Top Ten Semiconductor Foundries Report a 1.1% Quarterly Revenue Decline in 2Q23, Anticipated to Rebound in 3Q23, Says TrendForce

September 5, 2023 -- TrendForce reports an interesting shift in the electronics landscape: dwindling inventories for TV components, along with a surging mobile repair market that’s been driving TDDI demand, have sparked a smattering of urgent orders in the Q2 supply chain. These last-minute orders have served as pivotal lifelines, propping up Q2 capacity utilization and revenue for semiconductor foundries. However, the adrenaline rush from these stop-gap orders may be a short-lived phenomenon and is unlikely to be carried over into the third quarter.

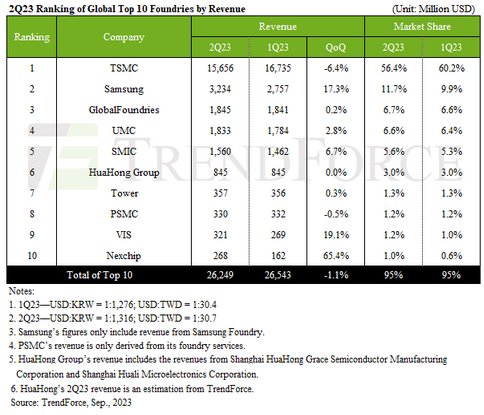

On the other hand, demand for staple consumer products like smartphones, PCs, and notebooks remains sluggish, perpetuating a slump in the use of expensive, cutting-edge manufacturing processes. At the same time, traditionally stable sectors—automotive, industrial control, and servers—are undergoing inventory correction. The confluence of these trends has resulted in a sustained contraction for the world’s top ten semiconductor foundries. Their global revenue declined by approximately 1.1% for the quarter, amounting to a staggering US$26.2 billion.

Additionally, the urgency in the supply chain seems largely fueled by demand for LDDI and TDDI components. This demand surge has catapulted Nexchip—a key player closely aligned with the panel industry’s fortunes—back into the top ten rankings.

Weak demand in advanced processes impacts TSMC’s Q2 revenue, a number of foundries expected to stabilize in Q3

In a season of fluctuating fortunes, TSMC—the titan of chipmaking—posted a Q2 revenue of US$15.66 billion, managing to limit the quarterly downturn to a modest 6.4%. While the revenue stream from 7/6 nm manufacturing processes flowed freely, the 5/4 nm sectors witnessed a contraction.

However, hope is on the horizon as TSMC looks forward to a likely boost in 3Q23. With the iPhone’s latest production cycle as a strong tailwind, the semiconductor giant anticipates a surge in demand for related components. Plus, the introduction of the costly yet revolutionary 3 nm process is set to make its financial debut, providing a much-needed jolt to offset the stagnation seen in mature processes. As a result, TSMC’s Q3 revenue landscape appears not only poised to stabilize but also primed for a potential rebound.

Samsung’s foundry business hit a high note in Q2 with an impressive revenue of US$3.23 billion—a robust QoQ leap of 17.3%. However, the third quarter is likely to be affected by a sluggish economy, driving down demand for Android smartphones, PCs, and laptops. As a result, the utilization rate for 8-inch fabs continues to decline. While Samsung hopes for a silver lining courtesy of Apple’s new device inventory buildup, the uplift in revenue growth may be limited.

Meanwhile, GlobalFoundries played it cool in Q2, virtually holding the line with a nominal revenue increase of 0.2% to around US$1.85 billion. Revenue from sectors like smartphones and automotive showed growth, while the networking sector saw a contraction. However, as Q3 begins taking shape amid economic turbulence, GlobalFoundries possesses the ability to stabilize itself in the form of long-term contracts in specialized niches—from US aerospace and defense to healthcare—as well as long-term agreements (LTAs) for automotive-related orders. These contracts not only solidify GlobalFoundries’ foothold but also effectively underpin its capacity utilization rates. Therefore, the company’s revenue is projected to maintain its equilibrium in the third quarter.

UMC saw a windfall in Q2, riding high on emergency orders for TV and Wi-Fi SoCs. This boost pushed their Q2 revenue to a tidy US$1.83 billion—a solid 2.8% bump QoQ. However, a glance into Q3 reveals an economic landscape that looks less than rosy. Consumer spending is showing no signs of a significant recovery, and those previous emergency orders are starting to dry up, leading to a decline in both capacity utilization and revenue.

