IDC Expects PC Shipments to Fall by -6% in 2014 and Decline Through 2018

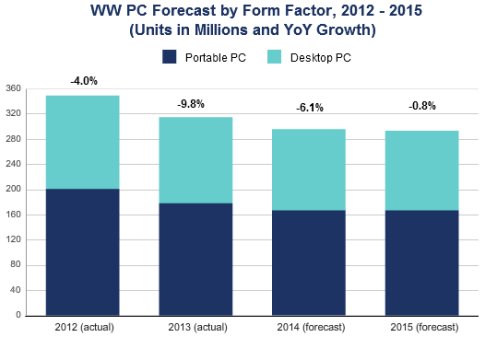

FRAMINGHAM, Mass. -- March 5, 2014 – Worldwide PC shipments fell by -9.8% in 2013, slightly better than a projected decline of -10.1%, but still the most severe contraction on record, according to the International Data Corporation (IDC) Worldwide Quarterly PC Tracker. Fourth quarter results were slightly better than expected, but the outlook for emerging markets has deteriorated as competition from other devices and economic pressures mount. In mature regions, the fourth quarter was also slightly ahead of expectations, although the improvement seems driven by short-term factors like a slight rise in XP replacements and is not expected to last long. Overall growth projections for 2014 were lowered by just over 2%, and subsequent years were lowered by less than 1%. However, the changes are enough to keep long-term growth just below zero, and push volumes below 300 million throughout the forecast rather than staying slightly above this level.

Emerging regions were on forecast for the fourth quarter (finishing a dismal year with volume declining by -11.3%), but concerns about the impact of slower economic growth, the culmination of some large projects, and conservative expectations for factors like touch capability, migration off of Windows XP, as well as continued pressure from tablets and smartphones has further depressed expectations going forward.

"Emerging markets used to be a core driver of the PC market, as rising penetration among large populations boosted overall growth," said Loren Loverde, Vice President, Worldwide PC Trackers. "At the moment, however, we're seeing emerging regions more affected by a weak economic environment as well as significant shifts in technology buying priorities. We do expect these regions to recover in the medium term and perform better than mature regions, but growth is expected to stabilize near zero percent, rather than driving increasing volumes as we saw in the past."

"2014 will remain a challenging year for PC vendors in Asia as a cautious economic outlook means consumers will prioritize device purchases. At the same time, tectonic changes in politics will affect commercial spending in some of the major countries, like India, Indonesia, and Thailand, which are due to hold elections this year," said Andi Handoko, Research Manager for Client Devices, IDC Asia/Pacific. "The region is also seeing a void in public sector spending this year after huge education deals seen in India and Malaysia last year failed to materialize."

PC Shipments by Region and Form Factor, 2013-2018 (Shipments in millions)

| Region | Form Factor | 2013 | 2014* | 2018* |

| Emerging Markets | Desktop PC | 85.6 | 80.5 | 77.2 |

| Emerging Markets | Portable PC | 96.2 | 87.2 | 94.5 |

| Emerging Markets | Total PC | 181.9 | 167.7 | 171.7 |

| Mature Markets | Desktop PC | 51.1 | 48.6 | 42.0 |

| Mature Markets | Portable PC | 82.2 | 79.6 | 77.9 |

| Mature Markets | Total PC | 133.3 | 128.2 | 120.0 |

| Worldwide | Desktop PC | 136.7 | 129.1 | 119.2 |

| Worldwide | Portable PC | 178.4 | 166.8 | 172.5 |

| Worldwide | Total PC | 315.1 | 295.9 | 291.7 |

Source: IDC Worldwide Quarter PC Tracker, February 2014

* Forecast data

See Table and Taxonomy Notes below.

PC Shipment Growth by Region and Form Factor, 2013-2018

| Region | Form Factor | 2013 | 2014* | 2018* |

| Emerging Markets | Desktop PC | -9.5% | -6.0% | -0.6% |

| Emerging Markets | Portable PC | -12.9% | -9.4% | 2.6% |

| Emerging Markets | Total PC | -11.3% | -7.8% | 1.1% |

| Mature Markets | Desktop PC | -4.8% | -4.8% | -3.2% |

| Mature Markets | Portable PC | -9.3% | -3.1% | -1.4% |

| Mature Markets | Total PC | -7.6% | -3.8% | -2.0% |

| Worldwide | Desktop PC | -7.8% | -5.6% | -1.5% |

| Worldwide | Portable PC | -11.3% | -6.5% | 0.8% |

| Worldwide | Total PC | -9.8% | -6.1% | -0.2% |

Source: IDC Worldwide Quarter PC Tracker, February 2014

* Forecast data

Table Note: Mature Markets include U.S., Western Europe, Japan, and Canada. Emerging Markets includes Asia/Pacific (excluding Japan), Latin America, Central and Eastern Europe, Middle East, and Africa.

Taxonomy Note: PCs include Desktop, Mini Notebook and other Portable PCs which possess non-detachable keyboards, and do not include handhelds or Tablets such as the Apple iPad, Microsoft Surface Pro or Android Tablets

IDC's Worldwide Quarterly PC Tracker gathers PC market data in more than 80 countries by vendor, form factor, brand, processor brand and speed, sales channel and user segment. The research includes historical and forecast trend analysis as well as price band and installed base data. For more information, or to subscribe to the research, please contact Kathy Nagamine at 650-350-6423 or knagamine@idc.com.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC's Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhone and iPad.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. IDC helps IT professionals, business executives, and the investment community to make fact-based decisions on technology purchases and business strategy. More than 1,000 IDC analysts provide global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. In 2014, IDC celebrates its 50th anniversary of providing strategic insights to help clients achieve their key business objectives. IDC is a subsidiary of IDG, the world's leading technology media, research, and events company. You can learn more about IDC by visiting www.idc.com.

Related Semiconductor IP

- 5G-NTN Modem IP for Satellite User Terminals

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

- 14-bit 12.5MSPS SAR ADC - Tower 65nm

- 5G-Advanced Modem IP for Edge and IoT Applications

Related News

- Gartner Says Worldwide PC Shipments Declined 6.9 Percent in Fourth Quarter of 2013

- Gartner Says Worldwide Traditional PC, Tablet, Ultramobile and Mobile Phone Shipments to Grow 4.2 Percent in 2014

- Total PC Shipments Seen Rising Despite Declines in Desktops, Notebooks

- Wafer Shipments Forecast to Increase in 2017, 2018 and 2019

Latest News

- OpenTitan Ships in Chromebooks: First Production Deployment

- Breker Verification Systems Adds RISC‑V Industry Expert Larry Lapides to its Advisory Board

- Weebit Nano’s ReRAM Selected for Korean National Compute-in-Memory Program

- Marvell Extends ZR/ZR+ Leadership with Industry-first 1.6T ZR/ZR+ Pluggable and 2nm Coherent DSPs for Secure AI Scale-across Interconnects

- BrainChip Announces Neuromorphyx as Strategic Customer and Go-to-Market Partner for AKD1500 Neuromorphic Processor