Chinese Companies Hold Only 5% of Global IC Marketshare

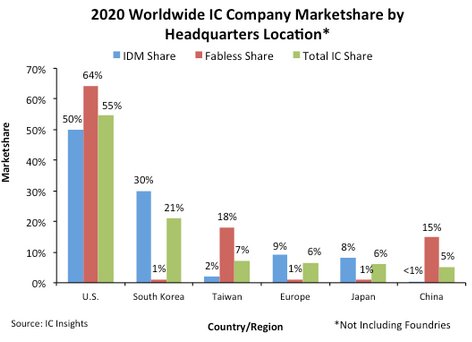

Propelled by 50% share of IDM sales and 64% share of fabless sales, U.S. companies captured 55% of the total worldwide IC market in 2020.

April 14, 2021 -- Regional marketshares of IDMs (companies operating wafer fabs), fabless companies, and total IC sales were led by U.S. headquartered companies in 2020, according to the March Update to The McClean Report 2021.

Figure 1 shows U.S. companies held 55% of the total worldwide IC market in 2020 followed by the South Korean companies with a 21% share. Taiwanese companies, on the strength of their fabless company IC sales, held 7% of total IC sales, one point greater than the European and Japanese companies. As shown, Chinese companies held only 5% of the global IC market in 2020.

Figure 1

South Korean and Japanese companies have an extremely weak presence in the fabless IC segment and the Taiwanese and Chinese companies have a very low share of the IDM portion of the IC market. Overall, U.S.-headquartered companies showed the most balance with regard to IDM, fabless, and total IC industry marketshare.

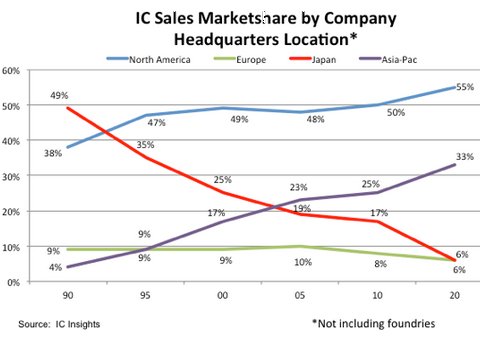

In 2020, the Japanese companies’ IC industry marketshare continued its decent that began back in the 1990s. As shown in Figure 2, Japanese companies held almost half of the worldwide IC marketshare in 1990 only to see that share fall precipitously over the past 30 years to only 6% in 2020. While the European companies marketshare decline has not been as steep as the Japanese companies, the European firms also held only a 6% share of the global IC market last year, down from 9% in 1990.

Figure 2

In contrast to the Japanese and European companies IC marketshare slide over the past three decades, the U.S. and Asian IC suppliers have seen their shares climb since 1990. As shown in Figure 2, the Asian companies have seen their share of the worldwide IC market surge from a miniscule 4% in 1990 to 33% in 2020. This increase in share by the Asian IC suppliers equates to a 30-year IC sales CAGR of 15.5%, slightly more than double the total IC market CAGR of 7.7% over this same timeperiod.

Report Details: The 2021 McClean Report

The 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry was released in January 2021. A subscription to The McClean Report includes free monthly updates from March through November (including a 180+ page Mid-Year Update), and free access to subscriber-only pre-recorded webcasts through November. An individual user license to the 2021 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2021.

https://www.icinsights.com/services/mcclean-report/pricing-order-forms/

Related Semiconductor IP

- 5G-NTN Modem IP for Satellite User Terminals

- HBM4E Controller IP

- 14-bit 12.5MSPS SAR ADC - Tower 65nm

- 5G-Advanced Modem IP for Edge and IoT Applications

- TSN Ethernet Endpoint Controller 10Gbps

Related News

- U.S. Companies Dominate Worldwide IC Marketshare

- Gartner Says Worldwide Semiconductor Revenue Grew 7.3% in 2020

- Gartner Says Worldwide Semiconductor Revenue Grew 10.4% in 2020

- Automotive IC Marketshare Slips in 2020 After Steady Gains Since 1998

Latest News

- Marvell Extends ZR/ZR+ Leadership with Industry-first 1.6T ZR/ZR+ Pluggable and 2nm Coherent DSPs for Secure AI Scale-across Interconnects

- BrainChip Announces Neuromorphyx as Strategic Customer and Go-to-Market Partner for AKD1500 Neuromorphic Processor

- SCI Semiconductor Announces First Silicon of Cybersecure MCU, ICENI™

- Allen Wu on Disrupting $100M Cost of Building Custom AI Chips

- GUC Monthly Sales Report – February 2026