers, and the IC foundries that serve them, will continue to become a stronger force in the total IC industry.

Report Details: The 2013 McClean Report

A thorough analysis of the top IC suppliers and IC foundries is just part of the information included in the 2013 edition of IC Insights’ flagship report, The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. The highly regarded annual study features more than 400 tables and graphs in the main report alone. A subscription to The McClean Report includes free attendance to one of The McClean Report half-day seminars held this month and delivered by IC Insights’ President Bill McClean. The McClean Report seminars will be held in the following locations:

- Scottsdale, Arizona on Tuesday, January 22

- Sunnyvale, California on Thursday, January 24

- Boston, Massachusetts Tuesday, January 29

- London, England Thursday, January 31

In addition to the half-day seminar, The McClean Report subscription includes free monthly updates from March through November (including a 250+ page Mid-Year Report), and free access to subscriber-only webinars throughout the year. An individual-user license to the 2013 edition of The McClean Report is priced at $3,390 and includes an Internet access password. A multi-user worldwide corporate license is available for $6,390.

To review additional information about IC Insights’ new and existing market research products and services please visit our website: www.icinsights.com

Related Semiconductor IP

- 5G-NTN Modem IP for Satellite User Terminals

- HBM4E Controller IP

- 14-bit 12.5MSPS SAR ADC - Tower 65nm

- 5G-Advanced Modem IP for Edge and IoT Applications

- TSN Ethernet Endpoint Controller 10Gbps

Related News

- The fabless-foundry model will survive (at least through 14-nm)

- Sequans Expands Business Model with Technology IP Licensing and Engineering Services

- TSMC Selects Legend's Model Diagnoser for Standard Cell Library Quality Assurance

- HDL Design House announces AT25DF161 VITAL behavioral model

Latest News

- OpenTitan Ships in Chromebooks: First Production Deployment

- Breker Verification Systems Adds RISC‑V Industry Expert Larry Lapides to its Advisory Board

- Weebit Nano’s ReRAM Selected for Korean National Compute-in-Memory Program

- Marvell Extends ZR/ZR+ Leadership with Industry-first 1.6T ZR/ZR+ Pluggable and 2nm Coherent DSPs for Secure AI Scale-across Interconnects

- BrainChip Announces Neuromorphyx as Strategic Customer and Go-to-Market Partner for AKD1500 Neuromorphic Processor