Progress in Importation of US Equipment Dispels Doubts on SMIC's Capacity Expansion for Mature Nodes for Now, Says TrendForce

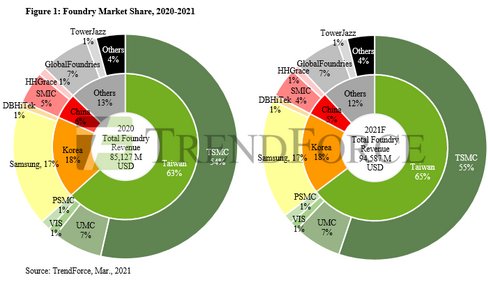

March 8, 2021 -- The major suppliers of WFE (wafer fab equipment) in the US are progressing smoothly in the application for license from the US government for the exportation of equipment systems, equipment parts, and customer services for 14nm and above processes to Chinese foundry SMIC. The US-based equipment suppliers that are applying for the license include Applied Materials, Lam Research, KLA-Tencor, and Axcelis. TrendForce believes that as some support from US-based equipment suppliers is forthcoming, SMIC should be able to continue its efforts in the optimization of the mature process modules and overcoming production bottlenecks to avoid a scission in raw materials and spare parts, and predicts the company to sit at a global market share of 4.2% in 2021. Keeping SMIC in operation will provide a bit of relief to the capacity crunch in the global foundry market, however, the tightening of the available production capacity will remain a challenge that is difficult to resolve for the foundry industry as a whole. Also, the US government continues to prohibit SMIC from obtaining the equipment of the advanced nodes that are 10nm and below, and the particular restriction poses a potential risk for the long-term development of the Chinese foundry.

SMIC Continues to Expand Domestic Demand and Localization under China’s Explicit Direction in Long-Term Development of Semiconductor

As the fifth largest IC foundry in the world, SMIC obtains over 70% of revenue from China and Asia-Pacific. In terms of process node perspectives, 0.18um, 55nm, and 40nm contribute to the majority of revenue that totaled to over 80% from being applied on service platforms such as logic, BCD, eFlash, sensor, RF, and HV, and the coordination with the IC projects listed in the 13th and 14th Five-Year Plan of China will continue to enhance on the assimilation of localized WFE (wafer fab equipment) and raw materials.

The sanctions imposed by the US Department of Commerce that have affected the long-term planning in production capacity and development strategies of SMIC are expected to result in a YoY declination of 25% in the capital expenditure of 2021 for the Chinese foundry. SMIC intends to allocate the majority of its capital expenditure to capacity expansion for the mature nodes and the construction of a new joint-venture fab in Beijing, and is conservative towards investing in advanced process technology such as FinFET. TrendForce believes that geopolitical factors and uncertainties in the WFE section of the supply chain have compelled SMIC to scale back its capital expenditure and shift its development focus to the 55/40nm and 0.18um nodes.

A breakdown of SMIC’s revenue by region shows that more than 50% comes from China, though whether major global clients are willing to continue placing their orders with SMIC under the consideration of foundry selection and long-term cooperation amidst the unabated status in the semiconductor competition between China and the US will be a focus of observation going forward. Pertaining to the return on investment for technology scaling and mature node, the development planning in advanced processes for SMIC no longer succumb to immediacy in demand under restricted client conditions and constraints from subcontractors. On the other hand, the resources for chiplet and specialty IC that exert better functions for the operation of the company are focused on the existing 14nm and above matured processes to enhance on PDK (process design kits) for clients that may create a business model with prolonged profitability, as well as preserve R&D staffs and future growth dynamics.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email Ms. Latte Chung from the Sales Department at lattechung@trendforce.com

Related Semiconductor IP

- 50MHz to 800MHz Integer-N RC Phase-Locked Loop on SMIC 55nm LL

- NFC wireless interface supporting ISO14443 A and B with EEPROM on SMIC 180nm

- NFC wireless interface supporting ISO14443 A and B on SMIC 180nm

- SMIC 55nm sub-LVDS Receiver

- SMIC 55nm sub-LVDS Receiver

Related News

- SMIC TianJin Launches Capacity Expansion Project; Expected to Become the World's Largest Integrated 8-Inch IC Production Line

- Following Significant Technology, Capacity and Expansion Milestones, GLOBALFOUNDRIES' Sanjay Jha to Pass Baton to Industry Veteran Tom Caulfield

- SMIC Aims to Raise More Than $3B for Expansion

- 2022 a Focus for 12-inch Capacity Expansion, 20% Annual Growth Expected in Mature Process Capacity, Says TrendForce

Latest News

- ZeroRISC and Leading Research Institutions Deliver Production-Grade Post-Quantum Cryptography for Open Silicon

- GlobalFoundries Announces Availability of AutoPro 150 eMRAM Technology on Enhanced FDX Platform for Advanced Automotive Applications

- MIPS and INOVA Collaborate to put Physical AI into the palm of Robotic hands with new Reference Platform

- Allegro DVT Launches DWP300 DeWarp Semiconductor IP

- Ubitium Tapes Out Universal Processor to End Embedded Computing Complexity Crisis