Global GDP Impact on Worldwide IC Market Growth Expected to Rise

Excluding memory, correlation coefficient expected to reach a very high level of 0.94 in the 2018-2023 timeframe.

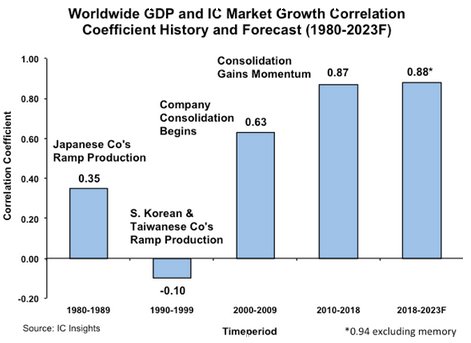

July 25, 2019 -- In its soon to be released Mid-Year Update to The McClean Report 2019, IC Insights forecasts that the 2018-2023 global GDP and IC market correlation coefficient will reach 0.88 (0.94 when excluding memory), up from 0.87 in the 2010-2018 timeperiod. IC Insights depicts the increasingly close correlation between worldwide GDP growth and IC market growth through 2018, as well as its forecast through 2023, in Figure 1.

Figure 1

From 2010-2018, the correlation coefficient between worldwide GDP growth and IC market growth was 0.87 (0.92 excluding memory), a strong figure given that a perfect positive correlation is 1.0. In the three decades previous to this timeperiod, the correlation coefficient ranged from a relatively weak 0.63 in the early 2000s to a negative correlation (i.e., essentially no correlation) of -0.10 in the 1990s.

IC Insights believes that the increasing number of mergers and acquisitions, leading to fewer major IC manufacturers and suppliers, is one of major changes in the supply base that illustrate the maturing of the industry and helping foster a closer correlation between worldwide GDP growth and IC market growth.

Another reason for a better correlation between worldwide GDP growth and the IC market growth is the continued movement to a more consumer driven IC market. Twenty years ago about 60% of the IC market was driven by business applications and 40% by consumer applications, but those percentages are reversed today. As a result, with a more consumer-oriented environment driving electronic system sales, and in turn IC market growth, the health of the worldwide economy is increasingly important in gauging IC market trends.

The 200+ page Mid-Year Update to the 2019 edition of The McClean Report further describes IC Insights’ IC market forecasts for 2019-2023.

Report Details: The 2019 McClean Report

Additional details on semiconductor and IC market trends will be provided in the Mid-Year Update to The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Report includes free monthly updates from March through November (including the 200+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual user license to The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

Related Semiconductor IP

- HiFi iQ DSP

- CXL 4 Verification IP

- JESD204E Controller IP

- eUSB2V2.0 Controller + PHY IP

- I/O Library with LVDS in SkyWater 90nm

Related News

- Global Top 10 IC Design Houses See 49% YoY Growth in 2024, NVIDIA Commands Half the Market, Says TrendForce

- 2022 to Mark the Third Year in a Row of ≥20% Growth for the Foundry Market

- The Worldwide Semiconductor Market is expected to slow to 4.4% growth in 2022, followed by a decline of 4.1% in 2023

- The Worldwide Semiconductor Market is expected to slow to 4.4 percent growth in 2022, followed by a decline of 4.1 percent in 2023

Latest News

- A new CEO, a cleared deck: Is Imagination finally ready for a deal?

- SkyeChip’s UCIe 3.0 Advanced Package PHY IP for SF4X Listed on Samsung Foundry CONNECT

- Victor Peng Joins Rambus Board of Directors

- Arteris Announces Financial Results for the Fourth Quarter and Full Year 2025 and Estimated First Quarter and Full Year 2026 Guidance

- Arteris Network-on-Chip Technology Achieves Deployment Milestone of 4 Billion Chips and Chiplets