Global Fab Equipment Spending on Track for 2024 Recovery After 2023 Slowdown, SEMI Reports

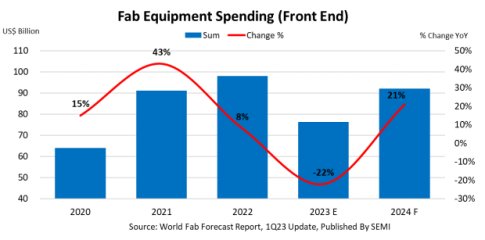

MILPITAS, Calif. — March 21, 2023 — Global fab equipment spending for front-end facilities is expected to decrease 22% year-over-year (YoY) to US$76 billion in 2023 from a record high of US$98 billion in 2022 before rising 21% YoY to US$92 billion in 2024 to reclaim lost ground, SEMI announced today in its latest quarterly World Fab Forecast report. The 2023 decline will stem from weakening chip demand and higher inventory of consumer and mobile devices.

Next year’s fab equipment spending recovery will be driven in part by the end of the semiconductor inventory correction in 2023 and strengthening demand for semiconductors in the high-performance computing (HPC) and automotive segments.

“This quarter’s SEMI World Fab Forecast update offers our first look ahead to 2024, highlighting the steady global expansion of fab capacity to support future semiconductor industry growth driven by the automotive and computing segments and a host of emerging applications,” said Ajit Manocha, SEMI president and CEO. “The report points to a healthy 21% uptick in equipment investment next year.”

Taiwan Continues to Lead Equipment Spending

Taiwan is expected to retain the global lead in fab equipment spending in 2024 with US$24.9 billion in investments, a 4.2% YoY increase, followed by Korea at US$21 billion, a YoY 41.5% jump. While China is forecast to place third in equipment spending worldwide in 2024, U.S. export controls are expected to limit the region’s spending to US$16 billion, comparable to the region’s investments in 2023.

The Americas is expected to remain the fourth largest region in spending with a record US$11 billion in investments in 2024, a 23.9% YoY increase. Europe & Mideast is also forecast to log record investments next year, increasing spending by 36% to US$8.2 billion. Fab equipment spending in Japan and Southeast Asia is expected to increase to US$7.0 billion and US$3.0 billion, respectively, in 2024.

Foundry Segment Continues to Lead Semiconductor Industry Expansion

Covering 2022 to 2024, the SEMI World Fab Forecast report shows the global semiconductor industry increasing capacity by 4.8% this year after a 7.2% rise in 2022. Capacity growth is expected to continue in 2024, rising 5.6%.

With more suppliers providing foundry services to increase global capacity, the foundry segment is expected to lead the semiconductor expansion in 2023 with US$43.4 billion in investments, a 12.1% YoY decline, and US$48.8 billion, a 12.4% increase, in 2024. Memory is forecast to place second in global spending in 2023 despite a 44.4% YoY decline to US$17.1 billion, with investments rising to US$28.2 billion next year.

Unlike other segments, analog and power will see a steady expansion with a forecast spending increase of 1.3% to US$9.7 billion in 2023 on the strength of stable growth in the automotive market. Investments by the segment are expected to remain flat next year.

The latest update of the SEMI World Fab Forecast report, published in March, lists 1,470 facilities and lines globally, including 142 volume facilities and lines with various probabilities that are expected to start production in 2023 or later.

Download a sample of the SEMI World Fab Forecast report.

For details about SEMI reports on other semiconductor sectors, visit SEMI Market Data or contact the SEMI Market Intelligence Team (MIT) at mktstats@semi.org.

About SEMI

SEMI® connects more than 2,500 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics design and manufacturing. SEMI members are responsible for the innovations in materials, design, equipment, software, devices, and services that enable smarter, faster, more powerful, and more affordable electronic products. Electronic System Design Alliance (ESD Alliance), FlexTech, the Fab Owners Alliance (FOA), the MEMS & Sensors Industry Group (MSIG) and SOI Consortium are SEMI Strategic Technology Communities. Visit www.semi.org to learn more.

Related Semiconductor IP

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

Related News

- Fab Equipment Spending Breaking Industry Records

- Total Fab Equipment Spending Reverses Course, Growth Outlook Revised Downward

- Global Fab Equipment Spending to Rebound in 2020 with 20 Percent Growth

- 300mm Fab Equipment Spending to Seesaw, Reach New Highs in 2021 and 2023, SEMI Reports

Latest News

- BrainChip Enables the Next Generation of Always-On Wearables with the AkidaTag© Reference Platform

- eSOL and Quintauris Partner to Expand Software Integration in RISC-V Automotive Platforms

- PQShield unveils ultra-small PQC embedded security breakthroughs

- CAST Introduces 400 Gbps UDP/IP Hardware Stack IP Core for High-Performance ASIC Designs

- EnSilica: New Contract Wins and Programme Upgrades