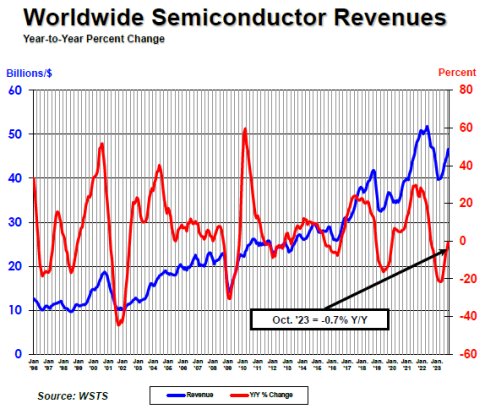

Global Semiconductor Sales Increase 3.9% Month-to-Month in October; Annual Sales Projected to Increase 13.1% in 2024

October increase marks eighth consecutive month of month-to-month market growth; worldwide chip sales down 0.7% year-to-year in October

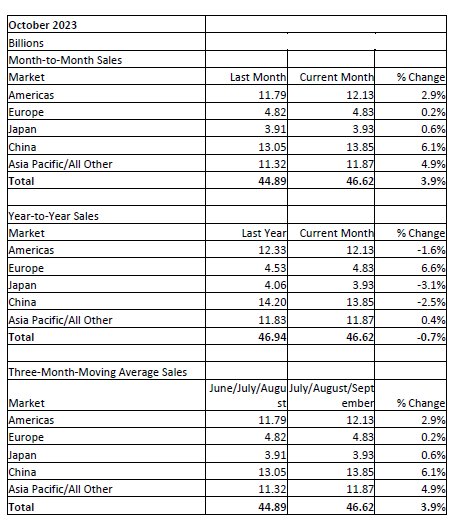

WASHINGTON—Dec. 4, 2023—The Semiconductor Industry Association (SIA) today announced global semiconductor industry sales totaled $46.6 billion during the month of October 2023, an increase of 3.9% compared to the September 2023 total of $44.9 billion but 0.7% less than the October 2022 total of $46.9 billion. Monthly sales are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. SIA represents 99% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms.

Additionally, a new WSTS industry forecast—endorsed by SIA—projects annual global sales will decrease 9.4% in 2023 but increase 13.1% in 2024. The forecast projects the industry’s worldwide sales will be $520. billion in 2023, down from the 2022 sales total of $574.1 billion. In 2024, global sales are projected to reach $588.4 billion. WSTS tabulates its semi-annual industry forecast by gathering input from an extensive group of global semiconductor companies that provide accurate and timely indicators of semiconductor trends.

“The global semiconductor market grew on a month-to-month basis for the eighth consecutive time in October, demonstrating clear, positive momentum for chip demand as 2023 winds down,” said John Neuffer, SIA president and CEO. “Moving forward, we forecast year-end sales for 2023 will be down compared to 2022, but the global semiconductor market is projected to rebound strongly next year with double-digit growth projected for 2024.”

Regionally, month-to-month sales increased in China (6.1%), Asia Pacific/All Other (4.9%), the Americas (2.9%), Japan (0.6%) and Europe (0.2%). Year-to-year sales were up in Europe (6.6%) and Asia Pacific/All other (0.4%), but down in the Americas (-1.6%), China (-2.5%), and Japan (-3.1%).

For comprehensive monthly semiconductor sales data and detailed WSTS forecasts, consider purchasing the WSTS Subscription Package. For detailed historical information about the global semiconductor industry and market, consider ordering the SIA Databook.

About SIA

The Semiconductor Industry Association (SIA) is the voice of the semiconductor industry, one of America’s top export industries and a key driver of America’s economic strength, national security, and global competitiveness. SIA represents 99% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms. Through this coalition, SIA seeks to strengthen leadership of semiconductor manufacturing, design, and research by working with Congress, the Administration, and key industry stakeholders around the world to encourage policies that fuel innovation, propel business, and drive international competition. Learn more at www.semiconductors.org.

About WSTS

World Semiconductor Trade Statistics (WSTS) is an independent non-profit organization representing the vast majority of the world semiconductor industry. The mission of WSTS is to be the respected source of semiconductor market data and forecasts. Founded in 1986, WSTS is the singular source for monthly industry shipment statistics.

Related Semiconductor IP

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

Related News

- Global Semiconductor Sales Increase 4.7% Month-to-Month in October

- Global Semiconductor Sales Decrease 8.2% in 2023; Market Rebounds Late in Year

- Global Semiconductor Sales Increase 18.3% in Q2 2024 Compared to Q2 2023; Quarter-to-Quarter Sales Up 6.5%

- Global Semiconductor Sales Increase 23.2% in Q3 2024 compared to Q3 2023; Quarter-to-Quarter sales up 10.7%

Latest News

- SEALSQ and Lattice Collaborate to Deliver Unified TPM-FPGA Architecture for Post-Quantum Security

- SEMIFIVE Partners with Niobium to Develop FHE Accelerator, Driving U.S. Market Expansion

- TASKING Delivers Advanced Worst-Case Timing Coupling Analysis and Mitigation for Multicore Designs

- Efficient Computer Raises $60 Million to Advance Energy-Efficient General-Purpose Processors for AI

- QuickLogic Announces $13 Million Contract Award for its Strategic Radiation Hardened Program