Semiconductor Equipment Sales Forecast: $62 Billion in 2018 A New Record, Market Reset in 2019 with New High in 2020

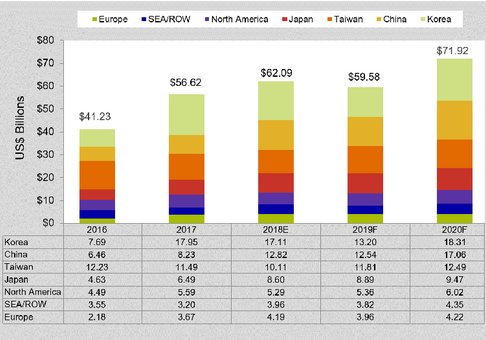

TOKYO – December 12, 2018 – Releasing its Year-End Total Equipment Forecast at the annual SEMICON Japan exposition, SEMI, the global industry association representing the electronics manufacturing supply chain, today reported that worldwide sales of new semiconductor manufacturing equipment are projected to increase 9.7 percent to $62.1 billion in 2018, exceeding the historic high of $56.6 billion set last year. The equipment market is expected to contract 4.0 percent in 2019 but grow 20.7 percent to reach $71.9 billion, an all-time high.

The SEMI Year-end Forecast predicts wafer processing equipment will rise 10.2 percent in 2018 to $50.2 billion. The other front-end segment – consisting of fab facilities equipment, wafer manufacturing, and mask/reticle equipment – is expected to increase 0.9 percent to $2.5 billion this year. The assembly and packaging equipment segment is projected to grow 1.9 percent to $4.0 billion in 2018, while semiconductor test equipment is forecast to increase 15.6 percent to $5.4 billion this year.

In 2018, South Korea will remain the largest equipment market for the second year in a row. China will rise in the rankings to claim the second spot for the first time, dislodging Taiwan, which will fall to the third position. All regions tracked except Taiwan, North America, and Korea will experience growth. China will lead in growth with 55.7 percent, followed by Japan at 32.5 percent, Rest of World (primarily Southeast Asia) at 23.7 percent, and Europe at 14.2 percent.

For 2019, SEMI forecasts that South Korea, China, and Taiwan will remain the top three markets, with all three regions maintaining their relative rankings. Equipment sales in South Korea is forecast to reach $13.2 billion, in China $12.5 billion, and in Taiwan $11.81 billion. Japan, Taiwan and North America are the only regions expected to experience growth next year. The growth picture is much more optimistic in 2020, with all regional markets expected to increase in 2020, with the market increasing the most in Korea, followed by China, and Rest of World.

The following results are in terms of market size in billions of U.S. dollars:

The Equipment Market Data Subscription (EMDS) from SEMI provides comprehensive market data for the global semiconductor equipment market. A subscription includes three reports:

- Monthly SEMI Billings Report, an early perspective of the trends in the equipment market

- Monthly Worldwide Semiconductor Equipment Market Statistics (SEMS), a detailed report of semiconductor equipment bookings and billings for seven regions and over 22 market segments

- SEMI Mid-Year Forecast, an outlook for the semiconductor equipment market

For more information or to subscribe, please contact SEMI customer service at 1.877.746.7788 (toll free in the U.S.). For more information online, please visit http://info.semi.org/semi-equipment-market-data-subscription.

About SEMI

SEMI® connects more than 2,100 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics manufacturing. SEMI members are responsible for the innovations in materials, design, equipment, software, devices, and services that enable smarter, faster, more powerful, and more affordable electronic products. Electronic System Design Alliance (ESD Alliance), FlexTech, the Fab Owners Alliance (FOA) and the MEMS & Sensors Industry Group (MSIG) are SEMI Strategic Association Partners, defined communities within SEMI focused on specific technologies. Since 1970, SEMI has built connections that have helped its members prosper, create new markets, and address common industry challenges together. SEMI maintains offices in Bangalore, Berlin, Brussels, Grenoble, Hsinchu, Seoul, Shanghai, Silicon Valley (Milpitas, Calif.), Singapore, Tokyo, and Washington, D.C. For more information, visit www.semi.org

Related Semiconductor IP

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

Related News

- $55.9 Billion Semiconductor Equipment Forecast - New Record with Korea at Top

- Global Semiconductor Equipment Sales Forecast - 2020 Rebound, 2021 Record High

- Global Fab Equipment Spending Forecast to Reach All-Time High of Nearly $100 Billion in 2022, SEMI Reports

- Global Total Semiconductor Equipment Sales Forecast to Reach Record High in 2022, SEMI Reports

Latest News

- proteanTecs and Gubo Technologies Collaborate to Deliver Unified Analytics Solution for Advanced Semiconductor Systems

- Cadence Completes Acquisition of Hexagon’s Design and Engineering Business, Advancing Leadership in Physical AI and Multiphysics

- TES Launches its µEngine: Parallel CPU System for Deterministic Real-Time HDL Applications

- PQShield becomes ST Authorized Partner

- sensiBel Licenses Sofics’ Advanced ESD Solutions for their Studio-quality MEMS Microphone Technology