Communications IC Market to Again Surpass Computer IC Market

Auto IC segment to show fastest future growth but still hold less than a 10% share in 2023.

June 6, 2019 -- IC Insights will release its June Update to the 2019 McClean Report later this month. This Update includes a 2017-2023 IC database that segments the actual 2017 and 2018 and forecasted 2019-2023 IC market by major product type by Consumer, Auto, Computer, Industrial, Communications, and Government/Military end-use applications in the Americas, Europe, Japan, and Asia-Pacific regions.

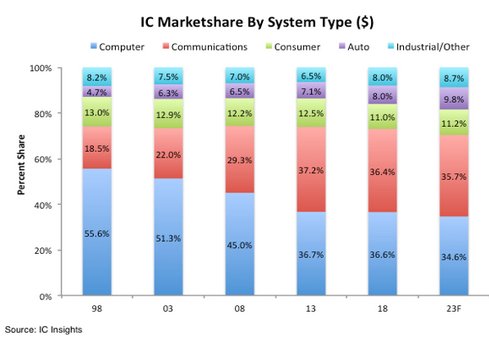

Over the past 20 years, the communications IC segment almost doubled its share of the total IC market from 18.5% in 1998 to 36.4% in 2018 (Figure 1).

Figure 1

The communications segment first surpassed the computer segment as the largest end-use market for ICs in 2013 but was passed by the computer segment in 2017 and 2018 due to the booming memory market (since more memory is used in computer than in communication systems). However, with the memory market forecast to plunge by 30% this year, the communications IC market is expected to surpass the computer IC market in 2019 and hold this position through 2023.

As shown, the automotive IC segment marketshare has displayed a steady increase since 1998 going from a 4.7% share that year to 8.0% in 2018. Moreover, the automotive IC market is forecast to register the strongest 2018-2023 CAGR of any of the end-use segments at 9.2%. Unfortunately, given its relatively small size, high growth in the automotive IC segment is not expected to be enough to significantly lift the growth rate of the total IC industry over the next five years.

In contrast to the rising shares of the automotive and communications segments, the computer and consumer IC marketshares have drifted lower over the past 20 years. As shown, the computer segment’s share of the total IC market dropped 19 percentage points since 1998 to 36.6% in 2018. However, strong server demand to help support the Internet of Things is expected to pump new life into the computer IC market over the next five years and slow the rate of marketshare decline for this segment.

Figure 1 showed that the Industrial/Other segment’s share of the total IC market was in a steady decline from 1998 through 2013. However, as industrial automation has picked up momentum worldwide, this segment is forecast to rise to an 8.7% share of the total IC market in 2023, up from only 6.5% in 2013.

One thing to keep in mind with regard to IC end-use marketshare figures is that they typically move at an evolutionary, not revolutionary, pace. Major changes and trends in the end-use percentage figures are sometimes only evident when looking at five or ten year timeperiods. Overall, this is one aspect of the IC industry that requires some perspective that only relatively long periods of time can provide.

Report Details: The 2019 McClean Report

Additional details on IC market trends by end-use application are provided in the June Update to The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Report includes free monthly updates from March through November (including a 250+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual user license to the 2019 edition of The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

Related Semiconductor IP

- HiFi iQ DSP

- CXL 4 Verification IP

- JESD204E Controller IP

- eUSB2V2.0 Controller + PHY IP

- I/O Library with LVDS in SkyWater 90nm

Related News

- Chinese Companies Hold Only 4% of Global IC Marketshare

- Top 10 Companies Hold 57% of Global Semi Marketshare

- Top Three Suppliers Held 94% of 2021 DRAM Marketshare

- Automotive IC Marketshare Seen Rising to 10% by 2026

Latest News

- A new CEO, a cleared deck: Is Imagination finally ready for a deal?

- SkyeChip’s UCIe 3.0 Advanced Package PHY IP for SF4X Listed on Samsung Foundry CONNECT

- Victor Peng Joins Rambus Board of Directors

- Arteris Announces Financial Results for the Fourth Quarter and Full Year 2025 and Estimated First Quarter and Full Year 2026 Guidance

- Arteris Network-on-Chip Technology Achieves Deployment Milestone of 4 Billion Chips and Chiplets