Automotive IC Marketshare Slips in 2020 After Steady Gains Since 1998

After a 3% drop in 2020, the automotive IC market is forecast to surge more than 25% in 2021.

June 9, 2021 -- In this month’s June Update to The McClean Report, IC Insights will present its forecast for IC usage by major product type and end-use application (i.e., computer, communications, consumer, automotive, industrial, and government/military) through 2025.

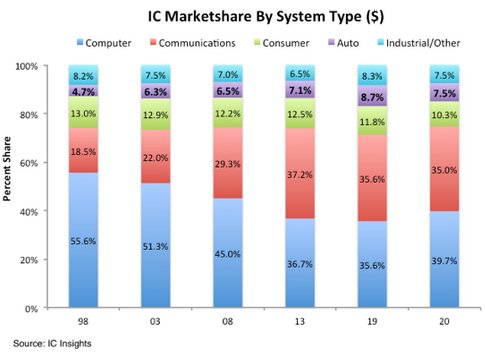

Figure 1 shows that since 1998, only the automotive and communications end-use segments have gained marketshare. Driven by the global explosion of smartphone demand, the communications market almost doubled its share of the IC market from 18.5% in 1998 to 35.0% in 2020.

Figure 1

Automotive’s marketshare increased from 4.7% in 1998 to 8.7% in 2019 before falling back to 7.5% during Covid-plagued 2020. The automotive share of the total IC market has never been greater than 9.0% while the communications share of the IC market peaked at 37.2% in 2013. In 2020, the communications IC market was 4.7x the size of the automotive IC market.

In many cases, automotive ICs represent only a small portion of an IC supplier’s total sales. (At TSMC, the world’s largest foundry, automotive applications have never accounted for more than 5% of its sales.) Producing automotive ICs does not typically require leading-edge technology—many non-memory automotive ICs continue to be manufactured on 200mm wafers—but it does require strict adherence to rigorous reliability and testing requirements and a commitment by the IC manufacturer to supply a customer’s long lifecycle needs. It is also worth noting that automotive IC end-users are notorious for being tough negotiators, oftentimes leaving slim margins for the automotive IC supplier.

Despite the current automotive IC shortage, the average selling price for many automotive IC products has remained fairly constant. For example, the ASP for automotive application-specific ICs was $0.96 in 2020 (15% less than the total application-specific IC market ASP last year) and only $0.95 in 1Q21. The automotive application-specific IC ASP in 1Q21 was less than it was in 2020.

Many IC industry headlines have recently focused on the shortage of automotive ICs, but given its relatively small size, strong growth in the automotive segment is not expected to significantly lift the growth rate of the total IC market this year. In fact, the 1Q21/1Q20 automotive IC market grew 23%, the same rate as the total worldwide IC market.

Report Details: The 2021 McClean Report

The 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry was released in January 2021. A subscription to The McClean Report includes free monthly updates from March through November (including a 180+ page Mid-Year Update), and free access to subscriber-only pre-recorded webcasts through November. An individual user license to the 2021 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2021.

Related Semiconductor IP

- 5G-NTN Modem IP for Satellite User Terminals

- HBM4E Controller IP

- 14-bit 12.5MSPS SAR ADC - Tower 65nm

- 5G-Advanced Modem IP for Edge and IoT Applications

- TSN Ethernet Endpoint Controller 10Gbps

Related News

- Chinese Companies Hold Only 4% of Global IC Marketshare

- Top 10 Companies Hold 57% of Global Semi Marketshare

- Top Three Suppliers Held 94% of 2021 DRAM Marketshare

- Automotive IC Marketshare Seen Rising to 10% by 2026

Latest News

- Marvell Extends ZR/ZR+ Leadership with Industry-first 1.6T ZR/ZR+ Pluggable and 2nm Coherent DSPs for Secure AI Scale-across Interconnects

- BrainChip Announces Neuromorphyx as Strategic Customer and Go-to-Market Partner for AKD1500 Neuromorphic Processor

- SCI Semiconductor Announces First Silicon of Cybersecure MCU, ICENI™

- Allen Wu on Disrupting $100M Cost of Building Custom AI Chips

- GUC Monthly Sales Report – February 2026