Wireless Leads of Growth for OEM Semiconductor Spending in 2013

Myson Robles-Bruce

February 14, 2013 -- Wireless is set to be the leading growth segment for semiconductor spending among original equipment manufacturers (OEMs) in 2013, with expenditures rising by a double-digit margin to support the burgeoning markets for smartphones, media tablets and mobile infrastructure gear.

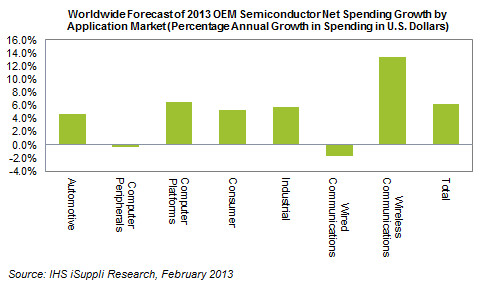

OEM spending on semiconductors for wireless applications is set to rise by 13.5 percent this year to reach a value of $69.6 billion, up from $62.3 billion in 2012, according to the IHS iSuppli Semiconductor Design & Spend Analysis Service from information and analytics provider IHS (NYSE: IHS). This represents the highest rate of growth of the seven major application markets, with the others set to undergo annual changes ranging from a 6.5 percent expansion to a 1.7 percent decline.

IHS defines OEM spending as all semiconductor spending either by the OEM itself directly or indirectly

through an electronic manufacturing service (EMS) or original design manufacturer (ODM). Also for those companies that operate as both OEM and semiconductor supplier, every effort has been made to calculate net spending only for those devices originating from the external merchant market. Therefore, net spend does not include internally sourced products.

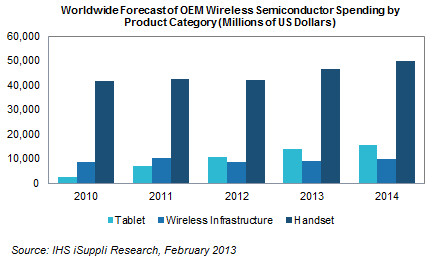

“The growth in wireless semiconductor spending this year reflects the strong and sustained consumer appeal of smartphones and media tablets—as well as the robust corporate infrastructure expenditures required to support this trend,” said Myson Robles-Bruce, senior analyst for semiconductor design and spend at IHS. “Mobile handsets continued to be the leading category for wireless semiconductor spending, but tablets are on the rise, with the new slate computers surpassing wireless infrastructure in 2012 for the first time ever.”

Tablet Chip Spending Gets Fatter

Spending for media tablets alone reached $10.5 billion in 2012, compared to $8.7 billion for wireless infrastructure.

Still, the largest submarket by dollar value will continue to be handsets, at $46.7 billion.

Big Spenders

Among the Top 20 OEM semiconductor spenders for wireless communications, IHS estimates that high year-over-year growth will be achieved by market leaders Apple and Samsung Electronics. Another company to watch will be LG Electronics, which will see significant growth in wireless spending. Lastly, this is a market that also includes rapidly emerging players from China, such as Huawei Technologies, ZTE and Lenovo.

The greatest OEM spenders on semiconductors for media tablets remain the market leaders Apple and Samsung, which together account for 75 percent of spending. Most media tablet sales are still concentrated in the North American geographic area, although the top manufacturers have recognized the need to more aggressively market products to the Asia-Pacific region.

Apple is still the dominant manufacturer of media tablets, although there have been lots of alternatives emerging—especially at the low-cost entry level. Also, it remains to be seen what the impact upon sales will be coming from the new media tablet releases that have Microsoft Windows RT installed. These will include new models coming to market from Microsoft, Asus, Dell and Lenovo.

Battling for Infrastructure

In wireless infrastructure, the top OEMs will remain unchanged in 2013: Ericsson, Huawei, Alcatel-Lucent and Nokia Siemens Networks. Ericsson and Huawei now are fiercely battling for the market leadership position in wireless infrastructure. The market ranking is closely reflected in the semiconductor spend analysis results for these OEMs. These are all companies that will rely heavily upon growth in the U.S. and Chinese markets in the future.

The wireless outlook for 2013 from an OEM semiconductor spend perspective is consistent with trends seen at the recent International Consumer Electronics Show (CES). According to many in attendance, the 2013 show could have been called “Wireless CES” or “Connected CES.”

Manufacturers of wireless devices will make incremental changes to their products this year, but beyond that there is also a need to address issues and problems associated with these devices in order to ensure a future of growth and profitability. Key areas of R&D focus include the following: efforts to significantly improve display resolutions for tablets and smartphones, and improvements to the sound quality of mobile devices by utilizing better noise-reduction technology.

On the wireless infrastructure side, there are critical connectivity issues that need to be resolved related to network congestion, power reliability, and privacy and security both for individuals and the public at large. Currently there have been no real solutions established—only a great deal of discussion and possible answers addressing these issues have taken place.

The wireless communications market has become viciously competitive all around, with an industry that is narrowing because of the large market shares enjoyed by the leaders, as well as the rapid growth seen in a few emerging players commonly acknowledged as “the winners.”

Wireless device manufacturers have recognized the need to shift their business models away from a unit-growth focus and toward a greater stress on revenue and profitability. The key to successfully negotiating this shift will be to sell products with higher profit margins. One recently widespread strategy has been to offer more software-driven solutions and services.

Learn More > IHS iSuppli Semiconductor Design & Spend Analysis Service

IHS iSuppli's market intelligence helps technology companies achieve market leadership. Catch the latest semiconductor news, semiconductor forecast, semiconductor market, semiconductor electronic market from all across the world straight from our immensely experienced analysts. iSuppli provides comprehensive IHS iSuppli® Semiconductor Market Research portal provides the latest supply chain industry news and trends. To learn more, call us at 310-524-4007. that is rigorous, reliable & relevant. To know more, send us an e-mail on info@isuppli.com or contact us on +1.310.524.4007.

Related Semiconductor IP

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

Related News

- Apple and Samsung Lord Over Field Once Again as Top OEMs in Semiconductor Spending for 2013

- OEM Chip Spending to Climb 4 Percent This Year after Flat 2012

- Gartner Says Worldwide Semiconductor Manufacturing Equipment Spending to Decline 8.5 Percent in 2013

- SEMI tells EU to quadruple semiconductor spending, says report

Latest News

- GlobalFoundries Announces Availability of AutoPro150 eMRAM Technology on Enhanced FDX Platform for Advanced Automotive Applications

- Axiomise Launches nocProve for NoC Verification

- CAST Debuts TSN-EP-10G IP for High-Performance, Time-Sensitive Networking Ethernet Designs

- Synopsys Introduces Software-Defined Hardware-Assisted Verification to Enable AI Proliferation

- AimFuture and ITM Semiconductor to Develop AI-Integrated Technology for Robotics and Mobility