DRAM Capex Spending Expected to Decline 20% in 2020

Suppliers cautious about spending plans this year, despite modest DRAM market recovery

August 20, 2020 -- The DRAM market is poised for a modest recovery in 2020, but suppliers are being very cautious, strategic, and thorough in their analysis of market conditions before they consider any further upgrades or decide to move ahead with any new DRAM wafer fab plans.

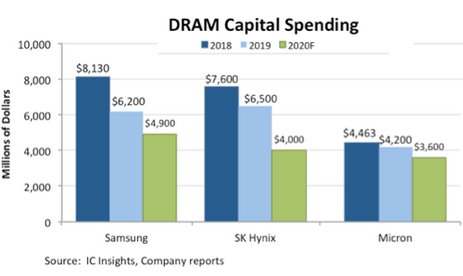

Figure 1 shows DRAM capex budgets for the three major suppliers. Each is expected to make further cuts in its DRAM capital spending in 2020 as most new facilities and upgrades to current fabs are in place to handle near-term demand. Among the three big DRAM players, IC Insights forecasts that Samsung’s DRAM capital expenditure budget will decline 21% to $4.9 billion this year, SK Hynix is expected to trim its DRAM capex budget 38% to $4.0 billion, and Micron is forecast to trim its DRAM capex by 16% this year to $3.6 billion.

Figure 1

New fabs, once built, must run at very high or full capacity given the high levels of capital expenditures required to build and equip them. Investing $6-10 billion in a wafer fab only to see it operate at partial capacity would have a destructive financial impact on any supplier. Consequently, DRAM makers will continue to closely monitor capacity and expansion plans in the coming months in order to limit potential damage from another supply/demand imbalance.

Samsung, SK Hynix, and Micron are wrapping up their significant DRAM capacity expansions in 2020, and each has made it clear that they will be restrained about how fast they progress with building and ramping their new manufacturing lines.

Even smaller niche DRAM suppliers like Winbond are being guarded. Winbond is building a new fab in Kaohsiung, southern Taiwan. It was originally scheduled for completion at the end of 2020 with commercial production slated for 2021. However, the company has now rescheduled equipment move-in for January 2022.

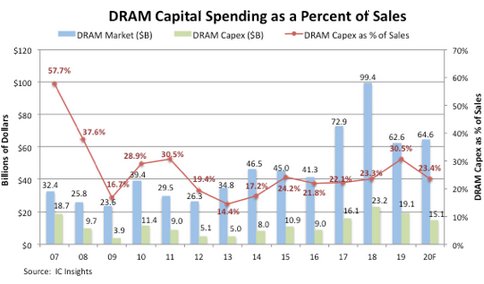

Collectively, suppliers are expected to allocate $15.1 billion to DRAM capex spending this year, a 20% decline from $19.1 billion in 2019 and down from the record high of $23.2 billion spent for DRAM in 2018.

Even with elevated capital spending levels the past few years, DRAM capex as a percent of DRAM sales was not terribly out of line with what the industry has seen since 2015. It is interesting to note, however, that with the 37% DRAM market collapse in 2019, DRAM capex spending as a percent of sales jumped to 30.5%, the highest level since 30.5% in 2011 (Figure 2).

Figure 2

Report Details: The 2020 McClean Report

Additional details on IC market trends are provided in the 2020 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Report includes free monthly updates from March through November (including a 180+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual-user license to the 2020 edition of The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

Related Semiconductor IP

- HiFi iQ DSP

- CXL 4 Verification IP

- JESD204E Controller IP

- eUSB2V2.0 Controller + PHY IP

- I/O Library with LVDS in SkyWater 90nm

Related News

- DRAM Capex to Plunge 28% in 2019 After Huge Outlays in 2017-18

- NAND Flash, DRAM Forecast to Remain Largest IC Markets in 2020

- DRAM Price Erosion Expected Through the End of 2020

- DRAM Leads in Revenue, NAND With Top Percentage Growth in 2020

Latest News

- A new CEO, a cleared deck: Is Imagination finally ready for a deal?

- SkyeChip’s UCIe 3.0 Advanced Package PHY IP for SF4X Listed on Samsung Foundry CONNECT

- Victor Peng Joins Rambus Board of Directors

- Arteris Announces Financial Results for the Fourth Quarter and Full Year 2025 and Estimated First Quarter and Full Year 2026 Guidance

- Arteris Network-on-Chip Technology Achieves Deployment Milestone of 4 Billion Chips and Chiplets