Groq Closes $300 Million Fundraise

With Investment Co-Led by Tiger Global Management and D1 Capital, Groq Is Well Capitalized for Accelerated Growth

MOUNTAIN VIEW, Calif., April 14, 2021 — Groq Inc., a leading innovator in compute accelerators for artificial intelligence (AI), machine learning (ML) and high performance computing, today announced that it has closed its Series C fundraising. Groq closed $300 million in new funding, co-led by Tiger Global Management and D1 Capital, with participation from The Spruce House Partnership and Addition, the venture firm founded by Lee Fixel. This round brings Groq’s total funding to $367 million, of which $300 million has been raised since the second-half of 2020, a direct result of strong customer endorsement since the company launched its first product.

By maintaining capital efficiency, this latest funding allows Groq to grow across industries while elevating the company’s efforts to hire top talent and accelerating its next-generation products in development. According to multiple published analyst reports,* the total available market for AI semiconductors is projected to reach $65 billion to $100 billion by 2025.

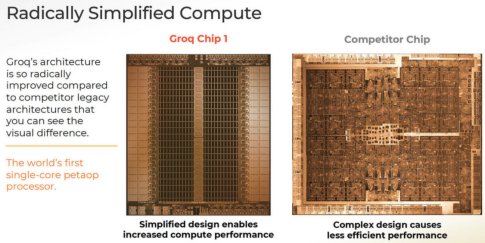

“AI is limited by existing systems, many of which are being followed or incrementally improved upon by new entrants. No matter how much money you throw at the problem, legacy architectures like GPUs and CPUs struggle to keep up with the growing demands of artificial intelligence and machine learning,” said Jonathan Ross, Groq Founder and CEO. “Our mission is more disruptive: Groq seeks to unleash the potential of AI by driving the cost of compute to zero.”

The round was co-led with investment from Tiger Global Management and D1 Capital. Further investment comes from The Spruce House Partnership, Addition, GCM Grosvenor, Xâ¿, Firebolt Ventures, General Global Capital, and Tru Arrow Partners, as well as follow-on investments from TDK Ventures, XTX Ventures, Boardman Bay Capital Management, and Infinitum Partners. The quality of Groq’s investors reflects deep expertise in identifying high growth companies that have a bold vision for how technology can change the world with breakthrough innovation.

“We are excited to partner with Groq as they continue building a world-class AI chip that is uniquely capable of addressing both inference and training applications,” said Scott Shleifer, Partner at Tiger Global Management. “We were impressed by Groq’s software first approach, innovative architecture, and focus on customer success.”

“We are more than doubling-down on our investment in Groq,” said Nicolas Sauvage, Managing Director, TDK Ventures. “Their elegant AI chipset architecture is impressive and will have a powerful impact for our planet. Scaling traditional compute consumes enormous energy. Groq’s solution delivers order-of-magnitude more efficient compute-per-energy performance at scale, thereby improving the carbon footprint of hyperscale data centers, an ideal about which TDK Ventures is very passionate.”

Groq’s tensor streaming processor (TSP) architecture is the industry’s fastest single core chip and eliminates the shortcomings of traditional computing. The Groq chip is easier to program, providing 10x lower latency compared to leading competitors. For additional information about the company’s innovative accelerator architecture visit groq.com/technology.

About Groq

Headquartered in Mountain View, CA with remote teams across the US and Canada, Groq delivers industry-leading performance, accuracy and sub-millisecond latency with efficient, software-driven solutions for compute-intensive applications. Groq redefines compute by focusing on key technology innovations: software-defined compute, silicon innovation and developer velocity. For more information, visit: www.groq.com.

Sources:

*Statista Report, November 2020: Estimated size of the artificial intelligence AI semiconductor market worldwide from 2017 to 2025, $65 billion by 2025

*Omdia 2021 Database: Omdia AI Chipsets for Edge Forecast Report, ~$71 billion by 2025

*Allied Market Research: Artificial Intelligence Chip Market Outlook by 2025, $91 billion by 2025

*As cited in Analytics Insight, referencing IHS Markit report: Potential expansion of AI market in Semiconductor and its Significance, $128.9 billion by 2025

Related Semiconductor IP

- HiFi iQ DSP

- CXL 4 Verification IP

- JESD204E Controller IP

- eUSB2V2.0 Controller + PHY IP

- I/O Library with LVDS in SkyWater 90nm

Related News

- Groq Hardware Now Available on Nimbix Cloud

- Codasip Awarded European Union Horizon 2020 Funding for Developing New RISC-V Processors

- Groq Adopts Synopsys ZeBu Server 4 to Develop Breakthrough AI Chip

- Percepio Closes Series A Funding Round with Fairpoint Capital

Latest News

- SkyeChip’s UCIe 3.0 Advanced Package PHY IP for SF4X Listed on Samsung Foundry CONNECT

- Victor Peng Joins Rambus Board of Directors

- Arteris Announces Financial Results for the Fourth Quarter and Full Year 2025 and Estimated First Quarter and Full Year 2026 Guidance

- Arteris Network-on-Chip Technology Achieves Deployment Milestone of 4 Billion Chips and Chiplets

- RISC-V Pivots from Academia to Industrial Heavyweight