Total IC Unit Shipments Forecast to Climb 9% This Year

Unit growth returns to the long-term growth rate after an enormous 22% surge in 2021.

April 14, 2022 -- IC Insights’ May 2Q Update to The McClean Report 2022 will be released next month. In the 2Q Update, IC Insights forecasts worldwide IC unit shipments will increase 9.2% this year to 427.7 billion units and resume tracking with the long-term IC unit compound annual growth rate (CAGR) of 9.4%. The 9.2% gain anticipated this year follows the large, 22% increase experienced during the economic recovery of 2021—the largest increase in IC unit growth since the boom year of 2010.

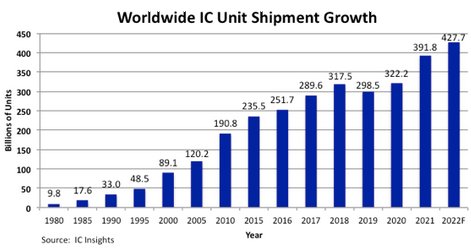

Figure 1 shows IC unit shipments in 2022 are forecast to reach a record-high level of 427.7 billion, almost 5x more units than were shipped in the year 2000 and nearly 44x more than were shipped in 1980.

Figure 1

The figure shows there was a falloff in shipments in 2019, which was only the fifth time in the history of the IC market that there was a year-over-year decline in IC unit volume. The previous four years with a drop in units were 1985, 2001, 2009, and 2012. Never have there been two consecutive years with a decline in IC unit shipments.

Of the 33 major IC product categories defined by the World Semiconductor Trade Statistics (WSTS) organization, 30 are forecast to show positive unit growth in 2022 and three (SRAM, DSP, and Gate Array) are forecast to have unit shipment declines. Twelve product segments are forecast to match or grow more than the expected 9.2% growth rate for total IC units this year.

From 2021-2026, IC Insights forecasts the IC unit CAGR will be 7%. Ignoring the 5-year CAGR timeperiods with abnormally high or low endpoints, IC Insights believes that the long-term CAGR for IC unit growth will be 7%-8%, moderately lower than the historical 42-year rate of 9.4%.

Report Details: The 2022 McClean Report

The McClean Report—A Complete Analysis and Forecast of the Semiconductor Industry, is now available. A subscription to The McClean Report service includes the January Semiconductor Industry Flash Report, which provides clients with IC Insights’ initial overview and forecast of the semiconductor industry for this year through 2026. In addition, the first of four Quarterly Updates to the report was released in February, with additional Quarterly Updates to be released in May, August, and November of this year. An individual user license to the 2022 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2022.

https://www.icinsights.com/services/mcclean-report/pricing-order-forms/

Related Semiconductor IP

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

Related News

- IC Unit Shipments Forecast to Display First-Ever Back-to-Back Decline

- Four Large Agreements Prop Up 2022 Semiconductor M&A Total

- After Record Sales in 2022, Semi Sales Forecast to Fall -5% in 2023

- Global Total Semiconductor Equipment Sales Forecast to Reach Record High in 2022, SEMI Reports

Latest News

- SEALSQ and Lattice Collaborate to Deliver Unified TPM-FPGA Architecture for Post-Quantum Security

- SEMIFIVE Partners with Niobium to Develop FHE Accelerator, Driving U.S. Market Expansion

- TASKING Delivers Advanced Worst-Case Timing Coupling Analysis and Mitigation for Multicore Designs

- Efficient Computer Raises $60 Million to Advance Energy-Efficient General-Purpose Processors for AI

- QuickLogic Announces $13 Million Contract Award for its Strategic Radiation Hardened Program