迎合5nm / 7nm IC工艺与日俱增的需求,每片晶圆的营收也节节攀升

Despite high development costs, smaller nodes bring greater revenue per wafer.

March 4, 2021 -- The success and proliferation of integrated circuits has largely hinged on the ability of IC manufacturers to continue offering more performance and functionality for the money. Driving down the cost of ICs (on a per-function or per-performance basis) is inescapably tied to a growing arsenal of technologies and wafer-fab manufacturing disciplines as mainstream CMOS processes reach their theoretical, practical, and economic limits.

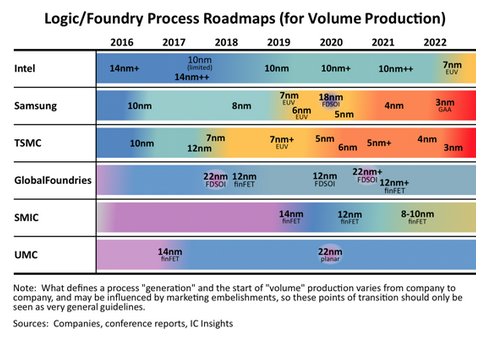

Data presented in IC Insights’ 2021 edition of The McClean Report (released in January 2021), notes that many fabless IC companies are clamoring to have their leading-edge devices, including high-performance microprocessors, low-power application processors, and other advanced logic devices, fabricated using 7nm and 5nm process nodes. Some of the current iterations from logic and foundry suppliers are shown in Figure 1.

Figure 1

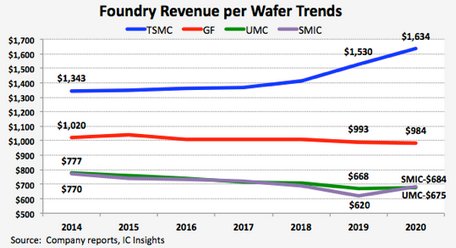

In the foundry world, particularly, manufacturing with leading-edge processes carries a distinct advantage. In 2020, TSMC was the only pure-play foundry manufacturing ICs using both 7nm and 5nm process nodes. Not coincidentally, its overall revenue per wafer increased significantly in 2020 as many of the top fabless IC suppliers—16 fabless IC companies with more than $1.0 billion in 2020 revenue—lined up to have their newest designs manufactured using these most advanced processes. Three of the four pure-play foundries enjoyed higher revenue-per-wafer in 2020 (GlobalFoundries’ revenue per wafer slipped 1% last year). TSMC’s figure of $1,634 exceeded GlobalFoundries by 66% and was more than double the revenue per wafer value at UMC and SMIC. With estimated capital expenditures of $27.5 billion in 2021, TSMC will expand its available capacity at these nodes and also begin risk production of 3nm ICs this year with 3nm volume production slated to start in 2022.

Figure 2

Besides foundry and logic IC manufacturing, memory suppliers like Samsung, Micron, SK Hynix, and Kioxia/WD are using advanced processes to make their DRAM and flash memory components. No matter the device type, the IC industry has evolved to the point where only a very small group of companies can develop leading-edge process technologies and fabricate leading edge ICs. Growing design and manufacturing challenges and costs have divided the integrated circuit world into the haves and have-nots. Marketshare makeup in various IC product segments has become “top heavy,” with increasing shares held by the top producers, leaving very little room for remaining competitors.

Report Details: The 2021 McClean Report

The 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry was released in January 2021. A subscription to The McClean Report includes free monthly updates from March through November (including a 180+ page Mid-Year Update), and free access to subscriber-only pre-recorded webcasts through November. An individual user license to the 2021 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2021.

https://www.icinsights.com/services/mcclean-report/pricing-order-forms/

Related Semiconductor IP

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

Related News

- 7纳米以下IC工艺需求增长,单片晶圆收入与日俱增

- 台湾赶超韩国成为最大IC晶圆产能基地

- 台湾独占鳌头,保持全球最大半导体晶圆生产基地

- 据集邦咨询最新数据:季节性消费与AI热潮延续,推升全球十大IC设计公司第三季营收环比增长17.8%