Meanwhile, SMIC is embracing its own set of challenges and opportunities. The company reported a 6.7% QoQ revenue surge in Q2, landing at US$1.56 billion. It’s a ‘tale of two wafers,’ though; while its 8-inch wafer revenue took a downturn, 12-inch chips surged by approximately 9% QoQ. The spotlight here is on the ‘Made in China’ pivot—SMIC’s robust revenue growth is primarily fueled by domestic substitutions in specialized chips, ranging from Driver ICs (AMOLED DDI, TDDI) and NOR Flash to MCUs. Although 2023 may not promise a peak season, SMIC’s shipments and capacity utilization are poised to continue improving, driving revenue growth in the third quarter.

The second quarter saw a striking change among the foundries ranked sixth to tenth, with Nexchip making a triumphant return to the number ten spot. Meanwhile, the rest of the lineup held their ground. HuaHong Group, Tower Semiconductor, and PSMC mostly stayed the course, with Q2 revenues remaining largely static or experiencing a slight downturn compared to the previous quarter. Predictions suggest that Q3 will tread the same financial path as Q2.

The quarter had its share of drama with an unexpected surge of emergency orders, mostly originating from the display sector. This windfall particularly benefitted niche players like VIS and Nexchip. Fueled by last-minute LDDI orders, VIS saw a stellar revenue uptick of 19.1% QoQ, rocketing to US$321 million. This rise wasn’t confined to one product; both small and large-size DDIs, as well as PMIC sectors, saw commendable revenue hikes. However, end-user demand has yet to fully recover. While Q3 operations are expected to show some growth, the momentum is likely to be restrained.

In a staggering comeback, Nexchip’s second-quarter revenue soared by an eye-popping 65.4% QoQ, reaching a remarkable US$268 million and eclipsing DB Hitek to retake its seat at the tenth spot. This stratospheric leap was fueled by a confluence of factors: a surge in last-minute restocking orders for LDDI and TDDI components, and the successful roll-out of high-margin products using the higher-priced 55 nm process. These drivers jacked up Nexchip’s capacity utilization rate to an impressive 60–65%, catalyzing an exhilarating sprint in revenue growth.

While the consumer electronic market has yet to rebound fully, Nexchip is not sitting idle. The company is projected to sustain its upward trajectory in both capacity utilization and revenue as it marches into Q3. This optimism hinges on China’s growing trend of domestic substitution, amplified by Nexchip’s relentless marketing blitz. Adding to this momentum is the advent of mass production for new offerings from CIS clients in 2H23. As these elements synergize, Nexchip’s Q3 promises not just growth, but another potentially dazzling performance.

Looking ahead to the third quarter, the seasonal demand for the latter half of the year is projected to be softer than in previous years. Anticipated orders for premium mainstream chips—such as Application Processors (AP) and modems—as well as peripheral ICs are set to bolster the capacity utilization metrics for partners in Apple’s intricate supply chain. Further turbocharging this landscape is an uptick in orders of high-end HPC AI chips, adding a burst of momentum to high-value manufacturing processes. TrendForce predicts that the revenue of the top ten global semiconductor foundries is likely to rebound from its lowest point in the third quarter, followed by gradual growth thereafter.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email Ms. Latte Chung from the Sales Department at lattechung@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit our blog at https://insider.trendforce.com/

Related Semiconductor IP

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

Related News

- Global Top Ten IC Foundries Ranked for 1Q19, with TSMC Expected to Reach 48.1% Market Share, Says TrendForce

- Global Top Ten Foundries for 2Q19 Perform Less-than-expected Due to Sliding Demand and High Inventories, Says TrendForce

- TrendForce Reports Top 10 Semiconductor Foundries Worldwide for 1H18, TSMC Ranks First with an Estimated Market Share of 56.1%

- Only Qualcomm Reported to Post Slight Decline Among Top Ten Fabless IC Design Houses by 3Q18 Revenue, Says TrendForce

Latest News

- TSMC February 2026 Revenue Report

- Silvaco Announces Immediate Availability of Production Ready Mixel MIPI PHY IP, Strengthening its Comprehensive Silicon IP Offering

- Movellus Partners with Synopsys to Deliver Power Efficiency for Next Generation IC’s

- BrainChip Enables the Next Generation of Always-On Wearables with the AkidaTag© Reference Platform

- eSOL and Quintauris Partner to Expand Software Integration in RISC-V Automotive Platforms