Global Semiconductor Manufacturing Industry Set for Q4 2023 Recovery, SEMI Reports

MILPITAS, Calif. – November 13, 2023 – The global semiconductor manufacturing industry is on track for recovery in the fourth quarter of 2023, setting the stage for continued growth in 2024, SEMI announced today in its Q3 2023 publication of the Semiconductor Manufacturing Monitor (SMM) Report, prepared in partnership with TechInsights.

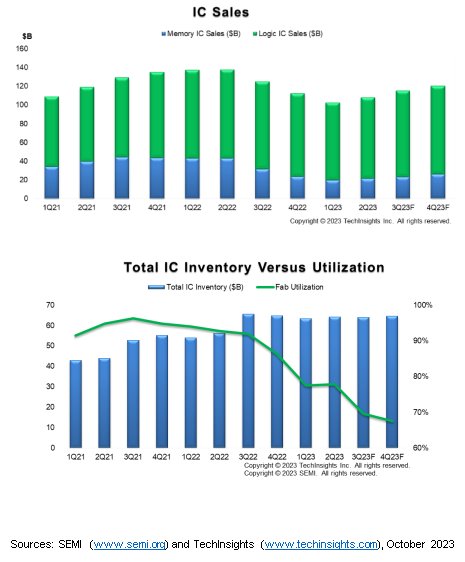

Electronic sales are predicted to register a robust 22% quarter-over-quarter increase in Q4 2023, adding to 7% growth posted in Q3 2023. IC sales are expected to rise 4% sequentially after improving 7% in Q3 2023 as end demand improves and inventories normalize.

Despite the improvement in electronics and IC sales, semiconductor manufacturing indicators remain soft. Fab utilization rates and capital expenditures continue to decline in the second half of this year. Overall, CapEx on non-memory is expected to outperform memory in 2023, but even spending in the non-memory segments has begun to weaken. Total capital expenditures in Q4 2023 are hovering at the levels seen in Q4 2020.

While overall semiconductor capital equipment sales are declining in line with capital expenditures, the contraction in wafer fab equipment spending has turned out to be much shallower than expected this year. Furthermore, back-end equipment billings are projected to increase in Q4 2023.

“While semiconductor markets have seen year-over-year declines the last five quarters, year-over-year growth is expected to return in the fourth quarter of 2023 as production cuts have worked their way through the supply chain,” said Boris Metodiev, Director of Market Analysis at TechInsights. “On the other hand, front-end equipment sales have been performing much better than the IC market, buoyed by government incentives and the filling of backlogs, strength expected to continue next year.”

“Despite low fab utilization rates and slowing capital expenditures in the second half of 2023, we expect back-end equipment billings to bottom in Q4 2023,” said Clark Tseng, Senior Director of Market Intelligence at SEMI. “This will mark an important turnaround for the chip manufacturing industry, signaling a recovery from the downturn with building momentum in 2024.”

The Semiconductor Manufacturing Monitor (SMM) report provides end-to-end data on the worldwide semiconductor manufacturing industry. The report highlights key trends based on industry indicators including capital equipment, fab capacity, and semiconductor and electronics sales, and includes a capital equipment market forecast. The SMM report also contains two years of quarterly data and a one-quarter outlook for the semiconductor manufacturing supply chain including leading IDM, fabless, foundry, and OSAT companies. An SMM subscription includes quarterly reports.

Download a sample Semiconductor Manufacturing Monitor report.

For more information on the report or to subscribe, please contact the SEMI Market Intelligence Team at mktstats@semi.org. Details on SEMI market data are available at SEMI Market Data.

About SEMI

SEMI® connects 3,000 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics design and manufacturing. SEMI members are responsible for the innovations in materials, design, equipment, software, devices, and services that enable smarter, faster, more powerful, and more affordable electronic products. Electronic System Design Alliance (ESD Alliance), FlexTech, the Fab Owners Alliance (FOA), the MEMS & Sensors Industry Group (MSIG) and SOI Consortium are SEMI Strategic Technology Communities. Visit www.semi.org to learn more.

Related Semiconductor IP

- Specialized Video Processing NPU IP for SR, NR, Demosaic, AI ISP, Object Detection, Semantic Segmentation

- Ultra-Low-Power Temperature/Voltage Monitor

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

Related News

- Credo Joins with Industry Players to Announce Effort to Standardize CXL Active Electrical Cables & Optics at OCP Global Summit 2023

- Global Top 10 Foundries Q4 Revenue Up 7.9%, Annual Total Hits US$111.54 Billion in 2023, Says TrendForce

- Electronic System Design Industry Posts $4.4 Billion in Revenue in Q4 2023, ESD Alliance Reports

- Global Semiconductor Manufacturing Industry Strengthens in Q2 2024, SEMI Reports

Latest News

- Breker Verification Systems and Moores Lab AI Partner to Create First AI-Driven SoC Verification Solution

- JEDEC® Announces Updates to Universal Flash Storage (UFS) and Memory Interface Standards

- SambaNova Abandons Intel Acquisition, Raises Funding Instead

- Tensor and Arm partner to deliver AI-defined compute foundation for world’s first personal robocar

- 10xEngineers and Andes Enable High-Performance AI Compilation for RISC-V AX46MPV Cores