January DRAM, NAND Flash Sales Point to Promising Year

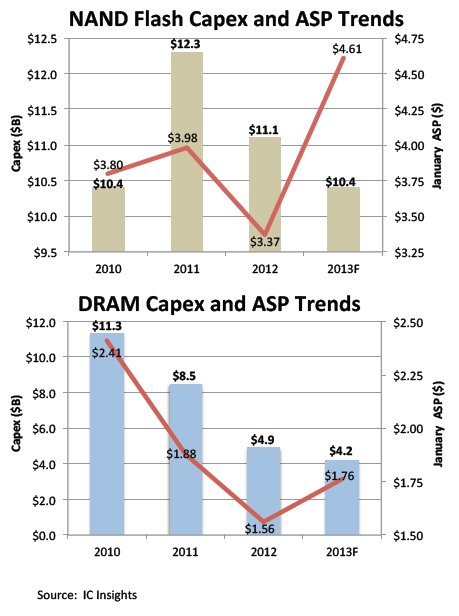

Cuts in capex among memory suppliers strengthen ASPs, boost January YoY memory sales.

March 06, 2013 -- Industry consolidation to just three big DRAM suppliers and a reduction in capital expenditures among these manufacturers helped propel DRAM average selling prices (ASPs) up 13% year over year in January, which contributed to a 19.9% jump in the total memory market and a 6.2% increase for the total IC market in January 2013. The strengthening memory segment also helped boost year-over-year semiconductor sales by 6.2%. These surprising numbers were positive news for an IC market that, like most other industries, continues to be weighed down by uncertainties regarding the health and direction of the global economy.

Significant reductions in capital equipment spending among DRAM manufacturers are expected to stabilize prices at a minimum, but more likely will help drive prices further upward throughout the balance of the year.

Capex budgets are also being trimmed for NAND flash (though not nearly as much as DRAM), and that, along with ongoing unit demand, has put upward pressure on ASPs for these memory devices as well. NAND flash ASPs increased 37% year over year in January (Figure 1).

Figure 1

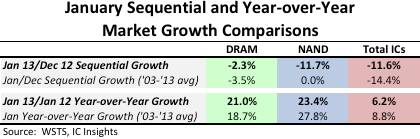

IC Insights shows monthly DRAM sales were down sequentially (January 2013 over December 2012), but not by as much as the past 10-year average. On a year-over-year basis, however, the DRAM market outperformed the past 10-year average. Since 2003, the January DRAM market has averaged year-over-year growth of 18.7%, but in 2013, DRAM sales beat that mark by growing 21.0%. Meanwhile, January year-over-year sales of NAND flash jumped 23.4%, which was 4.4 points less than it has averaged over the past 10 years. January total IC sales achieved year-over year growth of 6.2%, also slightly lower than the past 10-year average (Figure 2).

Figure 2

It is also worth noting that sequentially, the total semiconductor market (including optoelectronics, sensors/actuators, and discrete components) decreased 12% from December 2012 to January 2013. However, that decrease was far less than the -19% average sequential decrease the semiconductor market has experienced each January between 1999 and 2012.

January IC sales numbers were encouraging and represented a good start to the year. Further growth in the 2013 IC market is highly dependent on electronic systems growth, which in turn is highly dependent on a healthy global economy. A healthy U.S. economy is extremely important to the health of the global economy as it represents 24% of worldwide GDP. The U.S economy is forecast to show slightly better GDP growth in 2013 (2.4%) compared to 2012 (2.2%) and IC Insights' forecast for global GDP growth remains at 3.2% for 2013.

Report Details: The 2013 McClean Report

Additional details on IC product sales, capital expenditure forecasts, and the global economic outlook are included in the 2013 edition of IC Insights' flagship report, The McClean Report--A Complete Analysis and Forecast of the Integrated Circuit Industry, which features more than 400 tables and graphs in the main report alone. A subscription to The McClean Report includes free monthly updates from March through November (including a 250+ page Mid-Year Report), and free access to subscriber-only webinars throughout the year. An individual-user subscription to the 2013 edition of The McClean Report is priced at $3,390 and includes an Internet access password. A multi-user worldwide corporate license is available for $6,390.

Related Semiconductor IP

- Low Latency DRAM Synthesizable Transactor

- Low Latency DRAM Memory Model

- Embedded OTP (One-Time Programmable) IP, 2Kx32 bits for 1.0V/2.6V DRAM

- Embedded OTP (One-Time Programmable) IP, 4Kx32 bits for 1.2V/2.5V DRAM

- DDR2-PHY command/address block for DRAM chip, BOAC ; UMC 90nm SP/RVT Low-K Logic Process

Related News

- DRAM, NAND Flash, Automotive Analog/Logic Among Best-Growing ICs

- NAND Flash, DRAM Forecast to Remain Largest IC Markets in 2020

- Phison Licenses Tensilica's Dataplane Processor (DPU) for NAND Flash Memory Controllers and SSD Applications

- Arasan Chip Systems Announces Availability of ONFI 3.2 NAND Flash Controller IP & PHY Solution

Latest News

- ZeroRISC and Leading Research Institutions Deliver Production-Grade Post-Quantum Cryptography for Open Silicon

- GlobalFoundries Announces Availability of AutoPro 150 eMRAM Technology on Enhanced FDX Platform for Advanced Automotive Applications

- MIPS and INOVA Collaborate to put Physical AI into the palm of Robotic hands with new Reference Platform

- Allegro DVT Launches DWP300 DeWarp Semiconductor IP

- Ubitium Tapes Out Universal Processor to End Embedded Computing Complexity Crisis