Global Fab Equipment Spending Projected to Reach New High of Nearly $100 Billion in 2022, SEMI Reports

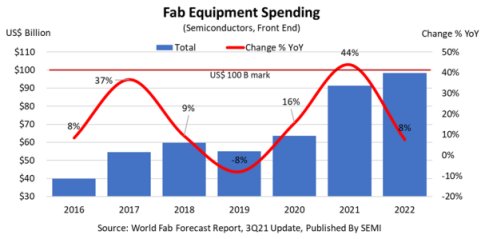

MILPITAS, Calif. — September 14, 2021 — Powered by digital transformation and other secular technology trends, global semiconductor equipment investments for front end fabs in 2022 are expected to reach nearly US$100 billion to meet soaring demand for electronics after topping a projected $90 billion this year, both new records, SEMI highlighted today in its World Fab Forecast report.

The new fab equipment spending records will mark a rare three consecutive years of growth that began in 2020, bucking the historical cyclical trend of a one- or two-year expansion followed by a year or two of tepid growth or declines. The semiconductor industry last saw more than two consecutive years of growth in the mid-1990s.

The foundry sector will account for the bulk of fab equipment investments in 2022, with more than US$44 billion in spending, followed by the memory sector at over US$38 billion. Both DRAM and NAND also show large increases in 2022 with jumps in spending to US$17 billion and US$21 billion, respectively. Micro/MPU investments will reach approximately US$9 billion, discrete/power US$3 billion, analog US$2 billion, and other devices about US$2 billion next year.

Regionally in 2022, Korea will lead in fab equipment spending at US$30 billion, followed by Taiwan at US$26 billion, and China at nearly US$17 billion. Japan will take the fourth spot with almost US$9 billion in fab equipment spending. While Europe/Mideast will be in fifth place at US$8 billion, the region is expected to post standout year-over-year percentage growth of 74% in 2022. In the Americas and Southeast Asia, spending is projected to reach more than US$6 billion and US$2 billion, respectively.

The World Fab Forecast report lists 1,417 facilities and lines globally, including 129 facilities and lines starting volume production in 2021 and beyond.

About SEMI

SEMI® connects more than 2,400 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics design and manufacturing. SEMI members are responsible for the innovations in materials, design, equipment, software, devices, and services that enable smarter, faster, more powerful, and more affordable electronic products. Electronic System Design Alliance (ESD Alliance), FlexTech, the Fab Owners Alliance (FOA) and the MEMS & Sensors Industry Group (MSIG) are SEMI Strategic Technology Communities, defined communities within SEMI focused on specific technologies. Visit www.semi.org to learn more.

Related Semiconductor IP

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

Related News

- Global Fab Equipment Spending Forecast to Reach All-Time High of Nearly $100 Billion in 2022, SEMI Reports

- Fab Equipment Spending Breaking Industry Records

- Total Fab Equipment Spending Reverses Course, Growth Outlook Revised Downward

- Global Fab Equipment Spending to Rebound in 2020 with 20 Percent Growth

Latest News

- Synopsys Introduces Software-Defined Hardware-Assisted Verification to Enable AI Proliferation

- AimFuture and ITM Semiconductor to Develop AI-Integrated Technology for Robotics and Mobility

- TSMC February 2026 Revenue Report

- Silvaco Announces Immediate Availability of Production Ready Mixel MIPI PHY IP, Strengthening its Comprehensive Silicon IP Offering

- Movellus Partners with Synopsys to Deliver Power Efficiency for Next Generation IC’s