Asia-Pacific-Based OEMs Dominate Chip Spending Growth on Home Turf

August 16, 2012 -- On a worldwide basis Apple Inc. and other multinational OEMs may be the leading semiconductor purchasers in 2012, but within the all-important Asia-Pacific region it is the locally based companies that are No. 1 when it comes to chip spending growth.

Semiconductor spending in Asia-Pacific among original equipment manufacturers (OEMs) headquartered in the region is expected to rise by an average of 6 percent in 2012, according to an IHS iSuppli OEM Semiconductor Spend Analysis Report from information and analytics provider IHS (NYSE: IHS). In contrast, chip purchasing growth in Asia-Pacific for all global OEMs is set to average only about 2.5 percent for the year.

Meanwhile, local firms are also leading the Asia-Pacific region in terms of semiconductor purchasing growth.

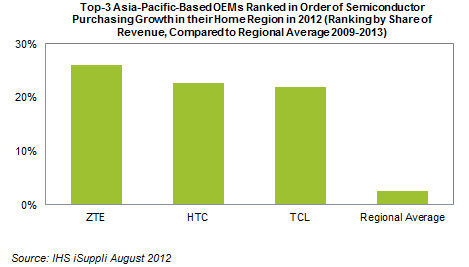

As IHS noted in July, Apple is expected to post the second-highest growth among the Top 10 biggest chip-buying OEMs in the Asia-Pacific region in 2012, at 15 percent. However, the fastest growth among the region’s Top 10 will be generated by Taiwan’s HTC Corp. at 23 percent. Furthermore, for all OEMs buying chips in Asia-Pacific, the fastest growth will be posted by three indigenous companies: ZTE Corp. of China; HTC; and TCL Corp., another entity from China, as presented in Figure 1 below.

“Local companies have led, are leading and will lead the Asia-Pacific region in semiconductor spending growth—not the larger OEMs headquartered elsewhere, such as Apple, Hewlett-Packard Co. and Dell Inc.,” said Myson Robles-Bruce, senior analyst for semiconductor spending and design activity at IHS. “This is critical given the Asia-Pacific is the largest global region for chip purchasing—and is set to outperform the rest of the world in coming years. Apple is leading the Top 10 in growth and size worldwide during 2012 and 2013, giving it enormous advantages in terms of component supply and pricing. However, the Asia-Pacific players are playing to their home-field advantage, wielding in Asia the same kind of influence that Apple now enjoys globally.”

A Lingering Trend

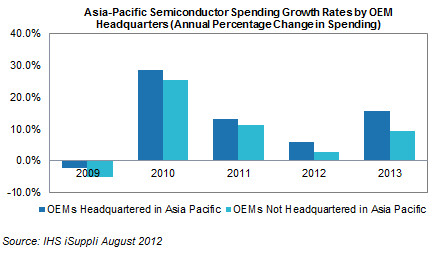

OEMs headquartered in Asia-Pacific have attained higher growth in semiconductor purchasing than those based in other regions for several years. Local companies expanded their chip spending in Asia-Pacific at a compound annual growth rate (CAGR) of 9 percent for the years 2008 to 2011. In contrast, Asia-Pacific spending for all OEMs worldwide increased by only 7 percent during the same period.

The forecast for 2013 shows semiconductor spending for this region will rise by 9.4 percent. However, looking only at local companies headquartered in the region, this growth rate becomes significantly higher, increasing to 15.5 percent for the year.

“The phenomenon of domestic OEMs increasing their Asia-Pacific chip spending at a faster rate than their global rivals represents a consistent long-term trend,” Robles-Bruce said. “This trend has persisted regardless of whether overall growth rates for Asia Pacific semiconductor spending have increased or decreased.”

Figure 2 below presents relative growth in Asia-Pacific chip spending growth for companies based in the region compared to those headquartered elsewhere.

The Leaders of the Asia Pack

For year 2012, ZTE is expected to show the highest growth in Asia-Pacific chip spending at 26 percent, followed by HTC at 23 percent and TCL at 22 percent.

Both ZTE and HTC are considered among the top smartphone vendors on a worldwide basis, trailing market leaders Samsung, Apple, and Nokia, with a combined share of slightly more than 10 percent.

ZTE has been able to effectively compete in the Chinese domestic smartphones market, matching Apple's smartphone share for that area. The company has announced that it plans to double its smartphone shipments for this year by dramatically increasing sales to the U.S. and Chinese markets.

HTC has been suffering of late, due to falling profits resulting from losing battles to Samsung and Apple in key markets. Although HTC has not yet achieved the branding it needs in order to reach greater success, the company continues to press forward with plans to challenge the market leaders with newer products like the HTC One X, as well as the upcoming Rio, Accord, and Zenith Windows phones.

TCL recently reported that its handset sales for the Chinese domestic market were up by more than 200 percent year over year. Most of this new growth was driven by the release of five new smartphone models this year. Also for 2012, the company has brought to the China market a new 7-inch tablet called the T50. TCL has publicly stated its goal of raising revenue by 30 percent for this year, a feat which will be based in part upon greater spending on semiconductors.

Read More > Worldwide OEM Semi Spend Higher for Consumer Electronics and Automotive

IHS iSuppli's market intelligence helps technology companies achieve market leadership. Catch the latest semiconductor news, semiconductor forecast, semiconductor market, semiconductor electronic market from all across the world straight from our immensely experienced analysts. iSuppli provides comprehensive IHS iSuppli® Semiconductor Market Research portal provides the latest supply chain industry news and trends. To learn more, call us at 310-524-4007. that is rigorous, reliable & relevant. To know more, send us an e-mail on info@isuppli.com or contact us on +1.310.524.4007.

Related Semiconductor IP

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

- JESD204E Controller IP

Related News

- SEMI tells EU to quadruple semiconductor spending, says report

- SkyWater Technology Expands Leadership in U.S. Semiconductor Manufacturing with Infineon IP License Agreement

- Global Semiconductor Sales Increase 7.8% from Q1 to Q2; Month-to-Month Sales Tick Up 1.5% in June

- Cirrus Logic and GlobalFoundries Expand Strategic Investment to Advance Next-Generation Mixed-Signal Semiconductor Manufacturing in the U.S.

Latest News

- Cadence Reports Fourth Quarter and Fiscal Year 2025 Financial Results

- Renesas Develops 3nm TCAM Technology Combining High Memory Density and Low Power, Suitable for Automotive SoCs

- RaiderChip showcases the evolution of its local Generative AI processor at ISE 2026

- ChipAgents Raises $74M to Scale an Agentic AI Platform to Accelerate Chip Design

- Avery Dennison announces first-to-market integration of Pragmatic Semiconductor’s chip on a mass scale