IC Market for Total Personal Computing Systems to Jump 6% in 2014

Three years of market growth forecast to offset past three years of sales declines

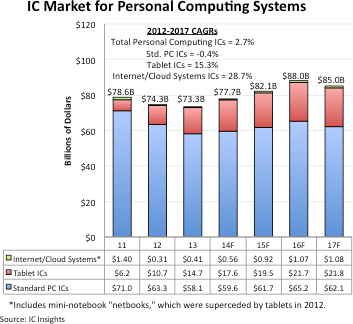

March 12, 2014 -- Following three consecutive years of declines, the IC market for total personal computing systems is forecast to increase 6% to $77.7 billion in 2014 and climb another 6% in 2015 to $82.1 billion, which will be just shy of the record-high $82.3 billion set in 2010, according to the 2014 edition of IC Insights’ IC Market Drivers—A Study of Emerging and Major End-Use Applications Fueling Demand for Integrated Circuits. A new record high is forecast to be set in 2016, when sales reach $88.0 billion. Between 2012 and 2017, personal computing IC sales are projected to rise by a CAGR of 2.7%, totaling $85.0 billion in the final year of the forecast (Figure 1).

Figure 1

Personal computing systems—standard PCs, tablets, and Internet/cloud-computing laptops—are forecast to remain the largest market for ICs with $77.7 billion (27%) of integrated circuit sales expected from these systems in 2014. When all computer systems are considered (e.g., mainframes, supercomputers, servers, printers, monitors, and other peripherals as well as personal computing products), 36% of all dollars spent on ICs is forecast to be for computer equipment in 2014, according the IC Market Drivers report.

In the last three years (2011-2013), personal computing system IC sales were pulled down by declines in integrated circuit purchases for standard desktop and notebook PCs. After surging 27% in the 2010 recovery year, PC IC sales slid 8% in 2011 to $71.0 billion, followed by an 11% drop in 2012 to $63.3 billion. In 2013, PC IC sales dropped 8% to $58.1 billion. PC integrated circuit sales are expected to rise 3% in 2014 to $59.6 billion. In the 2012-2017 period, PC IC sales are projected to fall by a CAGR of 0.4% to $62.1 billion in the final year of the forecast.

Meanwhile, tablet integrated circuit sales increased 37% in 2013 to $14.7 billion from $10.7 billion in 2012, when revenues surged 73% from $6.2 billion in 2011. IC Insights is forecasting a 20% increase in tablet integrated circuit sales in 2014 to $17.6 billion, followed by 10% growth in 2015 to $19.5 billion. Between 2012 and 2017, tablet IC sales are expected to grow by a CAGR of 15.3% to $21.8 billion in the final year of the forecast. The Internet/cloud systems segment is expected to generate $558 million in IC sales in 2014, which will be a 37% increase from about $408 million in 2013. IC sales for Internet/cloud computing systems are projected to grow by a CAGR of 28.7% in the forecast period, reaching $1.1 billion in 2017.

Report Details: IC Market Drivers 2014

IC Market Drivers 2014—A Study of Emerging and Major End-Use Applications Fueling Demand for Integrated Circuits examines the largest, existing system opportunities for ICs and evaluates the potential for new applications that are expected to help fuel the market for ICs.

IC Market Drivers is divided into two parts. Part 1 provides a detailed forecast of the IC industry by system type, by region, and by IC product type through 2017. In Part 2, the IC Market Drivers report examines and evaluates key existing and emerging end-use applications that will support and propel the IC industry through 2017. Some of these applications include the automotive market, cellular phones (including smartphones), personal/mobile computing (including tablets), wireless networks, digital imaging, and a review of many applications to watch—those that may potentially provide significant opportunity for IC suppliers later this decade. The 2014 IC Market Drivers report is priced at $3,290 for an individual-user license and $6,390 for a multi-user corporate license.

Related Semiconductor IP

- Multi-channel Ultra Ethernet TSS Transform Engine

- Configurable CPU tailored precisely to your needs

- Ultra high-performance low-power ADC

- HiFi iQ DSP

- CXL 4 Verification IP

Related News

- Cellphone IC Sales Will Top Total Personal Computing in 2017

- 2022 to Mark the Third Year in a Row of ≥20% Growth for the Foundry Market

- Andes and IAR Systems Enable Leading Automotive-Focused IC Design Companies to Accelerate Time to Market

- Analog Market Momentum to Continue Throughout 2022

Latest News

- ASICLAND Partners with Daegu Metropolitan City to Advance Demonstration and Commercialization of Korean AI Semiconductors

- SEALSQ and Lattice Collaborate to Deliver Unified TPM-FPGA Architecture for Post-Quantum Security

- SEMIFIVE Partners with Niobium to Develop FHE Accelerator, Driving U.S. Market Expansion

- TASKING Delivers Advanced Worst-Case Timing Coupling Analysis and Mitigation for Multicore Designs

- Efficient Computer Raises $60 Million to Advance Energy-Efficient General-Purpose Processors for AI