Semi Content in Electronic Systems Forecast to Set New Record in 2017

Semi content expected to reach 28.1% this year, breaking previous high of 25.9% set in 2010.

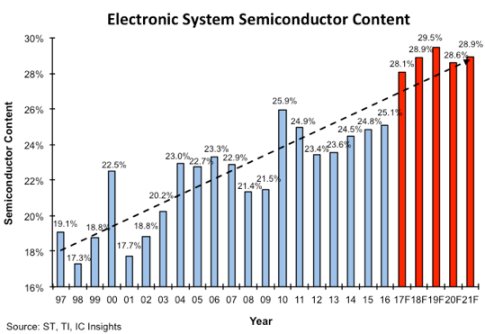

July 13, 2017 -- In its upcoming Mid-Year Update to The McClean Report 2017 (to be released at the end of July), IC Insights forecasts that the 2017 global electronic systems market will grow by only 2% to $1,493 billion while the worldwide semiconductor market is expected to surge by 15% this year to $419.1 billion. Moreover, IC Insights forecasts that the total semiconductor market will exceed $500.0 billion four years from now in 2021. If the 2017 forecasts come to fruition, the average semiconductor content in an electronic system will reach 28.1%, an all-time record (Figure 1).

Figure 1

Historically, the driving force behind the higher average annual growth rate of the semiconductor industry as compared to the electronic systems market is the increasing value or content of semiconductors used in electronic systems. With global unit shipments of cellphones (0%), automobiles (2%), and PCs (-2%) forecast to be weak in 2017, the disparity between the slow growth in the electronic systems market and high growth of the semiconductor market is directly due to the increasing content of semiconductors in electronic systems.

While the trend of increasing semiconductor content has been evident for the past 30 years, the big jump in the average semiconductor content in electronic systems in 2017 is expected to be primarily due to the huge surge in DRAM and NAND flash ASPs and below average electronic system sales growth this year. After dipping slightly to 28.6% in 2020, the semiconductor content figure is expected to climb to 28.9% in 2021, an average yearly gain over the 2016-2021 timeperiod of about 0.8 percentage points.

Of course, the trend of increasingly higher semiconductor value in electronic systems has a limit. Extrapolating an annual increase in the percent semiconductor figure indefinitely would, at some point in the future, result in the semiconductor content of an electronic system reaching 100%. Whatever the ultimate ceiling is, once it is reached, the average annual growth for the semiconductor industry will closely track that of the electronic systems market (i.e., about 4% per year). In IC Insights’ opinion, the “ceiling” is at least 30% but will not be reached within the forecast period.

The 250+ page Mid-Year Update to the 2017 edition of The McClean Report further describes IC Insights’ IC market forecast data for 2017-2021.

Report Details: The 2017 McClean Report

Additional details on the IC market forecast and other trends within the IC industry are provided in The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2017). A subscription to The McClean Report includes free monthly updates from March through November (including a 250+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual-user license to the 2017 edition of The McClean Report is priced at $4,090 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,090.

Related Semiconductor IP

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

Related News

- Semiconductor Industry Capital Spending Forecast to Jump 20% in 2017

- Wafer Shipments Forecast to Increase in 2017, 2018 and 2019

- IC Insights Raises 2017 IC Market Forecast to +22%

- Samsung Forecast to Top Intel as the #1 Semiconductor Supplier in 2017

Latest News

- Synopsys Introduces Software-Defined Hardware-Assisted Verification to Enable AI Proliferation

- AimFuture and ITM Semiconductor to Develop AI-Integrated Technology for Robotics and Mobility

- TSMC February 2026 Revenue Report

- Silvaco Announces Immediate Availability of Production Ready Mixel MIPI PHY IP, Strengthening its Comprehensive Silicon IP Offering

- Movellus Partners with Synopsys to Deliver Power Efficiency for Next Generation IC’s