IDMs Rapidly Transitioning Logic Production to Foundries

Costly process development and capex expenses drive move to outsource.

October 03, 2012 -- Fab-lite/asset-lite strategies began to take shape in the late 1990s when several U.S. IDMs launched initiatives to reduce manufacturing costs by increasing their use of third-party foundries. In 1998, Motorola’s Semiconductor Products Sector (which was later spun out as Freescale) became the first major IDM to use the term “asset light” when it announced plans to shift 50% of its wafer production to third-party manufacturers in four years. Motorola’s asset-light efforts were slow to take hold, and the strategy was re-launched a few more times before its semiconductor division was spun out in 2003 as Freescale. In 2011, about 28% of Freescale’s wafers were outsourced compared to 15% in 2007.

Arguably, no other trend has so quickly swept through the IC industry and stirred up so much debate about the future of chip making as the spread of “fab-lite” (or “asset-lite”) business models, which are being embraced by a growing number of major IDMs worldwide. Most recently, large Japanese IC makers—namely Toshiba, Renesas, Sony, and Fujitsu—joined the fab-lite/asset-lite movement several years after U.S. and European IDMs began reining in capital expenditures on expensive new 300mm wafer fabs and increasing their use of third-party foundries. Nearly all IDMs today (excluding giant Intel and many memory makers) are now aiming to keep capital spending at or below 10% of annual sales compared to the IC industry’s average of more than 20% in the last decade.

The advent of fab-/asset-lite strategies has led to a rash of predictions that many IDMs were on their way to becoming fabless because they have stopped investing in leading-edge wafer plants and development of next-generation digital CMOS technologies. Indeed, some IDMs have used fab-/asset-lite strategies as steppingstones to going fabless—such as LSI and most recently Integrated Device Technology (IDT)—but many other IC manufacturers insist “lite” business models are sustainable over the long term since they’ve narrowed their strategic product focus to categories that do not require 300mm wafer processes or expensive fabs.

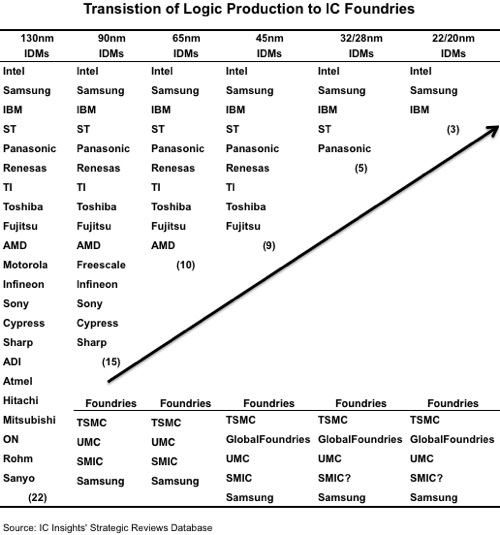

When looking at the increasing number of large companies that have stated their intentions to rely more on outside foundries for their IC production (e.g., ST, NXP, Infineon, Renesas, Sony, Fujitsu, Toshiba, etc.), it is easy to envision foundry sales to IDMs “impacting” an increasing amount of worldwide IC sales over the next 5-10 years. As shown in Figure 1, the number of IDMs producing leading edge logic devices is forecast to shrink from 22 at the 130nm technology node to only three at the 22/20nm technology node. Of course, the major IC foundries will continue to be the recipients of this business as it transitions away from the IDMs.

Figure 1

Report Details:

The McClean Report

IC Insights’ Mid-Year, August, and September Updates to the 2012 edition of The McClean Report refresh the outlook for IC markets through 2016 and examine important new trends impacting the IC foundry industry this year. A subscription to The 2012 McClean Report includes monthly updates for the year (March-November) as well as three subscriber-only webcasts. An individual-user subscription to the 2012 edition of The McClean Report is priced at $3,290 and includes an Internet access password. The subscription is also available under a multi-user worldwide corporate license for $6,290.

Related Semiconductor IP

- Very Low Latency BCH Codec

- 5G-NTN Modem IP for Satellite User Terminals

- 400G UDP/IP Hardware Protocol Stack

- AXI-S Protocol Layer for UCIe

- HBM4E Controller IP

Related News

- IDMs to hurt pure-play foundries, says report

- Major IDMs Increasingly Rely on Foundries for Logic Production

- intoPIX SDKs rev up performance to meet the rapidly increasing encoding and decoding demand of Software-based Production & Pro-AV

- European and Japanese IDMs Strengthen Collaboration with Chinese Foundries to Capture “China for China” Opportunities

Latest News

- TSMC February 2026 Revenue Report

- Silvaco Announces Immediate Availability of Production Ready Mixel MIPI PHY IP, Strengthening its Comprehensive Silicon IP Offering

- Movellus Partners with Synopsys to Deliver Power Efficiency for Next Generation IC’s

- BrainChip Enables the Next Generation of Always-On Wearables with the AkidaTag© Reference Platform

- eSOL and Quintauris Partner to Expand Software Integration in RISC-V Automotive Platforms