Google’s High-Speed Interconnect Architecture to Push 800G+ Optical Transceiver Share Past 60% by 2026, Says TrendForce

February 10, 2026 -- Google’s next-generation TPU, Ironwood, integrates a 3D Torus network topology with the Apollo optical circuit switch (OCS) all-optical network, marking a major step forward in AI data-center interconnect design. TrendForce’s latest research on the high-speed interconnect market indicates that this architecture will directly address the surging compute and bandwidth demands driven by large-scale AI workloads.

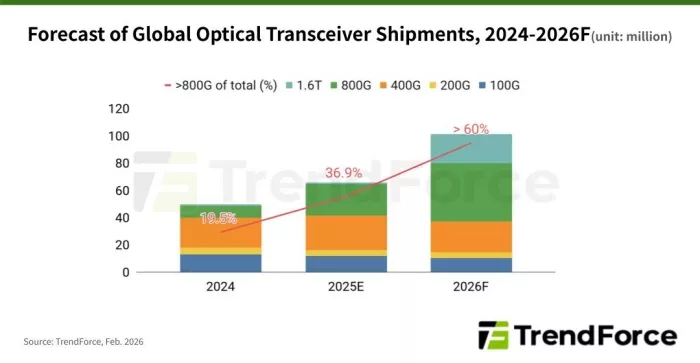

TrendForce estimates that the global shipment share of 800G and above optical transceiver modules will climb from 19.5% in 2024 to over 60% by 2026, positioning these modules to become standard components in AI-focused data centers.

In an OCS-enabled architecture, Ironwood TPUs rely on high-speed copper for short-reach connections, while the all-optical network handles inter-rack data transmission. As a result, AI clusters are designed from the outset to deploy sufficient 800G/1.6T optical modules. Based on TrendForce’s projection that nearly 4 million Google TPUs will be shipped in 2026, demand for 800G-plus optical modules is expected to exceed 6 million units.

Beyond architectural leadership for AI clusters, energy efficiency and cost savings are the standout advantages of Google’s design. TrendForce notes that the core of Apollo OCS lies in its use of micro-electromechanical systems (MEMS) micro-mirrors to enable direct fiber-to-fiber connections and avoid repeated optical-electrical-optical conversions that typically add power consumption and latency.

A single OCS switch consumes only around 100 watts, representing roughly a 95% reduction in power consumption compared with traditional switches that draw about 3,000 watts. Furthermore, upgrading bandwidth from 800G to 1.6T requires only swapping in higher-speed optical modules, rather than rebuilding the entire system, significantly lowering long-term upgrade costs.

From a supply-chain perspective, TrendForce expects Innolight, leveraging its close collaboration with Google on silicon photonics and 1.6T platforms, together with second-tier supplier Eoptolink, to capture nearly 80% of Google’s orders for 800G-plus optical modules. Meanwhile, Lumentum plays a pivotal role in supplying OCS systems and MEMS components, with its capacity planning set to directly influence the rollout pace of Apollo OCS deployments.

TrendForce concludes that data traffic between racks and across clusters will rise as compute density continues to scale. Consequently, advances in—and supply of—high-speed optical modules, lasers, and other optical components will become a decisive factor, alongside GPUs and memory, in determining the pace and cost of future compute expansion.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

Related Semiconductor IP

- 5G-NTN Modem IP for Satellite User Terminals

- HBM4E Controller IP

- 14-bit 12.5MSPS SAR ADC - Tower 65nm

- 5G-Advanced Modem IP for Edge and IoT Applications

- TSN Ethernet Endpoint Controller 10Gbps

Related News

- Ensphere Solutions to Deliver New Transceiver Integrated Circuit for Intel's Light Peak Optical Interconnect Technology

- Maxim Acquires Phyworks, a Leading Supplier of Optical Transceiver Chips for the Broadband Communications Market

- Ensphere Leverages TowerJazz's 0.18-micron SiGe BiCMOS Process to Achieve Fully Integrated One Chip Optical Transceiver IC

- Xilinx Virtex-6 HXT FPGAs Deliver Superior Transceiver Performance for Wired Optical Communications

Latest News

- OpenTitan Ships in Chromebooks: First Production Deployment

- Breker Verification Systems Adds RISC‑V Industry Expert Larry Lapides to its Advisory Board

- Weebit Nano’s ReRAM Selected for Korean National Compute-in-Memory Program

- Marvell Extends ZR/ZR+ Leadership with Industry-first 1.6T ZR/ZR+ Pluggable and 2nm Coherent DSPs for Secure AI Scale-across Interconnects

- BrainChip Announces Neuromorphyx as Strategic Customer and Go-to-Market Partner for AKD1500 Neuromorphic Processor